We discuss the outlook for equity income investing.

Key Points

- During previous inflationary periods, income stocks have proved an attractive proposition for investors looking for inflation protection and defensiveness at a reasonable price.

- Guided by our multi-dimensional research, our focus is on companies which are experiencing strong structural demand and have the ability to raise prices.

This time last year, our expectations for 2022 were that quantitative-easing programs would end, interest rates would start to rise in response to a more inflationary world, and income stocks would perform relatively well. One year on, we believe that we are getting closer to peak inflation and a peak in global interest rates. However, we do not expect interest rates to start to come down quickly, despite some market participants’ apparent clamor for a pivot from the US Federal Reserve. Instead we expect inflation to prove relatively sticky in response to long-term trends such as deglobalization, decarbonization and rising wages.

We believe an environment of slower growth, higher rates and high inflation represents a relatively favorable backdrop for income stocks in 2023. Post Covid-19, balance sheets have been repaired and although dividends have recovered, earnings have recovered faster, so payout ratios have come down and dividend cover is pretty good.

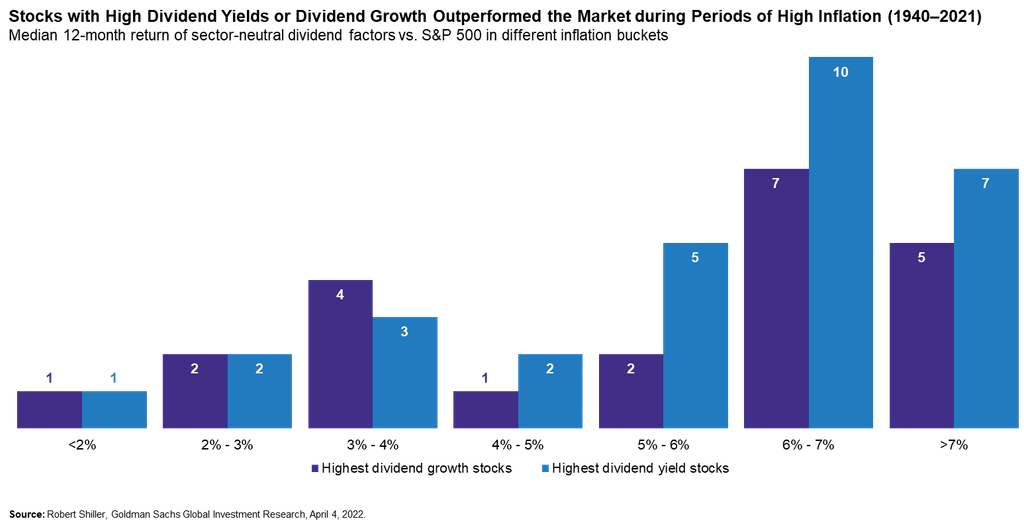

Taking a long-term view, it is noteworthy that during previous inflationary periods, income stocks have proved an attractive proposition for investors looking for inflation protection and defensiveness at a reasonable price, as the chart below, which looks at the performance of US income stocks, shows.

