Key Points

- In our view, interest-rate hikes are likely to be over, with the market now focused on the timing of rate cuts.

- Small-cap earnings have been negatively affected by inflation and higher-for-longer interest rates, both of which could see relief in the coming quarters.

- Currently, the valuation disparity skews heavily in favor of small caps, with small-cap valuations potentially at a trough, as earnings could accelerate amid slowing headwinds.

- However, investors would need to see sustained relative-earnings improvement for small caps to assume leadership.

Small and mid-cap stocks—also referred to as SMID caps—have faced persistent headwinds in recent years. The Russell 2500™ Index last beat the S&P 500® Index in 2020, with marginal outperformance. Looking back further, the small to mid-cap segment has trailed large caps in nine of the last 13 calendar years, and SMID caps are underperforming year to date. In our view, the status quo is unlikely to last forever. With market conditions shifting and signs of an interest-rate pivot on the horizon, could SMID-cap equities be poised for a rebound?

The Current Environment

Interest-Rate Uncertainty

The current rate-hiking cycle is unique. After over 20 years of quantitative easing, central banks shifted gears and set off on a new track, normalizing interest rates at the fastest pace in decades in an attempt to curb inflation. Prices have since stabilized, and the effects of monetary tightening have begun to hit both the economy and corporate earnings. In turn, policymakers have signaled that the current cycle of rate hikes may be over and that rate cuts could begin this year. With relief for borrowers on the table, we believe the market environment later in 2024 could be favorable for SMID-cap stocks, and particularly for secular growth stocks.

Inflation, as measured by the core personal-consumption expenditures price index (PCE), which excludes volatile food and energy prices, fell substantially last year—from the 5%-5.5% range in 2022 to 2.9% year over year in December 2023. However, pricing pressures have been building again in early 2024. While inflation is not surging, it remains sticky, leaving investors to contemplate whether a second wave could be on the way. History suggests that once inflation gains momentum, a second wave is likely to emerge, a phenomenon that has occurred in almost 90% of cases globally.1 Investors should consider this possibility as we move further into 2024, as it could potentially prolong the Federal Reserve’s (Fed) higher-rate stance and delay rate cuts.

Current Large-Cap Cycle

The small-cap surge in late 2023 was short-lived, and we are entering what appears to be the 14th year of the current large-cap cycle.2 Data points to a significant concentration among large-cap indices, with market share controlled by just a handful of companies. This, along with the relative valuation gap between small and large caps, suggests that the market could be primed for an inflection. Yet, large caps continue to climb higher than their small-cap counterparts.

To believe the large-cap cycle will not end, one would have to accept two premises: (1) the historical pattern of small and large-cap cycles, which has been in place for a century, no longer holds true; and (2) the valuation gap between large and small caps can widen into perpetuity. In our view, both propositions are unlikely, but the latter challenges the core of equity fundamentals. Over the last 13 years, large-cap valuations have expanded while small-cap valuations have contracted. However, despite this, small caps have outearned large caps over the same time period. Thus, large caps have enjoyed relative valuation expansion, but not relative earnings growth, versus their smaller-cap peers.3

In the current macroeconomic environment, exercising patience is imperative. Over the last year, small-cap earnings have faced significant challenges, both on an absolute basis and relative to large-cap earnings. Persistent inflation and higher-for-longer interest rates have contributed to double-digit declines in small-cap earnings year over year, while large-cap earnings continue to grow positively in the high single digits.

However, we do see a silver lining: as time goes on, the comparisons become more favorable for small caps, and any relief from inflation or interest rates could further boost their bottom line. While it might be ambitious to expect a turnaround in 2024 given the current macroeconomic backdrop, we believe the long-term trend of superior small-cap earnings growth suggests that it should happen in due course. Additionally, merger-and-acquisition (M&A) deals picked up considerably at the start of 2024, which has historically been favorable for smaller-cap companies. Moreover, high-yield bond spreads are well below average. Borrowing costs could fall, reducing pressure on smaller caps, and we could see the shape of yield curve slowly moving from inverted back to flat.

