In 2017, we saw the world return to synchronized global growth for the first time since the financial crisis, with all major regions accelerating in economic-growth terms. It was also notable as the first calendar year since the financial crisis when the U.S. equity market under-performed global equities, as is typical in periods of synchronized global growth.

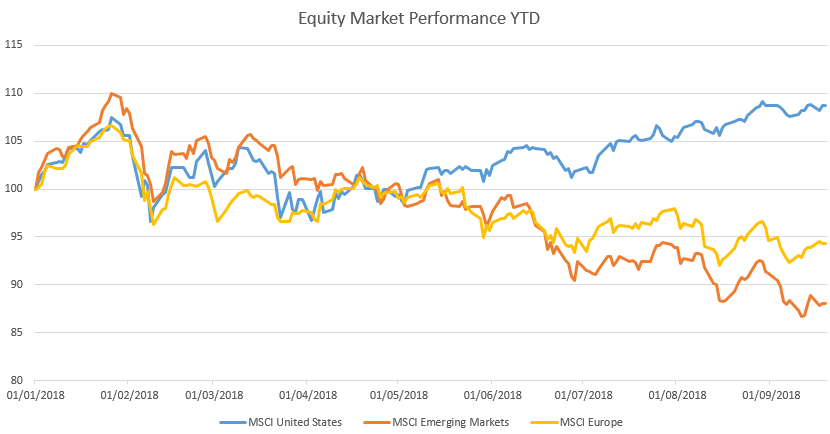

At the start of 2018, synchronized global growth was widely expected to continue, with the U.S. equity market expected to underperform further as the equity bull market broadened out and the post-financial crisis laggards took the lead. Yet, nine months into the year, the U.S. equity market is once again in pole position, having chalked up solid positive returns year to date, whereas many other markets are in negative territory (see chart below). If the present rate of outperformance chalked up this year continues, 2018 will be second only to 2011 of the post-crisis calendar years in terms of U.S. relative outperformance.

Source: Bloomberg 19/09/18

What went right for the U.S.? Or is it more a case of what has gone wrong for the rest of the world? The U.S. economy has benefited from a boost to household incomes as a result of tax cuts and increased government spending, which had more than offset the impact of higher interest rates as the U.S. Federal Reserve (Fed) has continued to tighten monetary policy. The U.S. equity market has also benefited from the tax-reform package, both directly (via higher profit margins) and indirectly, via share buybacks funded with newly repatriated foreign profits.

What Has Gone Wrong for the Rest of the World?

The combination of loose fiscal and relatively tight monetary policy in the U.S. is a rerun of the early 1980s under President Reagan. At the time, Henry Kaufman, then chief economist at Salomon Brothers, warned that government deficits would crowd out private-sector borrowers. In contrast to the 1970s, when the Fed was accommodating growing U.S. fiscal deficits by expanding its balance sheet, the U.S. government was in competition for scarce financial capital with private-sector borrowers, but it was foreign dollar borrowers who were crowded out first. The transfer of financial capital from the U.S. to the offshore dollar financial system dried up, leading to a tightening of financial conditions which hurt those countries that had borrowed in dollars.

Today, the U.S. is again running loose fiscal policy and tight monetary policy, and financial markets are again grappling with a tightening of global financial conditions in the offshore dollar financial system; this is driving up the cost of capital and hurting those financial systems with dollar liabilities. Only when the Fed stops tightening monetary policy will the pressure be alleviated.

At the same time, 2018 has seen global growth slow, in large part owing to the authorities in China reining in stimulus from the second half of 2017. This has acted as a particular headwind both for China and those emerging-market economies heavily dependent on strong Chinese demand. The combination of slower global growth and a rising cost of capital is, in our view, challenging for emerging markets.

China has recently announced measures to stimulate the Chinese economy, and markets are now weighing up whether this is sufficient to turn the Chinese economy around and offer relief to emerging markets. Based on the facts available today, the magnitude of the stimulus looks to fall well short of the 2009-11, 2012-13 and 2015-17 stimulus packages, and as such, it is unlikely to reflate the Chinese economy, let alone the global economy.

Scrutiny on the Chinese Financial System

Should the macro environment deteriorate further in China, a more concerted effort at reflation is likely; however, with the current-account surplus now much diminished, the bloated Chinese financial system is increasingly vulnerable to global financial conditions.

To this point, the experience of 2015 is perhaps indicative of the increasingly binding constraint faced by Chinese policymakers. When the People’s Bank of China began expanding its balance sheet to provide liquidity to Chinese commercial banks, it sparked capital outflows and currency weakness, undermining efforts to stimulate the economy. It was only when the Fed stopped tightening that the Beijing government had a free hand to reflate the Chinese economy.

For now, the Fed holds all the aces. Only when slower global growth and tighter global financial conditions begin to weigh on the U.S. economy and financial markets is the Fed likely to stop tightening. To this point, the apparent ‘decoupling’ of the U.S. economy and financial markets cannot be sustained in perpetuity as the rest of the world accounts for a much larger share of U.S. corporate revenues and profits than it did in the early 1980s.

In due course, we anticipate that the deflation of the offshore dollar economy that U.S. policy is currently precipitating will infect the U.S. economy and markets, but for now, they appear unruffled.

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

US - Text disclosure - NIM

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.