In our newly published paper, ‘A Perspective on Returns,’ the Real Return team discusses the probability that the boom we have seen in financial markets will end in a similar fashion to those experienced in the last twenty years.

In a short series of posts we discuss some of the key ideas in the paper. Our previous post looked at the arguments against the current economic cycle merely being a rerun of the previous cycle, and explained why we believe those arguments are likely to be incorrect.

In our final post, we move on to providing our own arguments as to why we think a boom-bust cycle is still a reasonable probability.

- Policymakers’ thinking has not changed since the last crisis

We see policymakers’ largely mechanistic, model-driven approach to economy management, which does not take account of skewed incentives, non-linear behaviours and human nature generally, as tending to cause monetary policymakers to overstate their influence on the real economy and understate the effects of their policies on the financial economy.

- ‘Inflation’ targeting in an era of structurally low inflation is distorting the financial world

Our contention is that, in attempting to set monetary policy to generate positive CPI inflation in an environment where inflation in goods and services has been restrained both by structural factors – demography, technology and globalization – and by central banks’ own policies (cheap money has incentivized capacity growth and kept ‘zombie’ companies in business) – policymakers have brought about huge over-stimulation of financial markets and heightened the risk of further asset bubbles.

- Debt growth continues to outpace economic growth globally

The evidence from history is clear that excessive credit growth leads to boom-bust cycles; so the fact that debt has increased by around 44% in this cycle from the levels seen in 2007[1] (a time when it was universally agreed that many economies already had a debt problem) to over 300% of GDP would seem concerning.

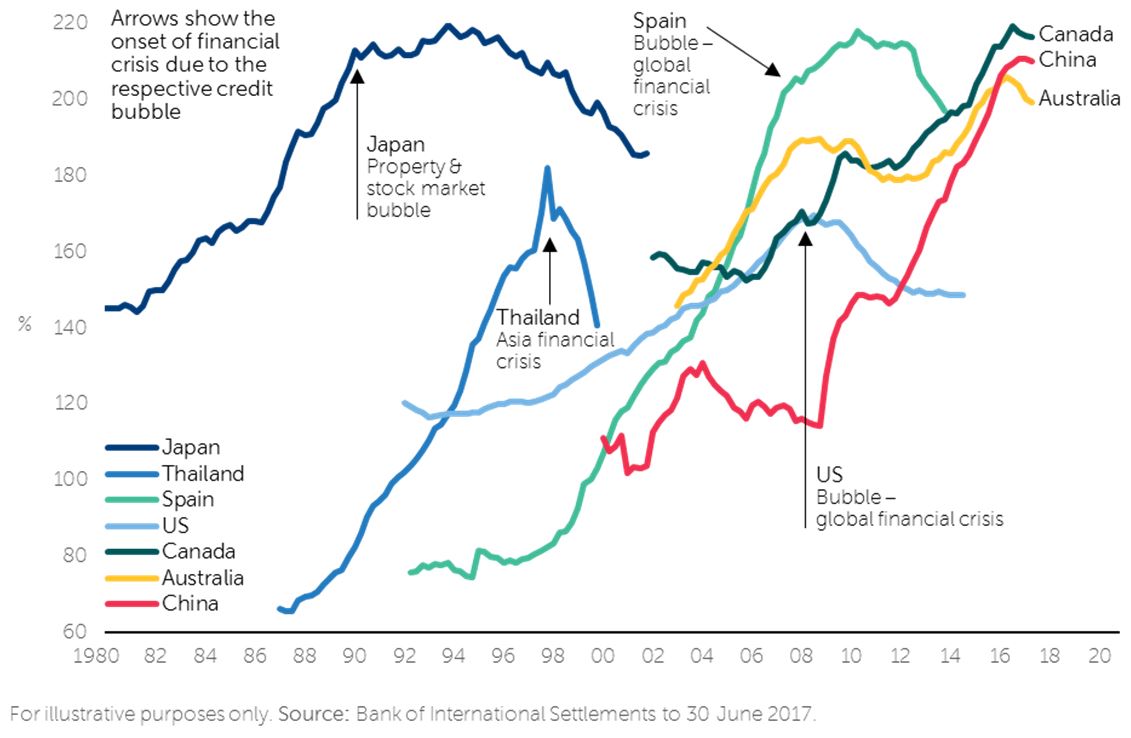

Some economies, particularly those that escaped recession in the last cycle (China, Australia, and Canada for example), are vying with previous bubble measures (see chart below).

Household + non-financial corporate debt as % of GDP

- Investors of all kinds have been displaced into risky and much less liquid assets

In this cycle, as never before, we observe that investors are en masse taking more risk in order to achieve their required returns, and we would emphasize that they are increasingly doing so in ways that have not been tested in an environment of market stress. Market liquidity could well be the greatest risk if nervous displaced investors were to choose to sell.

- Economies have become increasingly ‘financialized’

Policies like inflation-targeting, which are likely, in our opinion, to have kept interest rates too low through the cycle, as well as decades of asymmetric policy settings (loosening upon signs of stress in financial markets, but failing to act to manage booms), have led to over-stimulation of financial systems. At Newton, we have aggregated the implications, distortions and unintended consequences of this trend into a theme called ‘financialization,’ which we regard as perhaps the most important theme of our time.

We believe that financialization has made our systems much more sensitive to interest rates in all sorts of ways, at a time when such rates are some of the lowest in history. This, in our view, creates a significant threat.

- The financial system has been incentivized to be ‘short volatility’

To our mind, if you make excess liquidity available at little or no cost in tandem with what seems like an implicit ‘put,’ you will incentivize a giant trading community with an appetite for leverage, which is exactly what we have had! An important symptom of this is that one of the most popular trading strategies in the market place has been to be ‘short volatility’.

We believe this illustrates the interconnected fragility of the world’s giant and complex financial system. Should there be any unexpected change in financial-market volatility, interest rates or indeed correlations, we think there may be very substantial pain for market participants.

[1] https://www.iif.com/publication/global-debt-monitor/global-debt-monitor-january-2018

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.

Comments