We discuss the outlook for infrastructure amid rising inflation and increased demand for income.

Key points

- We believe that current inflationary pressures, constrained equity and fixed-income asset yields and an increase in demand for income by aging demographics have all created a compelling case for investment in infrastructure.

- Despite slowing global travel affecting many transport-focused businesses, the rest of the infrastructure sector remains relatively unscathed.

- While all infrastructure assets share the characteristic of possessing long-term, contractually inflation-protected cash flows, the drivers of different areas within infrastructure are varied.

Why do investors look to infrastructure? We believe they seek three things: defensive business models, inflation protection and income. The last two years tested and proved both the resilience of these business models and the defensive nature of non-transport businesses. While slowing global travel affected many transport organizations such as airports and toll roads, the balance of the infrastructure sector remains relatively unscathed despite current Covid headwinds. Additionally, current inflationary pressures, constrained equity and fixed-income asset yields and an increase in demand for income by aging demographics have all created a compelling case for investment in infrastructure.

Inflation

Investors can seek out those companies with mechanisms that help pass through inflation. Long a hallmark of the infrastructure asset class, these inflation call options have always been understood but underappreciated in deflationary periods. This low-inflation environment has drastically reversed course over the last six months, positioning infrastructure as one of the most natural asset classes to contractually protect from the erosive pressures of rising costs.

Income

With equity and bond markets hovering near all-time highs, their respective yields remain near all-time lows. Additionally, demographics continue to raise the demand for income despite an increasing dearth of supply. Historically, investors have invested in the infrastructure asset class because of its above-market-average yields. Most infrastructure businesses are toll collectors of pre-existing assets and generally pay out most of their cash to shareholders in the form of dividends. The delivery of income is in high demand and directly aligned with client demographics.

Infrastructure

Infrastructure is often viewed as a single asset class, when in fact the term ‘infrastructure’ encompasses a diverse set of assets. With exposure to themes such as broadband access via 5G (telecommunications infrastructure), energy transition (utilities and energy infrastructure) and aging demographics (health-care real estate), the asset class is quite diverse. While all infrastructure assets share the characteristic of possessing long-term, contractually inflation-protected cash flows, the drivers of different areas within infrastructure are varied.

Looking Ahead

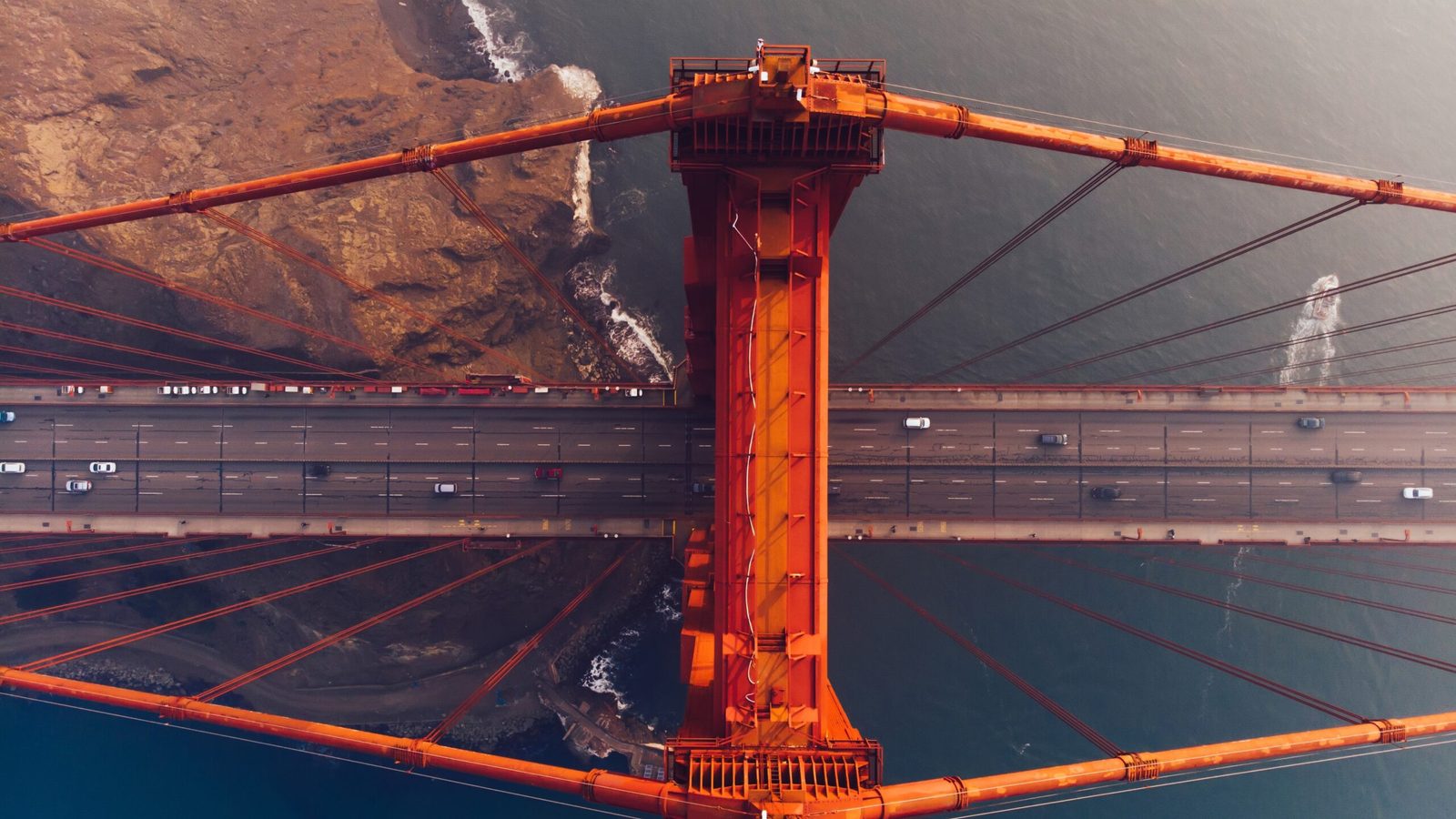

After many years of unsuccessful infrastructure spending legislation in the US, we finally saw a breakthrough in November of last year. The $1.2 trillion infrastructure plan includes approximately $550 billion in new spend targeting traditional infrastructure areas such as roads, bridges, rail, the power grid, broadband and water. When paired with the €1.0 trillion European Green Deal, there is a secular step up in infrastructure spend that remains supportive of the asset class. Additionally, supply-chain issues are not expected to affect infrastructure. These generational assets are, for the most part, already established and collecting rents. These businesses are generally domestically oriented and thus insulated from current supply-chain concerns. In summary, we believe that investors seeking steady, consistent and sustainable equity dividend yield return should consider the three ‘I’s by maintaining exposure to infrastructure when seeking income and inflation protection.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.