Investment team

Our Sustainable Global Equity strategy is managed by a team with a wide range of backgrounds and varied experience. Our investment team of research analysts and portfolio managers works together across regions and sectors, helping to ensure that our investment process is highly flexible. Our dedicated responsible investment team is an integral part of the investment decision-making process. Guided by our global investment themes, we seek to identify opportunities and risks through research and debate.

- 19

- years’ average investment experience

- 11

- years’ average time at Newton

-

Paul Markham

Head of Global Opportunities

-

Julianne McHugh

Head of Sustainable Equities

-

Nick Pope

Portfolio manager, sustainable equity strategies

-

Simon Nichols

Portfolio manager, global opportunities team

-

Paul Birchenough

Portfolio manager, Global Opportunities team

-

Ian Smith

Portfolio manager, Global Opportunities team

-

Duncan Bulgin

Portfolio manager, Global Opportunities team

-

Karen Miki Behr

Portfolio manager, Global Opportunities team

-

Aditya Shah

Portfolio analyst, Global Opportunities team

-

Jonathan Dennis

Portfolio analyst, Global Opportunities team

Strategy profile

-

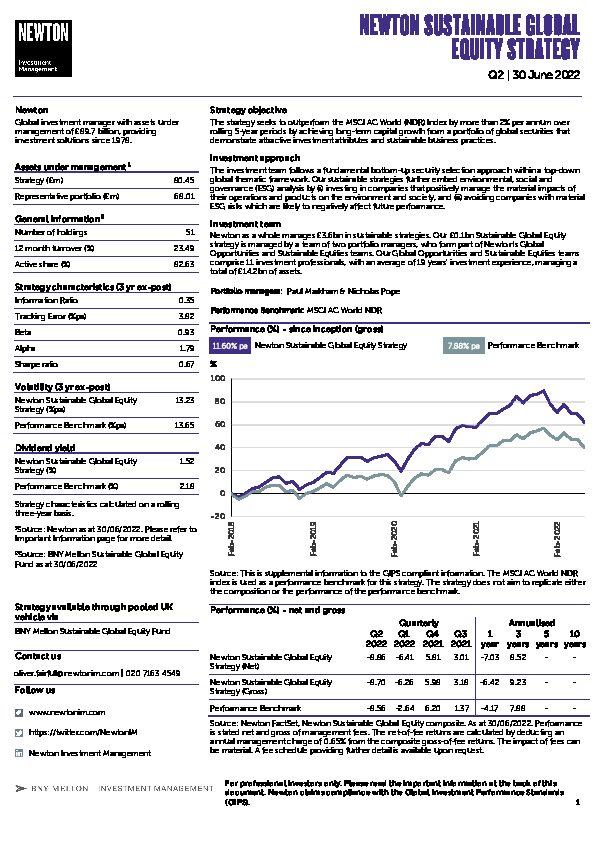

Objective

-

The strategy seeks to outperform the MSCI AC World (NDR) Index by more than 2% per annum over rolling 5-year periods by achieving long-term capital growth from a portfolio of global securities that demonstrate attractive investment attributes and sustainable business practices.

-

Performance benchmark

-

MSCI AC World Index (NDR)

-

Typical number of equity holdings

-

50 or fewer

-

Strategy inception

-

Composite inception: 1 February 2018

-

Strategy available through pooled UK vehicle

-

BNY Mellon Sustainable Global Equity Fund

View fund performance

View Key Investor Information Document

View prospectus

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

Newton will make investment decisions that are not based solely on ESG considerations. Other attributes of an investment may outweigh ESG considerations when making investment decisions. The way that ESG considerations are assessed and the assessment of their suitability for Newton’s sustainable strategies may vary depending on the asset class and strategy involved. For Newton’s sustainable strategies, ESG Quality Reviews are performed prior to investment for corporate investments (single name equity and fixed income securities).