We assess the drivers behind unusual recent moves in global bond markets and consider what may happen next.

Key points

- The multi-decade decline in inflation since the 1970s has been a key driver of the multi-decade bull market for bonds.

- Unusually, despite recent higher inflation, bond yields have fallen over the last couple of months.

- For government bonds, we anticipate a consolidation phase for the rest of the summer, with inflation numbers trending down and central-bank demand remaining high, but potential issues late in the year.

- We believe it may be prudent for bond investors to have some protection over the next couple of months.

- The supportive backdrop for some credit markets (improving profits, lower defaults, and inexpensive finance) should continue to put downward pressure on spreads.

Inflation has always been a serious influencer upon bond-market behaviour. The multi-decade decline in inflation since the 1970s explains in large part why we have enjoyed a multi-decade bull market for bonds. The reasons are simple: higher inflation erodes the fixed return you receive from a bond and prompts central banks to raise rates.

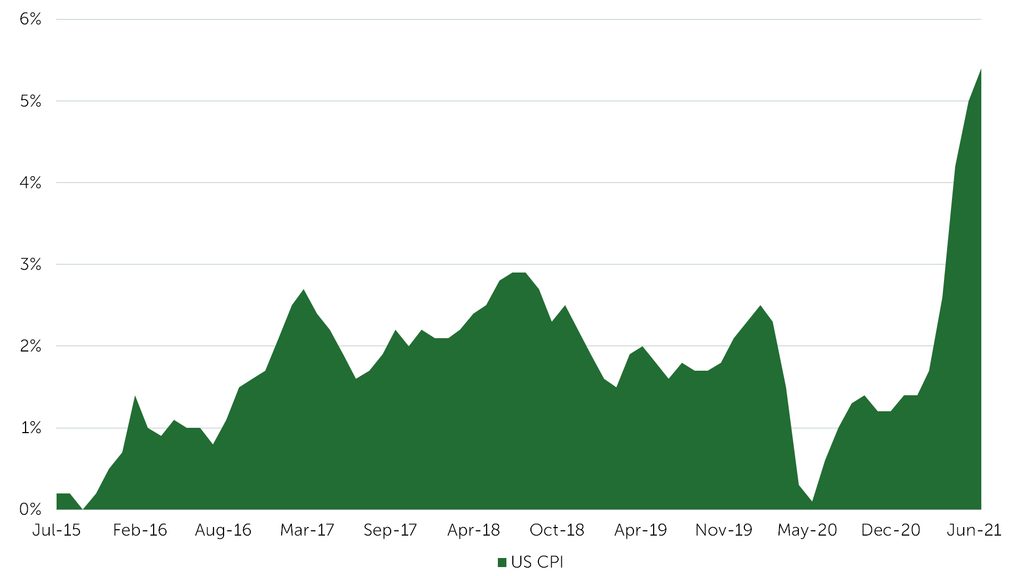

It is therefore strange that, despite recent higher inflation (see the US chart below), bond yields have fallen (returns have risen) over the last couple of months. Below, we will try to explain this phenomenon and provide our expectations for what we believe may happen next.

US consumer price inflation (CPI), July 2015-July 2021 (%)

Source: Bloomberg, 21 July 2021

Government-bond markets have been the best performing bond markets recently despite these higher-than-expected inflation numbers and central banks talking about tapering quantitative easing. Yields have fallen – for example, the US 10-year yield is down from 1.74% at the end of March to around 1.30% now.

When investors are confused about markets reacting illogically to the economic data, there are the inevitable stories about the less well-known fundamentals of supply and demand imbalances and market positioning. On the demand/supply point, it is well known now that in the US the Federal Reserve has been buying up all the net supply of Treasuries, and that investors have also been buying back Treasuries ever since.

Chinese economy slowing?

Moreover, if you dig a little deeper into the economic and monetary data, you can see that the reflation story is not all one-way traffic. Some forward-looking economic indicators have been rolling over (from very high levels) and the ‘transitory inflation story’ is well known, so why worry about it?

Furthermore, China’s credit cycle (historically a key leading indicator for commodity prices) has been tightening sharply, causing a domestic retrenchment. The China credit impulse has been declining since its peak in September last year and you can see the effects on some of China’s leading indicators below, alongside slowing momentum in US and European purchasing managers’ index (PMI) data too.

World economic indicators over the last five months

Source: Newton, Bloomberg July 2021

More importantly, what next?

For government bonds, we anticipate a consolidation phase for the rest of the summer, with inflation numbers trending down and central-bank demand remaining high. We also see fiscal support for the economy receding, with the removal of some of the emergency support packages. This support (through credit and income payments) has been significant, and not all of it will be replaced as economies open; for markets, it may offer more of a short-term catalyst for greater volatility.

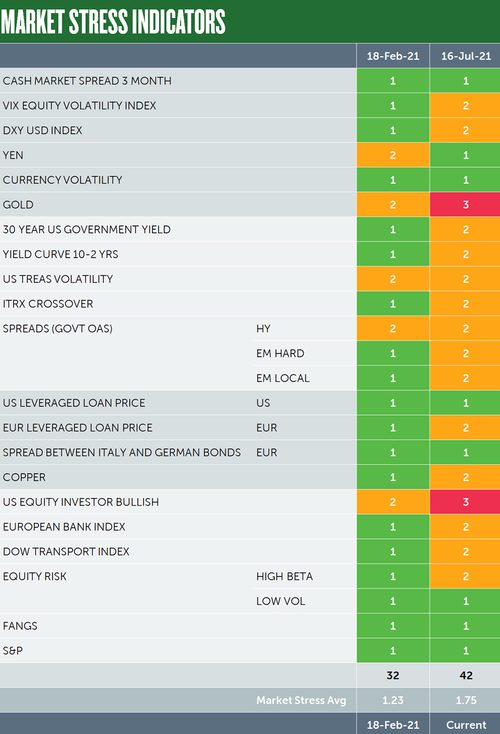

We have dusted off our market-stress table once again (see below). This set of indicators has been in ‘goldilocks’ territory since the middle of last year, but some indicators are flashing red, causing us some concerns right now.

Therefore, we believe it may be prudent for investors to have some protection over the next couple of months. There is also the continued spread of Covid-19 variants to worry about, and, increasingly, markets will be focusing on the ‘haves’ and the ‘have nots’, in terms of who has and has not been vaccinated.

Market stress indicators – 18 February and 16 July 2021

Source: Newton, Bloomberg July 2021

We believe it is prudent for bond investors to tactically reduce any shorts on the US dollar, and to consider reducing emerging-market currency exposure. In our view, it may also be worth considering adding to any call options on the US Treasury market.

The fourth quarter is where we see more significant problems developing for government–bond markets as central banks will need to step up the rhetoric about removing the various financial support ‘punchbowls’, and renewed fiscal support will weigh on bond supply. Furthermore, China is now loosening monetary policy which may support global growth later in the year. We expect government-bond market yields to rise as a result.

Credit markets to improve?

The supportive background for some credit markets (improving profits, low defaults, and cheap finance) will continue to put downward pressure on spreads. It is not a one-way story however, and we favour BBB to B-rated credit. High-quality credit is more influenced by government-bond yields and offers limited spread compression, while we believe CCC-rated bonds are very rich and do not reflect the uncertain economic recovery.

Emerging-market bonds are a mixed bag. Hard-currency emerging-market bonds have proven themselves to be a higher-beta US duration risk, and spreads are relatively tight. This suggests vulnerability if US yields rise once more. Local-currency markets are different, as divergent vaccination and monetary policy is likely to raise political volatility, and, as a result, currency risks.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice.

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments