We assess the ramifications of the European Union’s €750bn deal for EU bond markets and the euro.

- The liabilities for the new European Recovery Fund will be shared across all 27 European Union (EU) member states.

- A combination of the European Recovery Fund and the European Central Bank’s bond-buying programs should significantly reduce EU sovereign and corporate credit risk.

- We anticipate that spreads between core and peripheral EU bonds will continue to narrow.

After four days of intense and sometimes fractious negotiations, the European Union (EU) finally reached agreement on the size (€750 billion) and the structure of the European Recovery Fund, which is aimed at funding relief efforts across Europe in the aftermath of the pandemic. We believe that the deal finally hammered out in the early hours of July 21 could have profound implications for the integration of the EU, its bond markets, and also the single currency.

‘Frugal Four’ Appeased

A large chunk of the deal will be funded using bonds issued by the EU, and it will be jointly financed by the member countries. Other than the sheer scale of the package, the other truly noteworthy aspect is that the liabilities will be spread across all 27 EU member states. It is little surprise that the ‘frugal four’ EU states of Austria, Sweden, the Netherlands and Denmark had argued for a smaller fund and continued to play ‘hard to get’ throughout the negotiations, as a large majority of the €750bn (US$850bn) is going to be issued in grants and may never be paid back.

Spreads to Narrow

We anticipate that spreads between the European periphery and the core countries are liable to shrink over time for two reasons. First, if all countries are guaranteeing the new debt, the credit risk between sovereigns is reduced. Second, if the €750bn is put to good use and results in economic growth, solvency risk will be reduced across the EU. For the core countries, bond yields could see modest rises, owing to the increased debt on their books, but again, we would argue that if the economic outlook for the EU improves (and tax receipts rise) they will find it less challenging to service the debt.

The alliance struck between German Chancellor Angela Merkel and French President Emmanuel Macron prior to the latest negotiations meant that it was always likely that a deal would be agreed, but the focus was very much on the size of the grants (versus loans) contained within the final package.

Positive Combination

Originally, the talk was of a deal worth €500bn of grants, but this was watered down in the end and concessions were made to the ‘frugal four’. However, we believe this deal represents a very significant positive contribution for Europe.

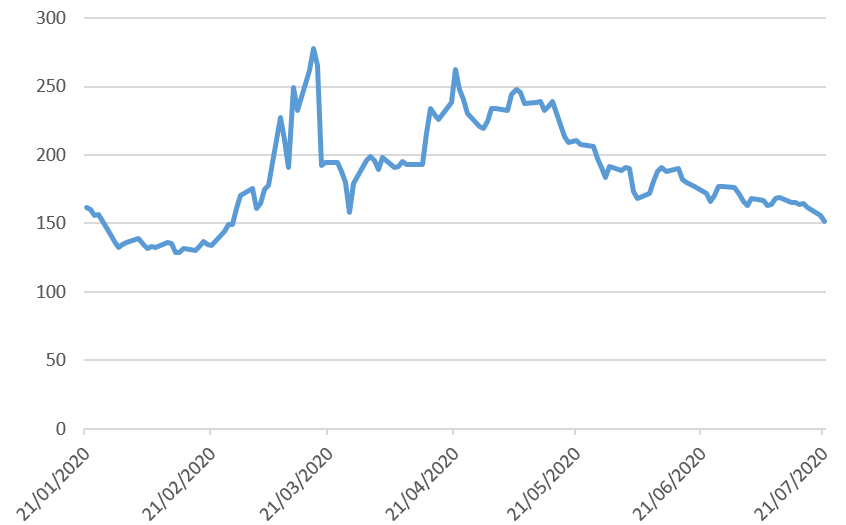

As the chart mapping Italian 10-year government-bond spreads versus German 10-year government bond spreads below shows, bond markets had already started to price in the result before it was announced. We would expect this spread narrowing to continue and even drop through the previous lows of around 90 basis points. In our view, a combination of the European Recovery Fund and the significant European Central Bank bond-buying programs already in place should narrow credit risk across the EU for both sovereign and corporate bonds.

Euro to Strengthen

The potential for an improved economic outlook following the implementation of the fund should also help the euro gain in value. The single currency has been held back by the previous slow policy response from the authorities as well as continuing background worries over the potential break-up of the euro if economies continued to diverge. We believe that the events of this week have reduced these concerns.

Italy 10-Year vs. Germany 10-Year Spreads (Basis Points)

Source: Bloomberg, July 21 2020

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.

In Canada, Newton Investment Management Limited is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Ontario and Quebec and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.