In a summer notable for its extreme weather events, including heatwaves and hurricanes in the US and flooding in Europe and China, the Intergovernmental Panel on Climate Change (IPCC), a United Nations (UN) body tasked with periodically assessing the scientific knowledge of climate change, released the first instalment of its sixth assessment cycle, which the UN has described as a “code red for humanity”. The report finds that limiting warming to 1.5°C or even 2°C above pre-industrial levels will be “beyond reach” unless there are “immediate, rapid and large-scale reductions” in greenhouse-gas emissions.1

In financial markets, a variety of concerns led to a number of warning lights starting to flash red, particularly in September. The third quarter had begun with a continuation of the broadly optimistic tone that had been dominant since the start of the year, and while concerns around the Covid-19 Delta variant and a government regulatory crackdown in China briefly unsettled markets, global equities maintained a largely upward trajectory during July and August. However, after reaching an all-time high on September 2, the S&P 500 index of US stocks, along with other global equity markets, experienced significant downside volatility over the remainder of the period.

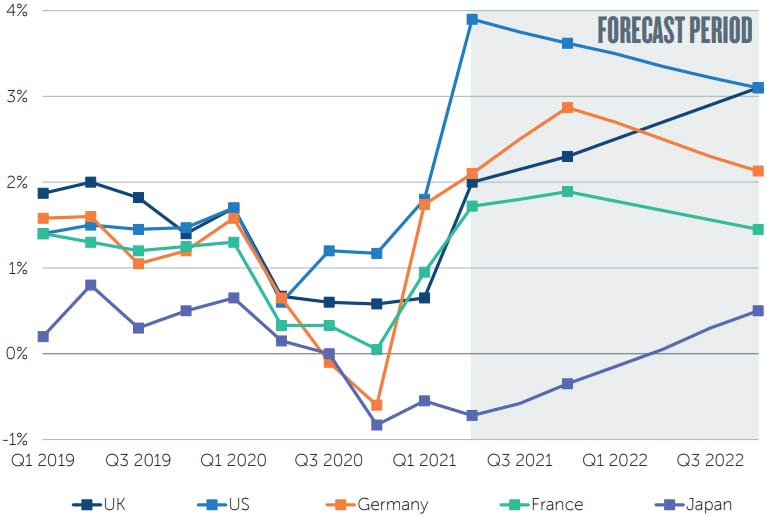

Chief among the factors which rattled markets were inflationary pressures, exemplified by a surge in energy costs across Europe, and the growing prospect of more ‘hawkish’ central-bank policy. In its September Interim Economic Outlook, the Organisation for Economic Cooperation and Development (OECD) forecast that inflation would continue to rise over the next two years, with price increases in 2021 and 2022 likely to be significantly higher than it had previously forecast for many countries. While it believed that inflation should moderate as supply-chain bottlenecks are resolved, the OECD warned that policymakers should “remain vigilant” for signs of more persistent inflation.2

Inflation

% year on year

Source: OECD Economic Outlook, Interim Report September 2021.

At its September Federal Open Market Committee (FOMC) meeting, the US Federal Reserve (Fed) signaled that a tapering of its US$120 billion per month asset-purchasing program “may soon be warranted”,3 with Chair Jerome Powell stating that he believed “the ‘substantial further progress’ test [referring to maximum employment] is all but met”, while its 2% average inflation target had already been achieved. In addition, the Fed began to indicate that interest-rate rises could occur sooner and faster, with nine (half) of the 18 FOMC officials now expecting a rise in 2022, compared to only seven at its June meeting.4 In the UK, the Bank of England’s Monetary Policy Committee predicted at its September meeting that consumer price inflation would rise to over 4% during the final quarter of 2021, and while voting unanimously to keep rates unchanged, indicated that the case appeared to have strengthened for some “modest tightening of monetary policy”.5

Markets around the world were also roiled in September by concerns over Evergrande, a massive Chinese property developer seemingly on the brink of collapse and threatening to default on bond-coupon payments. The size of the company, and the highly leveraged nature of China’s huge real-estate industry, led to fears that the event could become China’s ‘Lehman moment’, and also ignited a sell-off in riskier Asian offshore bonds. Furthermore, an overreliance on coal, which coincided with spiraling coal prices, resulted in a widespread energy crisis in China in late September, leading to industrial shutdowns which threatened to stymie the country’s growth and put further pressure on global supply chains.