Attractive Valuations

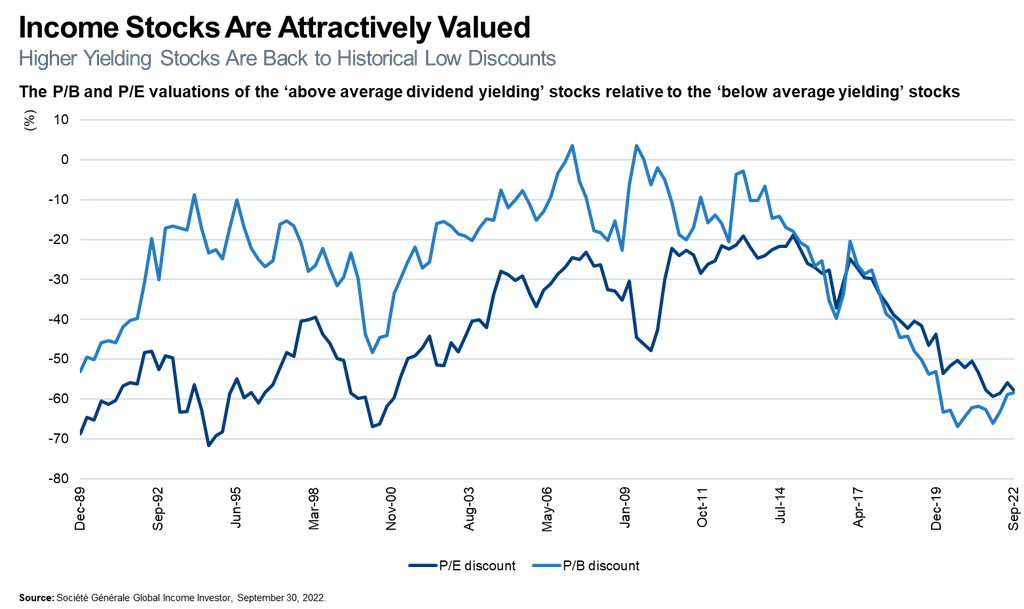

We believe another supportive factor is the attractive valuation of income stocks. The chart below highlights the valuation of above-average yielding stocks relative to below-average yielding stocks. At the time of writing, above-average-yielding stocks trade at a substantial discount to below-average-yielding stocks on price-to-earnings (P/E) and price-to-book (P/B) bases.

Why, after a period of much better performance from income stocks in 2022, do they remain inexpensive relative to non-income stocks? In our opinion, investors are keen to do what they have always done (at least in the years since the financial crisis), which is to own growth stocks. That is the reason why the market has not embraced income stocks and given them higher valuation multiples as a result of their improved prospects.

Targeting Companies Benefiting from Strong Structural Demand

Given the economic and inflation backdrop, our focus is on companies which are experiencing strong structural demand and have the ability to raise prices. This is where our themes, which help to shape our research agenda and support our equity-income portfolio construction, come to the fore. Themes provide us with a long-range lens to clearly view the structural changes that are taking place across the globe, alert us to the new opportunities that change creates, and help us to identify the emerging risks that threaten to impair the value of investments. This thematic research is guiding us towards companies with powerful structural tailwinds, pricing power and decent dividend profiles.

At their core, our global equity income portfolios remain overweight the consumer staples and utilities sectors. However, we recently reduced the size of the overweight in consumer staples following the sector’s rerating. We also like financials; we believe a more inflationary world with higher interest rates should be a positive backdrop for the financial sector. In addition, we are optimistic about the prospects for selected health-care stocks in response to scientific breakthroughs and widening access across developed and emerging markets, as our ‘picture of health’ theme outlines. Some industrials look interesting too. Despite the economic slowdown, it is still possible to get earnings growth in some industrial companies, where there is structural demand for HVAC (heating, ventilation, and air conditioning) equipment or electrification, for example.

We are cautious on large-cap US technology stocks. However, following the sector’s recent underperformance, we believe some opportunities are starting to emerge in technology and we are investigating these. We are also cautious on the consumer-discretionary and commodities sectors. The latter stance is arguably somewhat controversial because some commodities companies are big dividend payers. However, we prefer to buy cyclical businesses at, or near, the low point in the cycle, and it is impossible to argue that we are at a low point in the cycle for commodities!

Improving Outlook for Asian and Emerging Economies

We are looking closely at income opportunities across Asia and emerging markets. Over the next 12 months, it is possible that Asian and emerging markets could be in a better position if US-dollar strength starts to moderate.

China’s zero-Covid policy has recently come under intense scrutiny, but a fuller reopening is set to occur at some point in the future. This should be positive for the region as a whole. Our China-related exposure includes reopening beneficiaries, such as life-insurance companies, whereas we have been steering clear of the big index stocks such as the internet platforms which had been lockdown beneficiaries.

Interestingly, Singapore’s status as a financial hub is increasing as more capital is coming to the region via Singapore, making it an indirect reshoring beneficiary. We think Indonesia looks attractive too; it has been in the headlines with the G20 summit and green initiatives, which we view as a positive step. The Indonesian currency has been remarkably resilient in the face of a rising US dollar versus the rest of the region and we think Indonesia continues to look interesting thanks to economic reform and the country’s demographic profile.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.

Comments