In our newly published paper, ‘A Perspective on Returns’, the Real Return team discusses the probability that the boom we have seen in financial markets will end in a similar fashion to those experienced in the last twenty years.

In a short series of posts, we’ll discuss some of the key ideas in the paper, beginning with where we think financial markets currently stand.

Then and Now – Challenges in the Wake of the Global Financial Crisis

In the aftermath of the global financial crisis in 2008, it seemed unlikely to us that we were at the start of another secular expansion in financial-asset prices; with interest rates and bond yields standing at very low levels, and corporate margins and valuations having recovered substantially, the opportunity set appeared very different from that which investors enjoyed in the early 1980s. In addition, there were many other potential triggers for volatility, including experimental monetary policy interventions, inexorably rising global debt levels and rising wealth inequality.

In combination, these factors suggested to us that the period following the crisis could be marked by increasing risk and uncertainty. When we considered the outlook in previous iterations of ‘A Perspective on Returns’ (in 2012 and 2014), we concluded that the strong returns seen in risk-asset markets in the years immediately following the financial crisis could easily be consistent with the boom phase of the next boom-bust cycle, as opposed to signifying meaningful economic growth.

Our Perspective in 2018

Notwithstanding the bout of volatility we have seen in asset markets since the beginning of February, the bull market that began after the financial crash has continued for much longer than we had anticipated. However, the fact that the current boom is shaping up to be one of the longest on record does not necessarily mean that its underpinnings are any more stable than that of booms in the past. One could even argue the reverse – that the longer persistent interventions suppress volatility and raise risk-asset prices, the greater the risk that this perceived stability leads to greater instability in the future. This appears especially likely to us given that monetary policy has been the principal driver of asset appreciation since the financial crisis.

Investors have become increasingly conditioned to the idea that central banks will provide support and keep money cheap in times of crisis. This central bank ‘put’ was not the initial intent of policymakers, with extreme changes in monetary policy intended as short-term responses to domestic crises. However, the continued existence of these monetary policies has raised asset prices and given ‘zombie’ companies capital to function, arguably creating a deflationary impulse, rather than stoking the general (upward) pricing pressures authorities have intended to achieve.

This precedent set by the central banks, of liquidity injections in times of stress, is clearly a departure from traditional market capitalism. Without periods of capital destruction, markets struggle to allocate capital efficiently.

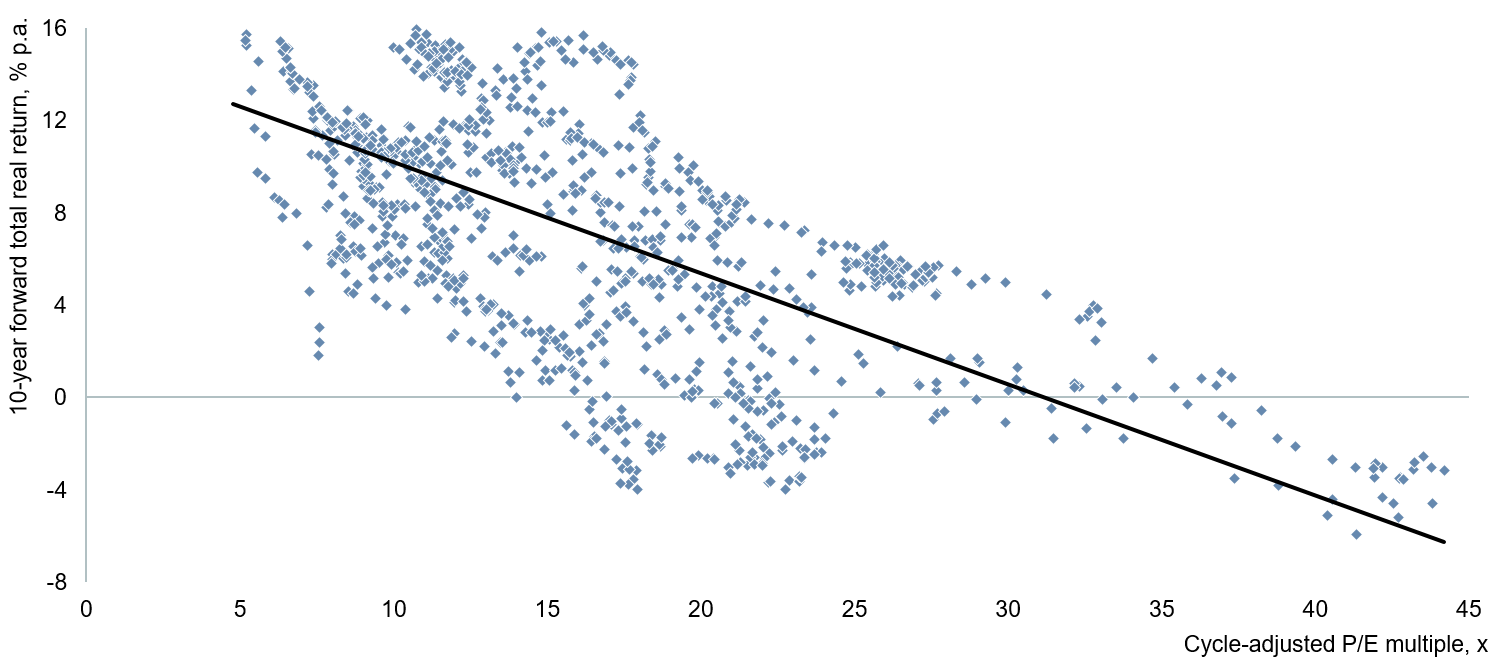

In terms of financial-market levels, valuations have become even more elevated (and therefore expected returns lower) on the back of expanding corporate margins. Indeed, a cyclically adjusted price-to-earnings ratio (based on an average of ten years’ earnings) of 32,[1] which has only been higher in the late 1990s bubble, implies an expected inflation-adjusted return over the next ten years of approximately zero percent per annum (see chart below).

What You Pay Influences Future Returns

Observations over 100 Years

S&P valuation level (cycle-adjusted) vs. 10-year average annual returns

Source: Prof Robert Shiller, Yale University, http://www.econ.yale.edu/~shiller/data/ie_data.xls, Newton, December 31, 2017. Chart depicts 100 years of monthly data points.

If one takes out the effect of corporate margins, by looking at the price/sales ratio of the S&P index, we observe that the market is now at its most expensive in history. As it has previously in this expansion, this expected return profile continues to suggest to us that this is yet another extended cyclical bull market rather than a sustainable secular expansion.

[1] Source: Bloomberg, as at 02.15.18

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.