In fixed income, the increased likelihood of interest-rate rises as inflationary pressures build appears to have been the main trigger behind a sharp rise in government-bond yields late in the quarter, as the asset class saw its steepest price declines since the sell-off in the opening months of the year. The JP Morgan Global Government Bond Index produced a return of -1.1% in US-dollar terms over the quarter (-5.7% over nine months). Corporate bonds, as represented by the ICE BofA Global Corporate Index, returned -0.8% over the quarter (-2.5% over the year to date).6

Japan was the strongest regional performer in equity markets, with the country’s stocks producing a positive return of +4.7% in US-dollar terms over the quarter (+6.2% over the nine months to September 30). North American stocks were just in positive territory, returning +0.3% over the quarter (+15.5% over the year to date), while UK equities returned -0.3% (+12.2%) and European shares delivered -1.5% (+10.6% over the year to date). Meanwhile, both emerging markets and Asia Pacific ex Japan equities saw more significant declines, with the former returning -8.0% over the quarter (-1.0% over nine months), and the latter returning -8.3% (-1.9%) to US-based investors.7

Gold delivered a return of -0.8% in US-dollar terms over the quarter (-7.5% over the year to date).8

The US economic recovery narrative suffered a series of setbacks over the quarter, not least as the spread of the Delta coronavirus variant threatened to act as a headwind to the momentum of economic reopening. Non-farm payroll data released by the Bureau of Labor Statistics showed that the US economy created 235,000 jobs in August, far below economists’ expectations, with the leisure and hospitality sectors seeing no gains during the month.9 However, the spread of the variant did not lead to the reintroduction of significant restrictions and cases appeared to have peaked by the end of the quarter.

Political gridlock in Washington also caused jitters in markets, with Democrats and Republicans unable to reach agreement on how to raise the country’s debt ceiling, which had been reintroduced in July after a suspension of two years. US Treasury Secretary Janet Yellen warned that the government would run out of money to meet its obligations to debtholders by October 18.10 The ruling Democrats have also faced an internal battle over the future of the bipartisan US$1.2 trillion infrastructure bill, with many on the progressive wing of the party pushing for President Biden’s larger US$3.5 trillion program that would make record investments in social services. While the possibility of increased fiscal stimulus could be supportive for markets, participants were also concerned about the risks associated with higher taxes.

