Key Points

- The cultivated-meat market has attracted significant capital in recent years, with numerous companies working to develop and commercialize the cell-culture technology.

- The US Food and Drug Administration’s (FDA) decision to grant two companies a ‘no questions’ letter indicates that regulators are becoming more comfortable with the cell-culture technology, which may signal a turning point for the nascent industry.

- While consumer acceptance and price competitiveness remain critical challenges to the industry, cultivated meat could improve food security and reduce the environmental impact of meat production, potentially transforming the way we generate food.

The cultivated-meat market has been growing rapidly in recent years, with numerous companies working to develop and commercialize the cell-culture technology. Much like the chicken, pork and beef that people consume today, cultivated meat is genuine animal meat, grown by cultivating stem cells from animals directly in a lab.[1] While regulatory approval has been a significant hurdle for the industry, recent US Food and Drug Administration (FDA) approval of cultivated-meat products from both GOOD Meat and UPSIDE Foods marked a significant milestone for the cultivated-meat market. While other challenges to the industry include consumer receptivity and cost, cultivated meat could potentially transform the way we produce food, improving food security and reducing the environmental effects of conventional meat production.

FDA Approves Lab-Grown Meat

GOOD Meat, the cultivated-meat branch of Eat Just, Inc., recently received a noteworthy ‘no questions’ letter from the FDA for its cultivated-meat product. This approval follows UPSIDE Foods’ receipt of the same clearance for its cultivated chicken product just a few months prior. The FDA’s letter indicates that, after a thorough investigation, the agency has deemed GOOD Meat’s product safe for consumption, meeting the same regulatory standards as traditional meat.[2] While the FDA’s letter is not the end of the regulatory road for the company, it does mark a major milestone for the cultivated-meat market, which has gained momentum in recent years in capital investment, attention and innovation.

GOOD Meat currently sells its cultivated-chicken product in Singapore, the only country that has approved the sale of cultivated meat to consumers to date.[3] According to the company’s chief executive officer, GOOD Meat sells less than 5,000 pounds of its product each year, underscoring the emerging nature of the industry.[4] It is not surprising that Singapore was the first country to approve its product for sale, as the country has been actively exploring ways to achieve food independence. The United States is vying to be second, with two notable startups navigating the regulatory approval process. In order to sell their cultivated-meat products in the US, these companies must next receive clearance from the US Department of Agriculture (USDA).[5]

Investing in the Future of Food

The FDA’s decision to grant two companies a ‘no questions’ letter indicates that regulators are becoming more comfortable with the cell-culture technology, which may signal a turning point for the nascent industry. We believe this could also be noteworthy from a venture capital perspective, as the cultivated-meat industry has already attracted billions of dollars in investment capital in recent years. The FDA’s pre-market review of the cultivated-meat products of both UPSIDE Foods and GOOD Meat is a major de-risking event, and it may encourage even more innovation in the marketplace.

At the close of 2022, there were over 150 companies in the space, with a total of $896 million in invested capital. While funding was down 33% from the prior year, it was in line with the broader drop in overall global funding in 2022—35% across all sectors. However, in the Asia-Pacific (APAC) region and in Europe, levels of capital invested in cultivated meat rose in 2022, with cultivated-meat companies in the APAC region raising more funding in 2022 than in all prior years combined.[6] In our view, capital should continue to flow into the space as companies work to solve challenges around scale, process and cost.

Beyond investments in venture capital, the Netherlands earmarked $65 million in funding in 2022 for cultivated meat and precision fermentation, marking the world’s largest public investment in the field.[7] In the US, Congress has directed $6 million in research funds to alternative protein research and development, and California—the first state to invest in cultivated-meat research, invested $5 million across three labs.[8]

