We assess two potential tail-risk scenarios from the pandemic that could hurt investment-grade bond investors.

- Global investment-grade credit spreads have largely recovered from pandemic-induced widening.

- The leisure sector has, unsurprisingly, yet to see spreads narrow.

- We see two tail-risk scenarios that might hurt the currently popular investment-grade sector:

– More severe and lasting economic damage than anticipated, leading to more credit-rating downgrades and defaults

– A more vigorous recovery than anticipated, leading to inflation and a need to unwind the extraordinary global monetary and fiscal stimulus much faster.

A decade ago, policymakers and central banks did a creditable job of safely navigating through the storm created by the global financial crisis to bring economies back to solid ground. Let us call that ‘Top Gun I’. This time, as the global economy struggles to recover from the coronavirus pandemic shock, perhaps the challenge is even greater; policymakers and central banks are in the spotlight once again – it is time for Top Gun II.

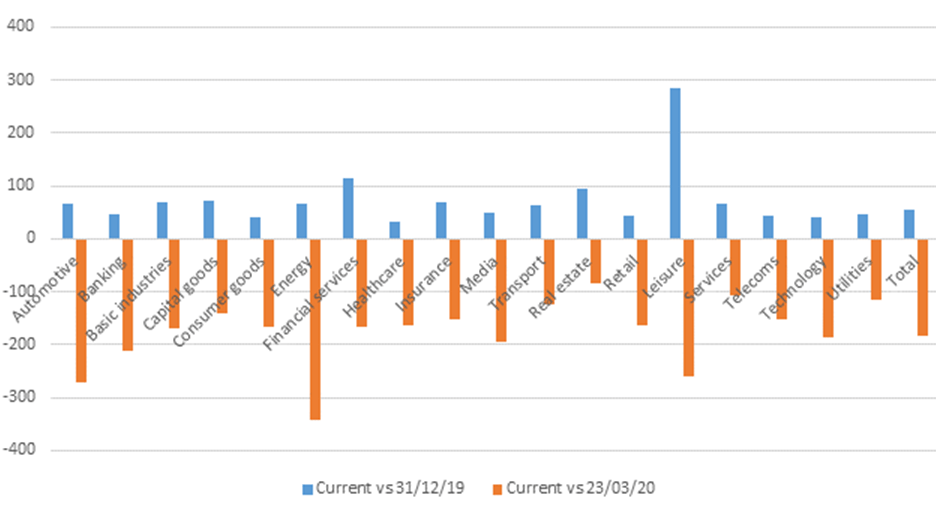

Three months ago, we believed it made sense for investors to increase exposure to investment-grade bonds and increase the average maturity of holdings because credit spreads had widened out to attractive levels, and our view was that they would recover once authorities implemented their inevitable policy responses. Indeed, global investment-grade credit spreads in many sectors have largely recovered from Covid-19-induced widening (which peaked on March 23), and are nearly back to levels seen at the start of the year, as the chart below shows:

Changes in Investment-Grade Spreads (Basis Points)

Source: BoAML, June 18, 2020.

Unsurprisingly, the outlier is the leisure sector. Sticking with the Top Gun analogy, with credit spreads still tightening, and investment-grade bonds and investment-grade funds in very high demand, it feels somewhat ‘maverick’ to suggest there may be tougher times ahead for holders of the asset class.

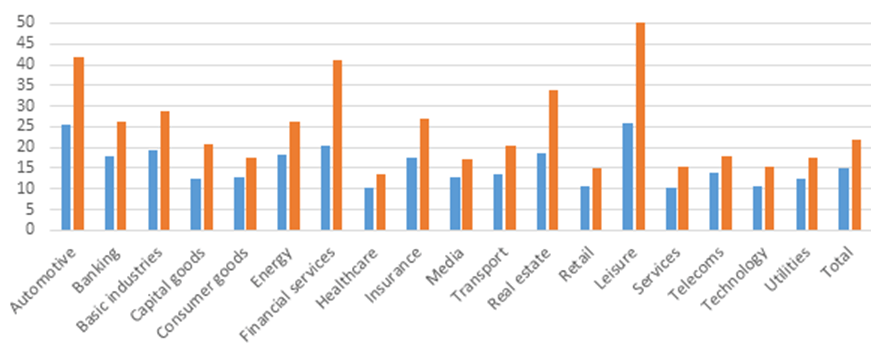

As spreads have narrowed, the compensation for credit risk has diminished, and because of the large drop in underlying government-bond yields, yields on corporate bonds in many sectors are lower than at the turn of the year, while duration (a measure of risk relative to a given increase in yields) has risen again. As a result, the spread per unit of duration is little higher than at the end of 2019, despite the enormous economic and fiscal damage witnessed since then.

Return (Spread in Basis Points) Versus Risk

Spread (BP) Divided by Duration as at 12/31/19 (Blue) and 02/23/20 (Orange)

Source: BoAML, June 18, 2020

Again, the outlier is the leisure sector (cut off in this chart, as the actual reading is 92 basis points).

