For the last couple of years, I have been writing about my concerns regarding the correlations between equities and bonds, and what they mean for multi-asset investors seeking a diversified portfolio to help buffer the pain in periods of market stress. These concerns have been centred on the unintended consequences of central-bank policy following the 2007-8 financial crisis. Sir Isaac Newton once opined that “you have to make the rules, not follow them”, and, as new information can change our expectations of how things work, it is important to try to better understand the world.

The vast majority of financial theory was written in a period before central banks and policymakers began their unconventional monetary stimulus of bringing interest rates down to zero (or even lower), and intervening in capital markets through vast swathes of bond purchases without consideration for the price. This action pushed bond prices up and yields (or future returns) down. If this policy has had an impact on capital-market returns (as it surely must have done), it seems likely that it will also have had an impact on the historical relationships between asset classes.

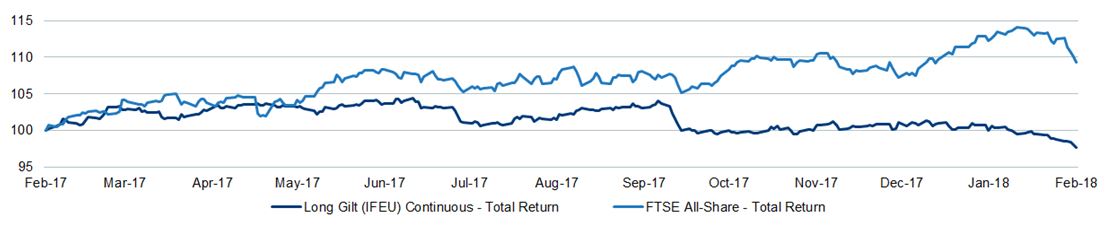

As can be seen in the chart below, the relationship between UK government bonds and equity markets has changed. Historically, we would have used government bonds to provide a balance to the portfolio in periods of market stress. However, over the last year, UK government bonds have provided little help during such periods, selling off in unison with UK and global equity markets. This has increased volatility, even in low-risk portfolios that tend to favour higher weightings to bonds, in reliance on historical correlations. The reason bonds have continued to sell off is arguably that investors do not see much value in the asset class: a 10-year government bond with a 1% yield offers little more than a 10% return over 10 years.