Potential ESG Opportunities

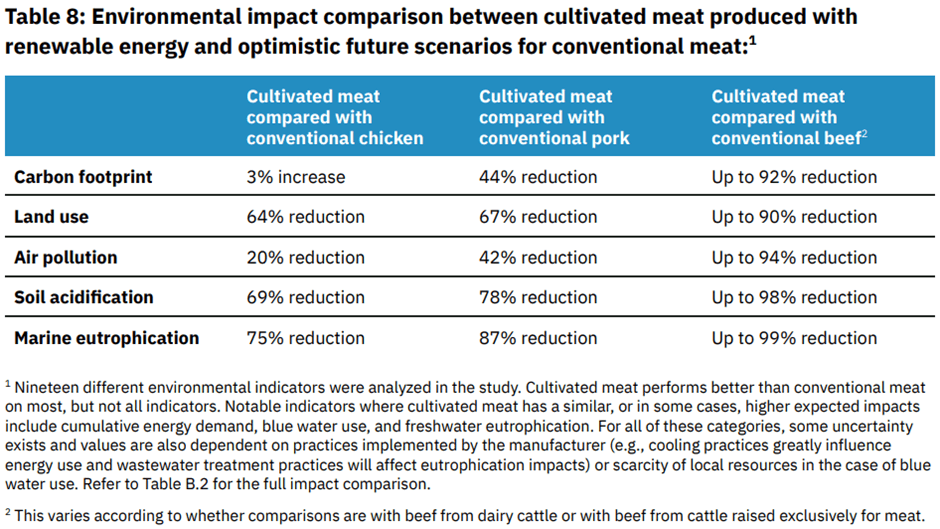

In our view, cultivated meat presents a myriad of potential environmental, social and governance (ESG) opportunities. Conventional meat production is known to have adverse effects on the environment, owing to deforestation, greenhouse gas emissions, water pollution and biodiversity loss. The industry also draws concerns around animal welfare, as well as taxing conditions for slaughterhouse workers. While carbon emissions are often the environmental focus, cultivated meat can potentially address a number of other environmental issues, making it applicable for those focused on sustainable solutions. A study involving over 15 companies, published in the International Journal of Life Cycle Assessment, highlights the benefits of cultivated meat over conventional meat across various environmental measures.[9]

In addition to its potential to reduce the environmental impact of meat production, as well as lessen the demand for traditional animal agriculture, cultivated meat may also improve food security. The nutritional profile of cultivated meat is expected to be similar to that of conventional meat, with the potential for modifications by adjusting how cells are grown and what they are fed. Regarding food safety, GOOD Meat had demonstrated that its cultivated chicken not only meets the microbiological and purity standards for poultry, but it also exhibits significantly lower and cleaner microbiological levels than conventional chicken.[10]

In order to meet growing global demand, meat production is projected to nearly double by 2050. However, meeting this demand using conventional meat production could derail other global goals set around climate, food security, public health and biodiversity.[11] While there is much more work to be done to improve the scalability and affordability of cultivated meat, it could transform the way we produce food, potentially providing a safe and efficient alternative for traditional meat production.

Cultivating Consumer Acceptance

The FDA’s stamp of approval could boost consumer interest in cultivated meat. A recent survey found that nearly 50% of American adults would try cultivated meat, with the percentage climbing to 60% for 18-to-34-year-olds.[12] This is largely in line with broader trends that show a greater openness among younger generations to innovative food technologies and plant-based alternatives. Education is also an important part of consumer acceptance, as studies have demonstrated an increase in consumer support for cultivated meat following a demonstration of the technology.[13]

Age may influence consumer receptiveness to cultivated meat, but geography is a critical factor as well. Studies have shown that 70% of Singaporeans who sampled GOOD Meat’s cultivated chicken deemed it equal to or better than traditional chicken.[14] However, other regions have exhibited a less welcoming attitude toward this innovative protein source. For instance, Italy imposed a ban on lab-grown meat and animal feed in the name of preserving its cultural and agricultural heritage.[15] There appears to be a link between regions of the world that oppose genetically modified organisms and those that express reluctance toward cultivated meat.

To compete with conventional meat, cultivated products must satisfy consumer demands regarding taste and price. Efforts are underway to refine the taste of cultivated meat through innovation, such as combining plant-based ingredients with cultivated fat to achieve a more desirable texture and flavor. We believe price parity would also be likely to be necessary for encouraging consumer acceptance; challenges surrounding the path to price parity are discussed in detail in the section below.

Challenges in the Cultivated-Meat Industry

Despite the remarkable potential of cultivated meat, the industry faces several obstacles that must be addressed before widespread adoption can be achieved. These challenges center on the ability to reach the necessary scale and price parity, and we believe that further development is required in critical areas such as cell lines, cell culture media, bio process design, scaffolding and end-product design. In our view, increased funding, innovation and policy efforts could help mitigate these challenges. Notably, the number of researchers focused on these topics is increasing, with 13 multi-year research projects published in 2022 alone.[16]

One particular challenge is the use of fetal bovine serum (FBS) within cell culture media. FBS poses difficulties owing to its limited availability, batch variability and ethical implications. Many companies are working to find an alternative to FBS, and some have even publicly disclosed their successful replacements.[17] Additionally, the development of an algorithm by a team at the University of California, Davis has streamlined the cell culture media formulation process by identifying the ingredients necessary for cells grown in specific conditions, thereby reducing the number of experiments required.[18]

Several studies have estimated the potential cost of cultured meat, with projections ranging from $17-$35/kg to as low as under $6/kg with significant technological advancements. These cost savings can be attributed to lower media costs, reduced capital expenditures, higher cell density, shorter production run time, optimized reactor size and design, and increased cell volume. While cost projections may vary, innovation in critical areas such as cell culture media, scaffolding and bioreactors could be key in reducing prices.[19]

