Investment team

Our Asian Equity Income strategy is managed by an experienced team. Our investment team of research analysts and portfolio managers works together across regions and sectors, helping to ensure that our investment process is highly flexible. Guided by our global investment themes, the team works together to identify opportunities and risks through research and debate.

- 23

- years’ average investment experience

- 19

- years’ average time at Newton

-

Zoe Kan

Portfolio manager, emerging and Asian equity income

-

Alex Khosla

Portfolio manager, global opportunities team

-

Robert Hay

Portfolio manager, global equity income

-

Paul Flood

Head of mixed assets investment

-

Jon Bell

Portfolio manager, equity income team

-

John C Bailer

Deputy head of equity income, portfolio manager

-

Brian Ferguson

Portfolio manager, equity income team

-

Peter D Goslin

Portfolio manager, equity income team

-

Keith Howell Jr.

Portfolio manager, equity income team

-

Adam Logan

Portfolio manager, equity income team

-

James A Lydotes

Deputy chief investment officer, equity

Strategy profile

-

Objective

-

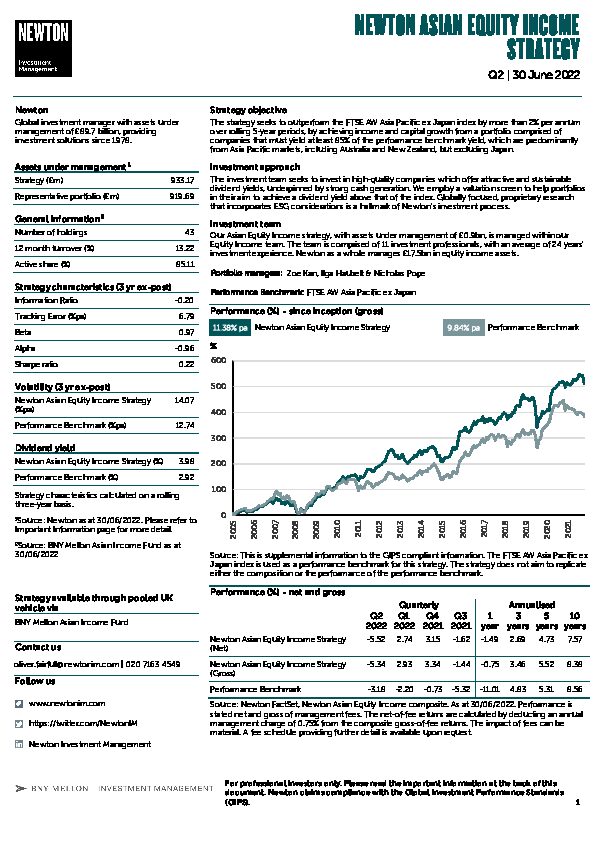

The strategy seeks to outperform the FTSE AW Asia Pacific ex Japan index by more than 2% per annum over rolling 5-year periods by achieving income and capital growth from a portfolio comprised of companies that must yield at least 85% of the performance benchmark yield, which are predominantly from Asia Pacific markets, including Australia and New Zealand, but excluding Japan.

-

Performance benchmark

-

FTSE All World Asia-Pacific ex Japan

-

Typical number of equity holdings

-

40 to 70

-

Yield discipline

-

Every new holding must have a prospective yield of at least 85% of the yield achieved by the comparative index. Any holding whose prospective yield falls below a 40% discount to the yield achieved by the index will be sold. On account of liquidity, it may not be possible to dispose of an entire holding immediately.

-

Strategy size

-

£0.9bn (as at 30 June 2022)

-

Strategy inception

-

Composite inception: 1 September 2005

-

Strategy available through pooled UK vehicle

-

BNY Mellon Asian Income Fund

View fund performance

View Key Investor Information Document

View prospectus

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

Newton will make investment decisions that are not based solely on ESG considerations. Other attributes of an investment may outweigh ESG considerations when making investment decisions. The way that ESG considerations are assessed may vary depending on the asset class and strategy involved. The research team performs ESG quality reviews on equity securities prior to their addition to Newton’s research recommended list (RRL). ESG quality reviews are not performed for all fixed income securities. The portfolio managers may purchase equity securities that are not included on the RRL and which do not have ESG quality reviews. Not all securities held by Newton’s strategies have an ESG quality review completed prior to investment, although since 2020 it has been a requirement for all (single name) equity securities to have an ESG quality review before they are purchased for the first time.