This strategy is offered by Newton Investment Management Ltd (‘NIM’). NIM is part of the Newton Investment Management Group.

Our philosophy and process

- The strategy seeks to invest in companies that are well governed and run for the benefit of all shareholders. It can also invest a proportion of assets in developed-market companies where business is driven by emerging-market operations.

- Material and relevant ESG risks, issues and opportunities are considered as part of the investment process.

- The strategy has a long-term investment horizon. It focuses on balance-sheet strength and return-on-capital metrics.

Earth matters

Environmental factors are high up the political agenda and provide areas of opportunity as well as risk. Governments are under pressure to respond but this can be expensive, despite advancements in technology. ‘Earth matters’ looks at these issues.

China influence

The influence of China on the world has grown exponentially but its economy looks increasingly risky. ‘China influence’ looks at how the country’s development affects the investment outlook beyond its borders.1

1 Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility owing to differences in generally accepted accounting principles or from economic or political instability or less developed market practices.

State intervention

Authorities have engaged in ever-greater policy intervention and regulation to shore up economic growth. We believe ‘state intervention’ has increased misallocation of capital, caused volatility in markets and inflated asset prices – and we think that calls for a stock-specific approach.

Smart revolution

Machines and networks are becoming more intelligent. This is disrupting the labour market, as machines increasingly replace humans in the workplace. ‘Smart revolution’ considers the implications commercially, socially and politically.

Transcript

But every emerging market is unique and prospects can vary because of regional, industrial and corporate differences.

With such divergent opportunities and risks, what should investors do?

We believe an active, long-term approach to stock picking could help identify the best long-term growth opportunities in developing markets.

And one particular solution could be our Global Emerging Markets strategy. It has four core principles:

Active management – we are unconstrained by an index. A passive investor is limited to areas which have already performed well, but we can actively position the strategy to try to harness future growth opportunities.

Long-term focus – we do not chase the short-term volatility in the market, but focus on trying to deliver sustainable growth.

Strong fundamentals – we search for companies with attractive valuations, strong growth potential and that have the backing of our global investment themes.

And we analyse the environmental, social and governance risks of every company which we consider for investment. We look for companies which are run in the best interests of all shareholders, not the state.

Our Global Emerging Markets strategy takes an active, highly selective approach in seeking out the best long-term growth opportunities in the developing world, for our clients.

Investment team

Our Global Emerging Markets Equity strategy is managed by an experienced team. Our investment team of research analysts and portfolio managers works together across regions and sectors, helping to ensure that our investment process is highly flexible. Guided by our global investment themes, we seek to identify opportunities and risks through research and debate.

- 18

- years’ average investment experience

- 11

- years’ average time at Newton

-

Paul Birchenough

Portfolio manager, Global Opportunities team

-

Ian Smith

Portfolio manager, Global Opportunities team

-

Simon Nichols

Portfolio manager, global opportunities team

-

Aditya Shah

Portfolio analyst, Global Opportunities team

-

Karen Miki Behr

Portfolio manager, Global Opportunities team

-

Paul Markham

Head of Global Opportunities

-

Duncan Bulgin

Portfolio manager, Global Opportunities team

-

Jonathan Dennis

Portfolio analyst, Global Opportunities team

Strategy profile

-

Objective

-

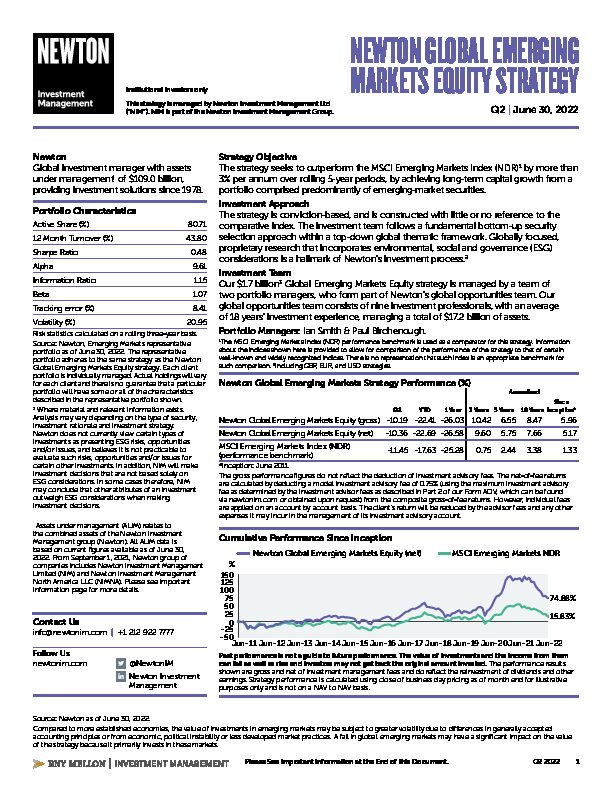

The strategy seeks to outperform the MSCI Emerging Markets Index (NDR) by more than 3% per annum over rolling 5-year periods, by achieving long-term capital growth from a portfolio comprised predominantly of emerging-market securities.

-

Performance benchmark

- MSCI Emerging Markets Index (NDR)

-

Typical number of equity holdings

- 40 to 70

-

Strategy size

-

US$1.7bn (as at June 30, 2022)

-

Strategy inception

-

May 2011

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

Newton will make investment decisions that are not based solely on ESG considerations. Other attributes of an investment may outweigh ESG considerations when making investment decisions. The way that ESG considerations are assessed may vary depending on the asset class and strategy involved. The research team performs ESG quality reviews on equity securities prior to their addition to Newton’s research recommended list (RRL). ESG quality reviews are not performed for all fixed income securities. The portfolio managers may purchase equity securities that are not included on the RRL and which do not have ESG quality reviews. Not all securities held by Newton’s strategies have an ESG quality review completed prior to investment, although since 2020 it has been a requirement for all (single name) equity securities to have an ESG quality review before they are purchased for the first time.