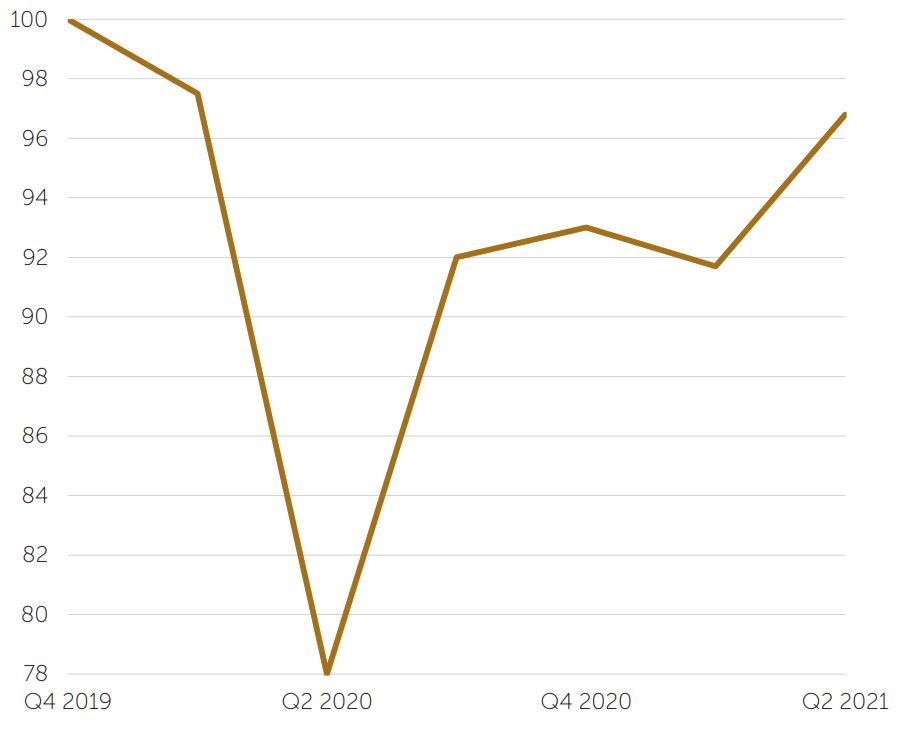

In late September, motorists in the UK faced empty pumps and long queues outside gas stations that did have fuel as an initially small number of gas-station closures caused by a shortage of tanker drivers was exacerbated by panic buying. While data from the Office for National Statistics estimated that the country’s economy had grown by 5.5% in the second quarter, faster than previously thought and bringing GDP closer to pre-pandemic levels,11 more recent IHS Markit purchasing managers’ index data published at the end of the quarter suggested that the economic recovery might also be running out of fuel.

UK Gross Domestic Product

Index, Q4 2019 = 100

Source: UK Office for National Statistics, September 2021.

Although the services sector reported rising consumer confidence, the IHS Markit data indicated that only a small majority of manufacturing businesses had seen an expansion in September. The survey also suggested that business activity has been increasingly hampered by shortages of materials and labor, most notably in the manufacturing sector, with a lack of staff and components causing falls in output within the food, drink and auto-manufacturing sectors.12

With Brexit widely cited as having worsened supply and labor-market constraints linked to the pandemic, many businesses are having to pass on higher expenses to consumers, who are also facing a large hike in energy prices and the end of the furlough scheme.

With Germany’s federal election on September 26 resulting in a close finish, Europe’s largest economy may face lengthy coalition negotiations before Olaf Scholz, whose Social Democratic Party took the largest share of the vote, is able to form a new government. The incoming administration will face a workforce which is demanding higher wages as inflation has risen to its highest level in 29 years. Inflation for the eurozone – at 3.4% – has also reached its highest point since the global financial crisis, as the bloc struggles with many of the same supply constraints and gas-price rises that have affected the UK.13

However, the European Central Bank (ECB) has distanced itself from the more hawkish rhetoric recently employed by its US and UK counterparts. In her opening address at the ECB’s annual forum on central banking, President Christine Lagarde said that she expected inflation to decline once the base effects linked to the pandemic had passed, and promised not to overreact to shocks that may temporarily drive inflation higher, adding that monetary policy “must remain focused on steering the economy safely out of the pandemic emergency and lifting inflation sustainably towards our 2% target”.14 Although the ECB has said it will slow down its €1.85 trillion pandemic bond-buying program as the European economy improves, it has not yet announced plans to end the program or begin tapering this year.

Japan’s Topix Index

Price

Source: FactSet, October 1, 2021.