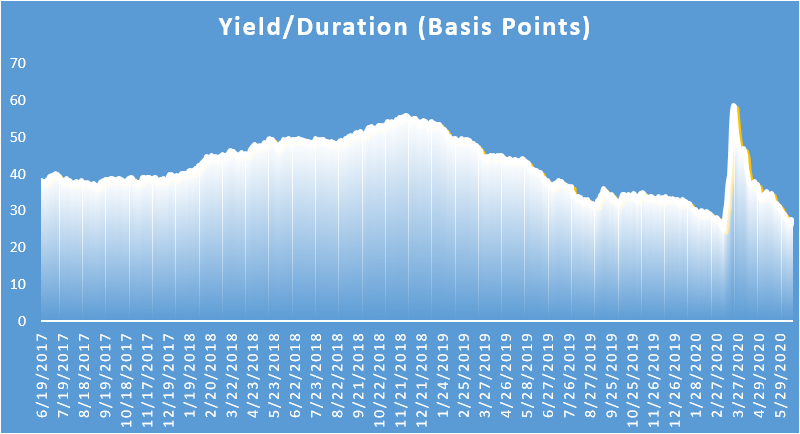

Meanwhile, having risen sharply in the first quarter of 2020, yield per unit of duration is now back to historic lows (see below).

Source: BoAML, June 18, 2020

Faced with declining spreads and yields and lengthening duration, contemplating the potential risks and returns brings us to the conclusion that returning credit markets to Earth after the extraordinary global economic shock (akin to war time) and monetary and fiscal response on a scale and pace not witnessed before, will be like trying to land a fighter jet on an aircraft carrier in a storm. That is to say, it can be done, but it requires great skill and is very hazardous. And although take-off from a carrier is tricky enough, landing is even more difficult.

A Tale of Two Tail Risks

While a smooth economic recovery and soft landing for the investment-grade bond sector is entirely possible, we see two fat tail risks, which turn it into a bumpy one at best:

- Scenario 1: More severe and lasting economic damage leading to more credit-rating downgrades and defaults, necessitating wider credit spreads (leading to lower corporate- bond prices).

- Scenario 2: A more vigorous recovery, leading to inflation and a need to unwind the extraordinary global monetary and fiscal stimulus much faster. This will in turn lead to higher government and corporate-bond yields (and hence lower prices for high-quality bonds).

There are three principal risks attached to investment-grade corporate bonds:

- Credit Risk

- Duration

- Illiquidity (relative to government bonds, equities or foreign-exchange markets, for example).

Of course, high yield carries more credit risk and is even less liquid, but those bonds tend to be shorter duration and less interest-rate sensitive, and inflation is less of an enemy. Government bonds typically have longer duration (and lower coupons, and are less able to cushion against capital-price falls), but they have no or less credit risk and are far more liquid. So, while investment grade would probably not be the worst-performing bond type in either of the tail-risk scenarios described above, it could still perform poorly in absolute terms in either scenario.

In scenario one, investment grade will easily outperform high yield, but massively underperform government bonds and, given the low yield starting point, probably deliver negative absolute returns.

In scenario two, while government bonds would be vulnerable to rising inflation and real yields, holders of government debt have two advantages over holders of investment-grade debt. First, the top priority of central banks and governments will be to focus remaining quantitative easing (QE) firepower on keeping government borrowing costs under control. They also have the option of outright debt monetization as advocated by some proponents of Modern Monetary Theory (MMT), (and could perhaps even go as far as financing government deficits and bond maturities by buying new debt at issuance at non-market rates).

Investment Grade Pressure to Build?

While some continuing support is likely for corporate bonds, it would not be of the same magnitude. Furthermore, government bonds are liquid and you can sell them in large quantities at pace if you are worried about rising inflation or real yields. The same cannot be said for investment-grade corporate bonds. High yield is even less liquid, but the correlation with government bond yields is typically much lower; strong growth and inflation can help ‘inflate away’ these companies’ high leverage. Since high-yield bonds are generally shorter dated, with higher coupons and higher spreads, they have less sensitivity to rising government-bond yields.

Barbell Approach

So, while investment grade is appropriately priced for a well-orchestrated soft economic landing, we are concerned that valuations and liquidity constraints do not adequately reflect the sizeable tail risks. Accordingly, we believe it is prudent for absolute-return bond investors to consider reducing investment-grade exposure in favor of a more ‘barbelled’ approach (i.e. adding to government bonds and high yield). We acknowledge this strategy may prove premature, but our view is that given investment grade is a ‘crowded trade’, we think it wise to act now rather than wait until it becomes more evident that either tail scenario is becoming more probable than possible.

Maverick: “I can see it’s dangerous for you, but if the government trusts me, maybe you could”

Charlie: “It takes a lot more than just fancy flying”

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

US - Text disclosure - NIM

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.