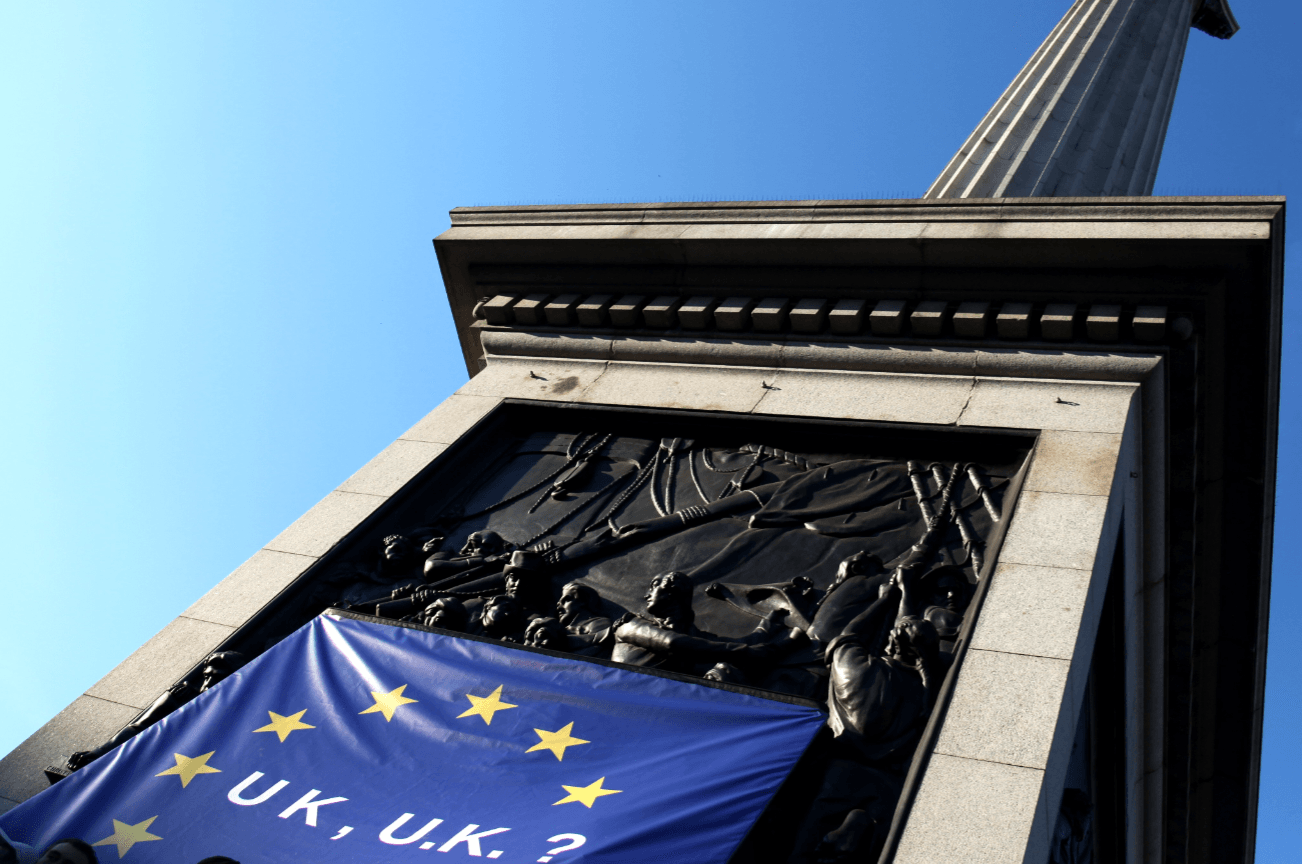

British Prime Minister Theresa May has been quoted as saying that in terms of striking a deal on the UK leaving the European Union (EU), the two sides are 95% there. While it is entirely feasible (even allowing for some poetic license) to believe that 95% of the individual points under discussion have been agreed upon, it is highly unlikely that the parties are anywhere near to having completed 95% of the actual work that needs doing if an agreement is to be reached within the current deadline.

Over the last few days, the political heat has been turned up on the prime minister, but it appears that we have reached a political stalemate. It is almost indubitable that the opposition Labour Party wants to bring down the government at any cost; and there is a fair chance that many Labour politicians who might support a deal brokered by the prime minister would be whipped out of accepting it by their own party. Discussions over another general election rumble on but if one took place, it seems likely that it would, once again, end in a ‘hung parliament’ (i.e. with no party enjoying an overall majority) and the stalemate would continue.

Deal or No Deal?

There is a significant (albeit minority in our view) chance of ‘no deal’ being agreed within the deadline. To us, there is more likelihood of a deal, but whether it is one acceptable to the hard-Brexit-supporting European Research Group within the governing Conservative Party is another matter entirely. Similarly, it is hard to know whether it would be acceptable to more pragmatic ‘leavers’ within the party such as Michael Gove, who appears to regard an initial deal as a starting point for a ‘harder’ Brexit further down the line.

The toughest single obstacle to the UK reaching agreement with the EU remains the Northern Ireland border. Whether or not there is some affiliation to a customs union or a hard border is one of the major intractable issues of the negotiations. Any suggestion of Northern Ireland not remaining part of the UK would be unacceptable to the Democratic Unionist Party (DUP), and given that the DUP is vital in maintaining the Conservative government’s slender parliamentary majority, the withdrawal of its support would have serious political implications. My feeling is that an extension of the negotiations beyond March 2019 is the prime minister’s preferred option, but most of the Conservative Party’s Brexiteers have made it clear that they will not support such an approach.

There are two aspects to the current brinkmanship worth noting. One is that Conservative Brexiteers are using the threat of ‘no deal’ to drive a better deal for the UK, and will only drop their opposition to Theresa May’s plans at the eleventh hour. Second, the EU has historically displayed a cultural propensity to strike deals very late in the negotiating process. There is a slight hope in some quarters that the UK may achieve a ‘Canada-plus’ style agreement within the timeframe; but the fact that Canada’s negotiations with the EU took seven years to reach fruition would suggest that while being in the EU already will be helpful, the UK is highly unlikely to reach an agreement in the next five months.

EU Bruised

We suspect that a ‘no deal’ would have serious consequences in terms of economic confidence for both the EU and the UK, but it could be potentially worse for the EU. The latter has been bruised from conflict with various member states for some years, and faith in its institutions is already at a low ebb. A ‘no deal’ might lead to further infighting among some of its member states, most notably at present Italy, which is still holding out on its radical budget plans in defiance of Brussels’ austerity-driven wishes. The EU will be wary of reigniting anti-EU sentiment in Italy at a time when it will feel quite vulnerable. By contrast, the UK has its own central bank and currency, and a longstanding and outward-looking culture of global trading built up over hundreds of years. This infrastructure might give it the chance to be more dynamic and to reinvent itself more quickly if it crashes out of the EU. This does not mean that a ‘no deal’ should be viewed overall as a positive, but simply that having historic infrastructure and a degree of autonomy already in place may soften the blow to the UK of a no-deal Brexit.

If the UK and the EU do strike a deal, it is likely to be greeted with near-term relief by the markets, while a no-deal scenario would be likely to lead to a flight to quality within equities, bonds and currencies.

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.