Growth Versus Value

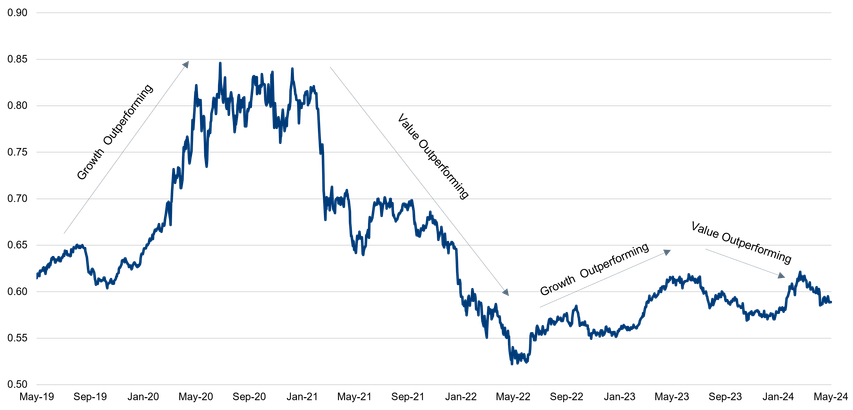

Investors generally expect to see dramatic dispersion between growth and value styles, typically when market and economic cycles are distinct—for instance, the environment favored growth stocks in 2019 and 2020, while conditions supported their value counterparts in 2021 through mid-2022. Since mid-2022, the oscillation between small-cap growth and small-cap value has been more muted, and while market leadership has shifted between the two styles, the overall direction has favored growth.

Small-cap growth stocks tend to be more concentrated in the health care, information technology and consumer discretionary sectors. If gross domestic product (GDP) begins to decelerate, growth companies that can thrive independent of economic trends may have the upper hand. Additionally, the capacity for growth would probably be scarcer in this environment, putting a premium on those companies that are able to thrive. However, if GDP remains elevated, the more cyclically exposed value companies could benefit, with economic strength bolstering their gains.

This year, GDP has been surprisingly robust. Despite signs of a potential slowdown, a deceleration has not yet materialized. This has contributed to the more muted relative returns, or dispersion, between growth and value.

Russell 2000 Growth – Index Total Return Level / Russell 2000 Value – Index Total Return Level

Opportunities Across Sectors

Health Care

Within small and mid-cap markets, we believe health care is a sector that could present a number of attractive investment opportunities. There are revolutionary changes happening across the field, and in many areas we expect to see decades of progress condensed into the next few years. In our view, new methods of health-care delivery, including telehealth technologies and better primary-care services, are poised to expand and become much more robust. Additionally, ongoing efforts to hold the health-care system accountable for outcomes and costs could encourage innovation and drive further progress. At Newton, these are some of our focus areas on the margin today.

Information Technology

We are also constructive on small and mid-cap technology stocks. Within the information technology sector, trends such as the digital transformation, the frictionless economy and cloud computing, among others, are in relatively early stages of development, with a decade-plus runway for growth, in our view. Our fundamental research analysts are closely watching a number of small and medium-sized technology companies with exposure to these themes, and we believe that several are well positioned to benefit from multiple thematic tailwinds.

For example, our analysts are following a US-based cloud communications company that we believe could dominate the landscape. This company has assembled impressive innovation and go-to-market engines, and has achieved significant scale in its core CPaaS (communications platform as a service) business. The CPaaS industry continues to penetrate new use cases and market verticals, and we believe that this potential for expansion could help the company achieve its long-term growth targets.

Energy and Consumer Discretionary

We also believe the environment may be favorable for certain energy and consumer discretionary stocks. Select small and medium-sized energy companies are effectively demonstrating production discipline; in particular, they are not overproducing. While oil and natural-gas prices have pulled back recently, we believe the supply-demand balance could skew in favor of these producers and service companies, potentially boosting their revenue and earnings growth.

We are also constructive on SMID caps within the consumer discretionary space as many consumers are well capitalized and household balance sheets are among the most robust in decades. Consumer resiliency has helped sustain GDP and has held off the largely expected “soft landing.” The sector offers investors an opportunity to diversify across solid executors and innovators providing products and services across segments such as retail and leisure.

Industrials

Within SMID caps, we are less constructive on the industrials sector. In our view, there are a select few companies that have growth opportunities tied to specific industries. However, from a bottom-up perspective the environment could pose challenges for industrials companies, particularly if interest rates remain elevated and GDP begins to slow. The Institute for Supply Management, which surveys purchasing managers at manufacturing firms, reports that US manufacturing activity has been in contraction territory (any measure below 50) since October 2022, with the exception of March 2024 when the measure briefly broke over 50.4 Other indicators, including inventories, new orders and loan growth, also point to a sluggish industrial economy, signifying that the manufacturing sector could be in the latter stages of an economic cycle.