Following the abrupt resignation of Japan‘s Prime Minister Yoshihide Suga at the start of September after his struggle to control the coronavirus pandemic, the Topix index of Japanese stocks rallied to reach a 30-year high as markets predicted that a change in leadership would bring greater stimulus.15 Suga’s successor, the 64-year-old Fumio Kishida, pledged to put together “an economic stimulus package worth tens of trillions of yen by the year-end”.16

With vaccination rates having risen and Covid cases declining, Japan’s economy should receive a boost as the government lifted a state of emergency across all areas of the country at the end of September. Japan’s economy grew by only 0.3% during the second quarter,17 while the tighter restrictions seen during the summer, epitomized by an Olympic Games that took place without spectators, are likely to have further subdued the recovery.

With China‘s property sector estimated to account for around a quarter of the country’s GDP, contagion from the collapse of developer Evergrande could have a significant impact on China’s economic growth, which is already likely to have been affected by disruption linked to the Delta Covid variant during the quarter. Evergrande has had an exceptionally bloated balance sheet and was in breach of the central government’s property-sector guidelines for around a year, so a restructuring or bankruptcy appeared almost inevitable. With the government keen to set an example, a full-scale bailout is unlikely, but as a large percentage of the country’s household wealth is tied into the property sector, it appears unlikely that authorities will allow a default of Evergrande to become a much wider systemic issue. Nevertheless, the situation is likely to result in elevated levels of volatility within directly and indirectly linked areas, so warrants close attention.

There is no risk-free path for monetary policy.

Jerome Powell, chair of the US Federal Reserve

1 https://www.ipcc.ch/2021/08/09/ar6-wg1-20210809-pr/

2 https://www.oecd.org/economic-outlook – accessed October 1, 2021

3 https://www.federalreserve.gov/newsevents/pressreleases/monetary20210922a.htm

4 https://www.ft.com/content/719c11ec-fb24-40b3-a661-518aa3bc6028

5 https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2021/september-2021

6 Bond market returns sourced from FactSet, 10.01.21

7 Equity market returns sourced from FactSet, 10.01.21 (All US-dollar returns, MSCI index series)

8 Gold bullion returns sourced from FactSet, 10.01.21

9 https://www.ft.com/content/2b66803b-59a4-4596-be91-ccb241043864

10 https://www.ft.com/content/1c059500-68ce-4dec-946e-1e1480fb9b0a

11 https://www.ft.com/content/b1840226-0147-40e8-84b2-814fa8d28917

12 https://www.markiteconomics.com/Public/Home/PressRelease/5f645e668caa437dab9db76721130775

13 https://www.ft.com/content/1241b033-6fe3-4cc0-95fc-befdfc7935ab

14 https://www.ft.com/content/81c48cca-7e11-4888-b633-511996789648

15 https://www.ft.com/content/4578764f-dadb-49a4-8341-629a8106989e

16 https://www.ft.com/content/9c3b578f-2dd5-4913-acc9-4252c80214e1

17 https://www.ft.com/content/5a43557d-4c78-45cc-9fc8-4febed331b97

All data is sourced from FactSet unless otherwise stated. All references to dollars are US dollars unless otherwise stated.

This is a financial promotion. This document is for institutional investors only. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Registered in England No. 01371973. Newton Investment Management is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN. 'Newton Investment Management Group' is used to collectively describe a group of affiliated companies that provide investment advisory services under the brand name 'Newton' or 'Newton Investment Management'. Investment advisory services are provided in the United Kingdom by Newton Investment Management Ltd (NIM) and in the United States by Newton Investment Management North America LLC (NIMNA). Both firms are indirect subsidiaries of The Bank of New York Mellon Corporation ('BNY Mellon'). Newton Investment Management Limited is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton Investment Management Limited's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. In Canada, Newton Investment Management Limited is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Ontario and Quebec and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations. Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton. Certain information contained herein is based on outside sources believed to be reliable, but their accuracy is not guaranteed. Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2021 The Bank of New York Company, Inc. All rights reserved. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. The companies referenced may or may not represent securities purchased or sold for advisory clients. It should not be assumed that an investment in the companies discussed was or will be profitable. To the extent that copyright subsists in any picture used in this document, Newton recognizes the copyright therein.