While news flow may have moved on in the last few days, we believe that much of Turkey’s current political and economic strife is entirely predictable and has been brewing for some time. Given our concern over the country’s very visible fiscal and current-account deficits in recent months, combined with it being an oil importer and executing significant levels of foreign-currency (FX) lending, Turkey has long seemed vulnerable given the resulting currency risk, even without the political risk associated with President Erdoğan’s rather alternative approach to government and geopolitical negotiations. For these reasons, we have had no exposure to the country for the last few years.

While emerging markets as a whole have come under recent pressure owing to concerns about a strong US dollar and the prospect of further US interest-rate rises, we believe investors should keep in mind that the sector is not homogenous, and that Turkey is far from representative of emerging markets as a whole. We believe the country’s current woes are unlikely to spark contagion in other markets beyond some elevation of risk aversion and an impact on rates. It is important to note that, in aggregate, emerging markets today are significantly more resilient than they were during other periods of higher risk aversion (for example, the ‘taper tantrum’ in 2013): deficit positions and levels of FX funding are lower, and there has been a trend towards more economically reformist governments (such as in India, Mexico, China and Argentina).

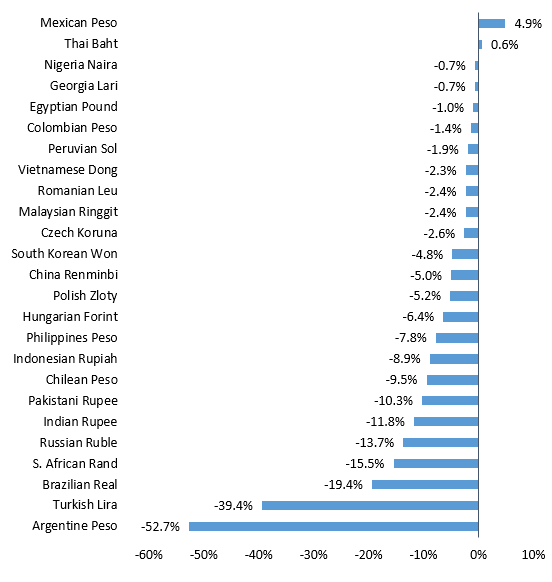

So far, the currency performance we have seen over the year to date is well informed by the varying fundamentals at the individual country level. Brazil, Argentina and Turkey have been among those leading the field down on account of their more fragile deficit and funding positions, while Asia, in aggregate, has proved comparatively more resilient. Meanwhile, as the chart below shows, Mexico and Thailand have even seen currency appreciation in the year to October 22.

Argentina’s Contrasting Approach

Argentina has suffered the greatest currency depreciation among emerging markets in the year to October 22, beating Turkey into second place. However, while the two countries share the same headwinds in terms of the increased cost of US-dollar funding, it is here that the similarities end. Argentina’s response to its crisis has been entirely different to Turkey’s, and has involved hiking interest rates significantly, pursuing drastic fiscal reform, and welcoming assistance from the International Monetary Fund (IMF). While, currently, we would agree that investors should remain relatively cautious on exposure to Argentina, we believe that this is a market which is likely to be in a much stronger position in five years’ time, and, at some point, should represent an attractive opportunity for emerging-market investors.

A country’s response to its economic condition is almost as important as its condition to start with, and for Argentina, in direct contrast to Turkey, we note a more constructive and orthodox approach to economic ills, albeit within what remains, at this time, a challenging macroeconomic environment.

Emerging-Market Currency Moves Versus US Dollar Year-to-Date

Source: MSCI EM Currency Index vs US$, 10/22/18

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

Important information

US - Text disclosure - NIM

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.