Notable Industries

Energy

We are constructive on small and medium-sized offshore oil-service companies, particularly those that we believe have a multi-year runway for growth. We look for evidence of intentions, time from the last cycle, and the multi-year contract activity we have seen in the bookings of offshore rigs for drilling. For the exploration and production segment, we have a current preference for natural gas over oil leverage. In our view, natural gas could have a floor underneath its price as US capacity for exporting liquefied natural gas is set to increase starting in 2025.

Housing

Within the housing industry, we have a favorable view on select homebuilders; however, these stocks have largely recovered. In our view, the bigger play on housing is through a rebound in existing home sales, where activity has dropped over 90% to historic lows because of the run-up in mortgage rates. As mortgage rates have eased somewhat, and as rates are expected to drop in the future, we look for exposure to the rebound in activity in areas such as housing services and mortgage insurance.

Commercial Real Estate (CRE)

In our view, the coming mark to market in commercial real estate is likely to cause some pain but should unfold rather slowly. We believe the pain may be concentrated in urban office towers, which we also believe could feel the effects first.

Banks

Post the Silicon Valley Bank scare, we have maintained our confidence in a handful of names. In our view, the recent rebound in banks reflects the anticipation of a soft landing and lessening fears over a deterioration in credit. However, as the yield curve remains inverted, we believe commercial real estate is still a long-term concern and banks as a group are overrepresented as a part of the Russell 2000® Value Index relative to their importance in the economy.

Time for a SMID Revival?

In our view, the SMID asset class currently offers distinct advantages to investors, including attractive relative valuations and a potential trough in relative earnings growth expectations. Over nearly the last 14 years, especially post pandemic, small-cap stocks have seen their relative valuations to large-cap names fall dramatically. As the global economy reopened and the supply-demand dynamic became more distorted, exacerbated by unprecedented stimulus, large-cap stocks saw their valuations meaningfully outpace their smaller-cap brethren, which lacked their scale.

Despite a fleeting rally in late 2023, smaller caps remain in an extended downturn, both on an absolute basis and relative to large caps. Large-cap stocks—and particularly the “magnificent seven” group of mega-cap technology growth stocks—have dominated the market since the 2022 decline. However, the group has notably posted mixed results year to date, which could suggest a shift is underway.

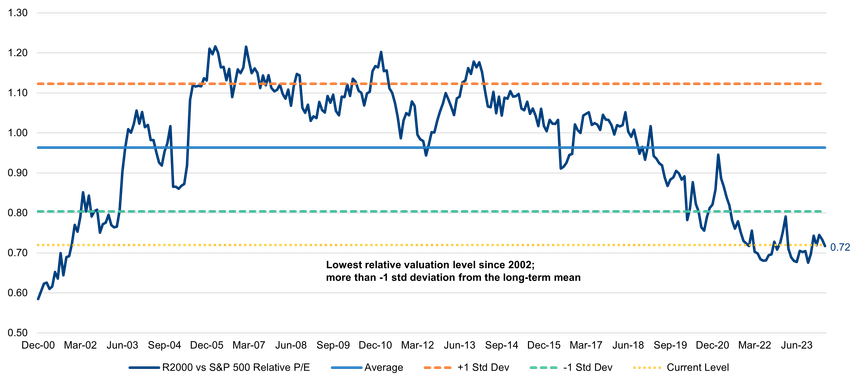

On the back of a robust December, small caps faded in early 2024 amid a solid economy and waning hopes for near-term rate cuts. In our view, we are likely to see the global economy slow under the weight of higher rates, among other factors. When the Fed does eventually cut rates, we believe smaller-cap stocks are poised to benefit. With valuations of small caps relative to large caps at 2002 lows, as depicted in the chart below, we believe this could be an attractive entry point for investors. Additionally, M&A and initial-public-offering activity appears to be accelerating down cap, which we believe could unlock robust alpha opportunities. In our view, if a shift in earnings occurs, as discussed previously, we could see durable strength in the SMID asset class.

Russell 2000 Index Versus S&P 500 Index Relative Price-to-Earnings (P/E) Fiscal Year (FY) 2 Estimates

1. Strategas as of March 18, 2024.

2. FactSet as of April 23, 2024.

3. Aditya S. Karande, CFA, Furey Associates, April 18, 2024.

4. Institute for Supply Management. April 2024. https://ycharts.com/indicators/us_pmi

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. MAR006226 Exp 06/29. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.