Conclusion

The recent FDA approval of both GOOD Meat’s and UPSIDE Foods’ cultivated-meat products through a ‘no questions’ letter signifies a significant milestone for the cultivated-meat market, which has been growing rapidly in recent years. In our view, this approval signals a growing comfort with the cell-culture technology from regulatory bodies. The cultivated-meat industry has attracted significant investment, and this recent green light is a de-risking event, which could encourage even more innovation in the market. While consumer acceptance and price competitiveness remain critical challenges to the industry, we believe cultivated meat could improve food security and reduce the environmental impact of meat production, potentially transforming the way we generate food.

[1] The Good Food Institute. Accessed May 23, 2023. https://gfi.org/science/the-science-of-cultivated-meat/

[2] Food Dive. Updated March 22, 2023. https://www.fooddive.com/news/eat-just-cultivated-cell-based-meat-fda-approval-good-meat/645600/

[3] Eat Just, Inc. January 18, 2023. https://www.goodmeat.co/all-news/good-meat-receives-approval-to-commercialize-serum-free-media#:~:text=GOOD%20Meat%20remains%20the%20only,stalls%20and%20via%20food%20delivery.

[4] The Wall Street Journal. April 23, 2023. https://www.wsj.com/articles/inside-the-struggle-to-make-lab-grown-meat-12cf46ab

[5] NPR. March 21, 2023. https://www.npr.org/sections/health-shots/2023/03/21/1165071880/fda-gives-2nd-safety-nod-to-cultivated-meat-produced-without-slaughtering-animal

[6] The Good Food Institute, 2022. Accessed May 2, 2023. https://gfi.org/wp-content/uploads/2023/01/2022-Cultivated-Meat-State-of-the-Industry-Report-2.pdf

[7] The Good Food Institute, 2022. Accessed May 2, 2023. https://gfi.org/wp-content/uploads/2023/01/2022-Cultivated-Meat-State-of-the-Industry-Report-2.pdf

[8] The Good Food Institute. July 12, 2022. https://gfi.org/blog/gfi-commends-californias-landmark-5-million-investment-in-the-future-of-protein/

[9] Sinke, P., Swartz, E., Sanctorum, H. et al. Ex-ante life cycle assessment of commercial-scale cultivated meat production in 2030. Int J Life Cycle Assess 28, 234–254 (2023). https://doi.org/10.1007/s11367-022-02128-8

[10] Business Wire. March 21, 2023. https://www.businesswire.com/news/home/20230321005793/en/GOOD-Meat-the-World%E2%80%99s-First-to-Market-Cultivated-Meat-Company-Receives-U.S.-FDA-Clearance

[11] The Good Food Institute, 2022. Accessed May 2, 2023. https://gfi.org/wp-content/uploads/2023/01/2022-Cultivated-Meat-State-of-the-Industry-Report-2.pdf

[12] The Good Food Institute and Embold Research, 2022. Accessed May 2, 2023. https://gfi.org/wp-content/uploads/2023/01/CM-consumer-insights-and-nomenclature-insights-2.pdf

[13] The Good Food Institute, 2022. Accessed May 2, 2023. https://gfi.org/wp-content/uploads/2023/01/2022-Cultivated-Meat-State-of-the-Industry-Report-2.pdf

[14] Business Wire. March 21, 2023. https://www.businesswire.com/news/home/20230321005793/en/GOOD-Meat-the-World%E2%80%99s-First-to-Market-Cultivated-Meat-Company-Receives-U.S.-FDA-Clearance

[15] Reuters. March 28, 2023. https://www.reuters.com/world/europe/italy-moves-ban-lab-grown-meat-drive-protect-home-products-2023-03-28/

[16] The Good Food Institute, 2022. Accessed May 2, 2023. https://gfi.org/wp-content/uploads/2023/01/2022-Cultivated-Meat-State-of-the-Industry-Report-2.pdf

[17] Green Queen Media. January 14, 2022. https://www.greenqueen.com.hk/mosa-meat-fetal-bovine-serum-cultivated-meat/

[18] The Good Food Institute, 2022. Accessed May 2, 2023. https://gfi.org/wp-content/uploads/2023/01/2022-Cultivated-Meat-State-of-the-Industry-Report-2.pdf

[19] The Good Food Institute, 2022. Accessed May 2, 2023. https://gfi.org/wp-content/uploads/2023/01/2022-Cultivated-Meat-State-of-the-Industry-Report-2.pdf

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Newton manages a variety of investment strategies. How ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions. ESG considerations do not form part of the research process for Newton's small cap and multi-asset solutions strategies. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.