The beauty industry is having a makeover. Just as the rise of the internet, social media and e-commerce have affected so many other sectors, the beauty business is undergoing its own transformation at the hands of the digital world. With the average woman in the UK expected to spend £100,000 on beauty products over her lifetime,[1] these changes could have a huge effect on traditional manufacturers, and also give rise to a big opportunity for e-commerce retailers and smaller boutique manufacturers.

The beauty industry is having a makeover. Just as the rise of the internet, social media and e-commerce have affected so many other sectors, the beauty business is undergoing its own transformation at the hands of the digital world. With the average woman in the UK expected to spend £100,000 on beauty products over her lifetime,[1] these changes could have a huge effect on traditional manufacturers, and also give rise to a big opportunity for e-commerce retailers and smaller boutique manufacturers.

Breaking down barriers

The large, household-name beauty product manufacturers used to be protected by significant barriers to entry. First, they had relationships with the ‘bricks and mortar’ retailers, which enabled them to get their products in stores. Second, as very high gross margin businesses, they were able to spend a lot on traditional TV and print-media advertising.

Currently in the UK (which has one of the highest e-commerce penetrations globally), e-commerce accounts for around 7-8% of all beauty sales, and this is growing at roughly 20% year-on-year as the traditional ‘moats’ around bricks-and-mortar retailers shrink at the hands of the online world.[2]

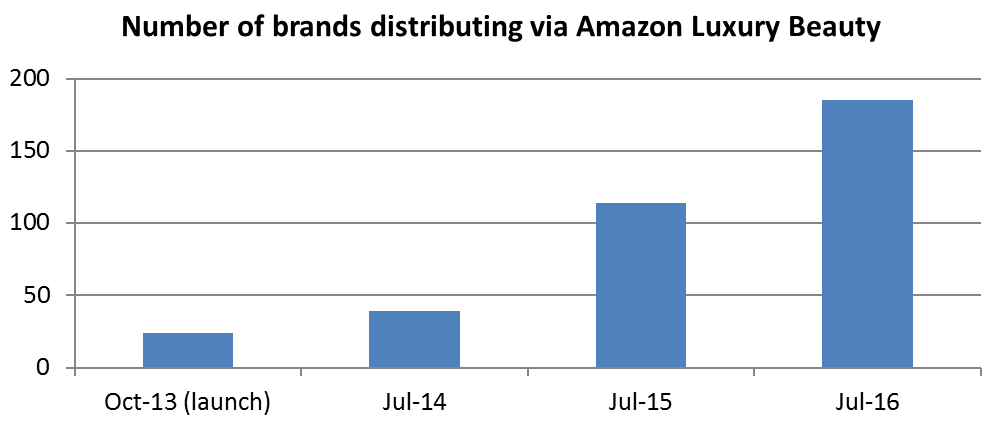

No longer does a manufacturer have to rely on relationships with a conventional retailer to get its product into consumers’ hands; the internet has introduced the concept of an ‘infinite shelf’ – meaning anyone can now sell online. Take, for example, the rapidly growing number of brands distributing via Amazon’s Luxury Beauty platform (see chart below).

Source: L2 Inc., Amazon IQ: Amazon vs. Beauty E-Tailers, October 2016.

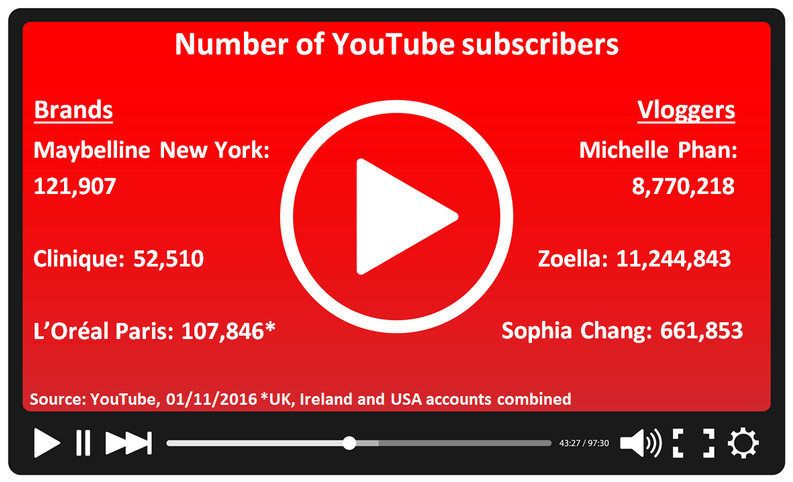

Added to this, the ever-growing social media universe has brought further complications, making it increasingly difficult for manufacturers to manage their own brand message. Advertising isn’t just about buying prime-time TV spots anymore; there are now bloggers and ‘influencers’ to consider, each of them posting reviews and tutorials of the latest ‘hot’ products online through countless social channels.

Scale still matters

There is still an argument that the big beauty names will triumph. These large firms benefit from their scale, and have the most to invest in big data and analytics, tracking what people search for and talk about online – key if you want to spot the next big trend. They can also spend more money working with the biggest influencers, and they have the budgets to develop technology to provide a more personalised service to their customers (an increasingly important aspect of beauty retailing, which I will discuss further in my next post).

Already we have seen companies make big changes to adapt to this new world, including shifting their large marketing budgets to digital media and data analytics. Take the example of US beauty firm Coty, which recently announced its purchase of digital marketing specialist Beamly, bringing the firm’s expertise in content production and data analysis in-house.

Another example is a skincare and cosmetics giant, which at a recent investor day I attended showed a live demonstration of how it is developing a more personalised customer journey. It showed a customer searching for a product through a search engine, visiting the company’s website and opening a live chat window with a customer service expert. It then demonstrated how the customer service expert could build a profile for that customer, tracking what they had searched for previously in order to best meet their requirements.

While some may feel this has a ‘big brother’ strain to it, the ‘digital native’ generation may not feel it is so intrusive. In fact, many view this monitoring and tracking as simply a way of improving their customer experience.

In my next post, I’d like to explain how digital isn’t just transforming how people buy digital products, but is also influencing what they buy.

[1] Bionsen, 2015

[2] L’Oréal

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that holdings and positioning are subject to change without notice.

Comments