- In response to the global pandemic, we have already witnessed two stages of state intervention: a liquidity injection, followed by continuing emergency support for struggling economies.

- Stage three involves government and central-bank support for restructuring economies that are transitioning from old ways of doing business to new ones, and will be the most difficult stage of the recovery.

- We anticipate that the global recovery is more likely to be shaped like a U-bend rather than in the form of a ‘V’ or ‘W’.

- We expect to see a deflationary environment over the next 12 months, but beyond that, we believe inflation is more likely to return.

The bounce in markets during the second quarter of 2020 enabled bond strategies to recover most of the losses that they suffered during the initial dislocation caused by the pandemic in March. The second half of the year will be more difficult, however, as we anticipate that low cash and government-bond yields will continue, alongside a rise in corporate defaults and downgrades.

One of our primary investment themes, which plays a key role in fixed-income investing, is state intervention, and we have already witnessed two of the three phases of state intervention in response to the pandemic over the last six months: first, March’s liquidity injection, and secondly, continuing emergency support for the pandemic-induced fall in gross domestic product (GDP). This began in April, but may continue well into the autumn.

Difficult Phase Three

The third phase of state intervention will be more difficult to navigate. It concerns the support from government and central-bank authorities for a restructuring of economies as they transition from an old way of doing business to a new one; the difficulty stems from the fact that some of the emergency measures that are in place roll off before companies and employees can benefit from any new economic direction. In this third phase, we would expect to see more ‘recovery fund’-type fiscal stimulus and less direct employment support. However, this transition is hampered by the need to extend phase two owing to the lingering virus threat, and the politics of getting the stimulus packages approved.

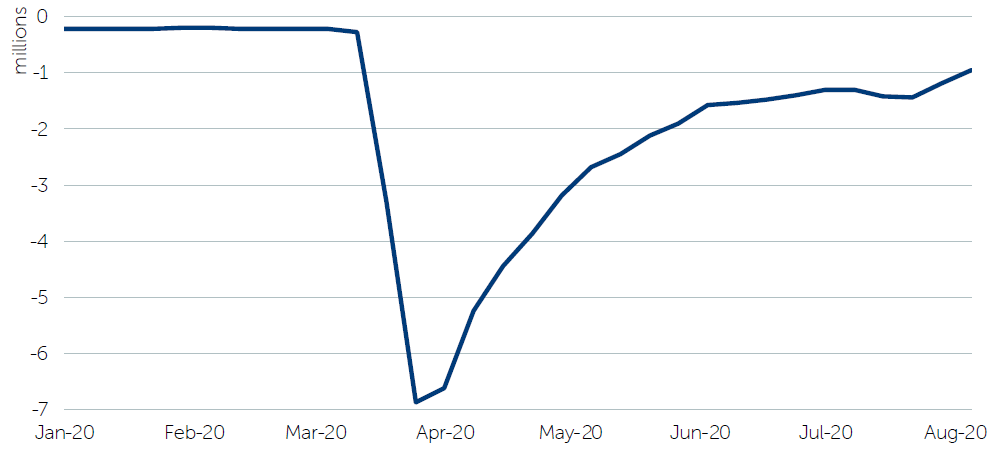

The chart below shows initial US unemployment claims and is a good example of our view that economic data (having bounced from the lows of the March/April lockdown periods) will take a while to get back to pre-crisis levels. While the market has debated a ‘V’ or ‘W’-shaped recovery, we have been talking about a U-bend shape.

US Initial Jobless Claims, January 1 – August 6, 2020

Source: Bloomberg, August 7, 2020

No Immediate Return

There are a few reasons why we think economies will not return in two years’ time to the same pattern in which they were before the pandemic. This is about more than the virus alone, and has its roots in the leverage-distorted system which was in place prior to the pandemic, which helped to create untenable wealth inequality which, in turn, fueled populism and a reversal of the globalization trend.

As always with a crisis, there are reasons why previous trends are accelerated and new trends emerge. The global financial crisis was a good example: economies weakened and then recovered, political parties changed, and some other pre-existing trends accelerated while new ones came into force. The rise of social media, smartphones and technology continued after the crisis, probably helped in part by the low cost of finance and the abundant availability of venture capital. The banking system, however, had to restructure by shrinking balance sheets and reducing staff.

Significant economic turmoil always leads to a change in political parties as new leaders suggest they can do better than their predecessors, and a disillusioned electorate looks for change. The long-term trend of globalization was also a casualty of the global financial crisis; the current calls to bring jobs home and rising trade tensions are a symptom of this.

People Crisis

The new crisis is a people crisis rather than a financial one, and therefore the systems that are in need of a restructure are those that are connected to a change in the way people live, rather than a restructuring of the financial system. Therefore, the prior trends that are not hit by this change should continue, and may receive a boost from the availability of cheaper money and, more importantly, the increasing use of fiscal stimulus rather than just loose monetary policy.

For example, the rise of populism and its negative effect on trade is likely to continue, but crucially, as governments get more involved in the economy, investment in environmental projects is likely to rise and the focus on the social agenda will also pick up; the wellbeing of staff will be a key concern and health-care systems will see more investment too.

ESG Considerations

When it comes to environment, social and governance (ESG) concerns, the increasing focus on the ‘E’ that we witnessed prior to the crisis should continue as the recovery grows. The ‘S’ agenda is more difficult to define, but those employers that look after their staff through greater use of flexible working and wellbeing support may attract the highest-caliber workers. Finally, the ‘G’ consideration should also attract heightened interest, as weak economies tend to flush out bad practice.

In our view, the sectors that need to change or adapt are those that were gearing up before the crisis based on previous trends that are no longer there. For example, the airline industry was constantly focused on expanding passenger traffic, but much of this growth may not now materialize. Many of the deflationary trends that were there in the decades before the crisis had already started to roll off – for example, globalization and demographics. Over the next 12 months as economies restructure, unemployment is likely to remain high, demand weak, and inflation at low levels.

Inflation Lurking Further Out?

Once that transition has passed, there is a real possibility that inflation could end up higher than it was previously. Prior to the crisis we were starting to worry about many of the deflation champions reaching a share of the market where (instead of looking to gain market share at a cheaper price) they would be inclined to raise prices as their market share plateaued. For example, low-cost airlines were steadily increasing prices as their competition was squeezed out of the market. The airlines that survive the current dip in travel demand will be operating with lower capacity and, perhaps as a result, higher costs.

Meanwhile, the ‘baby boomer’ generation is retiring, and thus shifting from saving to consumption mode. Delocalization will receive fresh impetus as supply chains are shortened (but become more inefficient), trade barriers are erected, and politicians try to boost domestic employment. Finally, from their current low levels, we anticipate that energy prices could rise as we shift towards more renewable energy sources – all factors that could lead to higher inflation over the longer term.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.

In Canada, Newton Investment Management Limited is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Ontario and Quebec and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.