Total return – long gilt futures vs FTSE All-Share

Source: Bloomberg, 27 February 2018

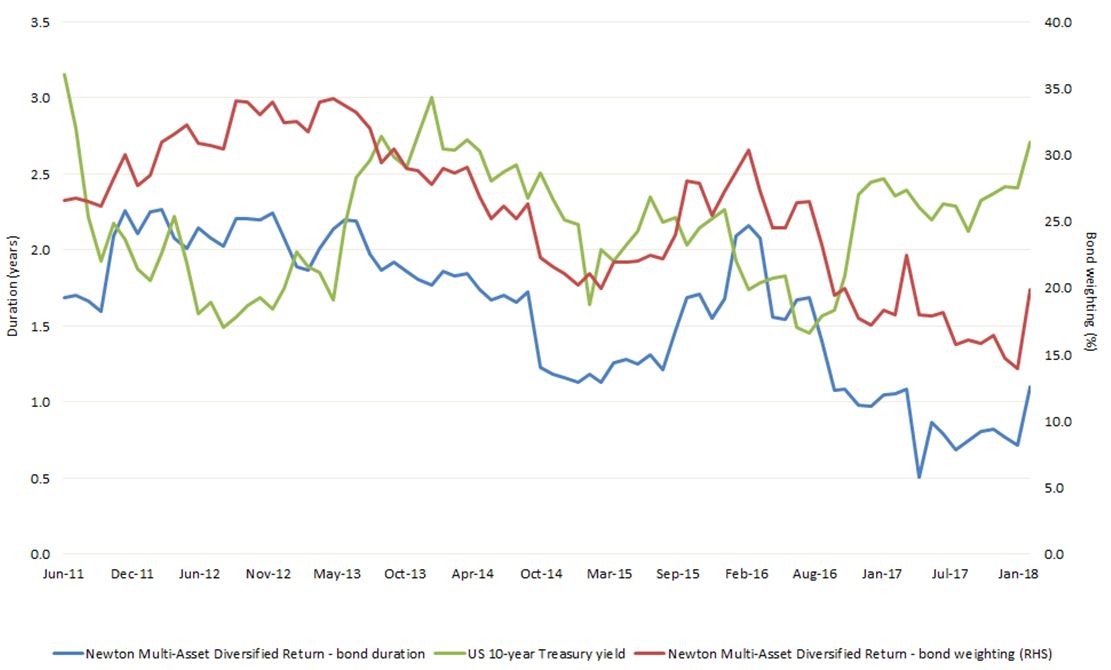

Because of our concerns, we have had very little exposure to bonds or duration (the portfolio’s sensitivity to changes in interest rates) in our Multi-Asset Diversified Return strategy, and we have also reduced equities in favour of cash, which we have viewed as a better ‘safe haven’ than government bonds.

As mentioned, the prices of government bonds have been artificially inflated owing to central-bank policy. However, this is now starting to be unwound as the US Federal Reserve begins to reduce its balance sheet, and by October this year the US central bank is set to be cutting its holdings by $50 billion per month.

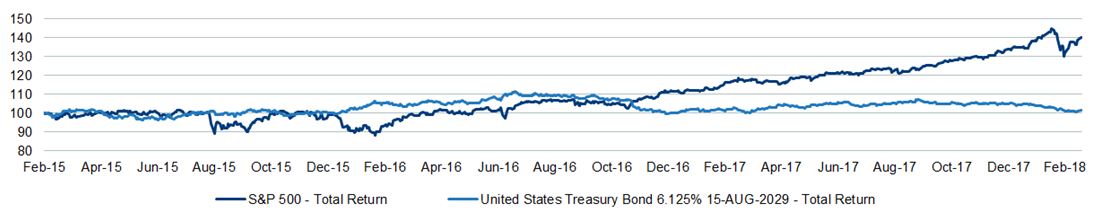

While US Treasuries have held up better in previous periods of falling equity markets, they did not perform so well in the February 2018 sell-off, which leads one to question whether global bond/equity correlations are breaking down.

Total return – S&P 500 vs US Treasuries

Source: Bloomberg, 27 February 2018

We don’t believe so, and our valuation concerns for US bonds have largely played out in the recent derating as yields on US 10-year government bonds have now risen back up to 2.85% – a level not seen for five years.

Source: Bloomberg, 27 February 2018

US Treasuries are also yielding substantially more than UK gilts (1.5%) and German bunds (0.65%), so are likely, we would suggest, to benefit more if we see economic conditions deteriorate from here. Therefore, we have recently been adding to US government bonds as we once again see a place for them in the portfolio for diversification purposes. However, these additions have been limited to short-duration bonds, and we are still avoiding UK and European government bonds. Our overall portfolio duration is still well below the level at which it stood at the beginning of 2016 and remains towards the low end of its range (with cash at the higher end), highlighting our continued concerns around the benefits bonds can provide to portfolio diversification. Given the current limitations of using bonds as diversifiers during periods of market stress, we have also reduced exposure to equities, which have been trading on historically high valuations.

During such periods when traditional correlations do not work and diversification breaks down, we think it is important to have the flexibility to reduce unnecessary risk in a portfolio, for example by increasing the cash weighting.

Despite current challenges in finding asset classes to diversify a portfolio, we remain focused on a philosophy of fundamental diversification, as it helps us to understand why an asset should provide diversification benefits in the future, rather than relying on historical correlations.

This is a financial promotion. Any reference to a specific country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. Please note that holdings and positioning are subject to change without notice.

Comments