Key Points

- We believe the financial stress over the last few days initiated by the collapse of Silicon Valley Bank (SVB) is enough to rein in, but not stop, expectations of rate increases in the near term.

- We think it reasonable to assume that volatility around SVB and Credit Suisse could reduce investor appetite to take on European bank exposure.

- We have been talking for some time about a ‘regime change’ in market conditions. We reference this via two of our macro themes, financialization and big government, which we can use as a framework to help us understand and interpret some of the volatility we have seen in the banking system in recent days.

- We anticipate that we will see more ‘breakages’ this year, potentially in the leveraged loans market for example.

- Our biggest current concern is that tighter money supply causes a recession, thus derating both the economy and asset prices at the same time.

Investors can waste a lot of time and energy trying to predict what the central banks might or might not do over the coming days and weeks, but the bottom line is that we do not have a seat on their respective councils so will not find out until they make their announcements.

Financial Stress

For us, the financial stress over the last few days, initiated by the collapse of Silicon Valley Bank (SVB), is enough to rein in expectations of rate increases for the moment, but if that volatility goes away, why wouldn’t central banks consider further rate hikes?

Meanwhile, we are focused on the secondary effects of the market volatility. Over the last few days, for example, we have received a number of questions from clients about our overall exposure to the European banking sector.

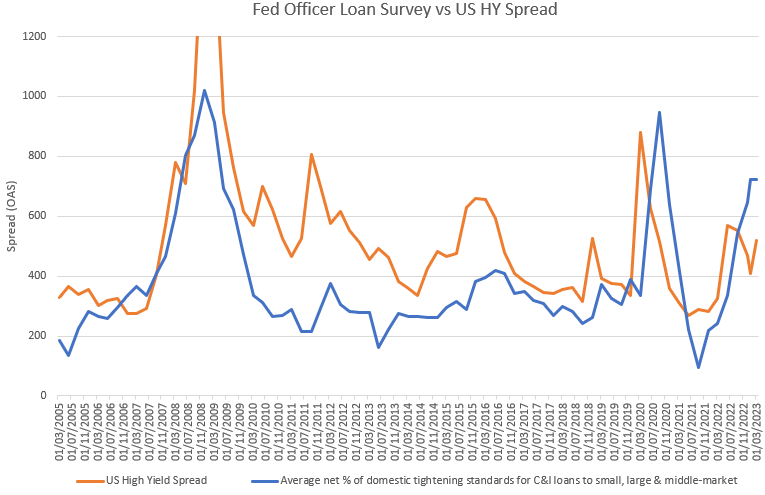

We think it is reasonable to assume that this volatility could have a global impact on the financial sector, and could, at the margin, reduce the appetite to take on risk. We have already seen the commercial banks tighten their lending criteria in the US (see chart below), and we are likely to see the same in Europe. The relationship between tighter lending standards and a weaker real economy is a strong one and gives us confidence that a hard landing for the economy may be coming sooner than financial markets imply. As the chart suggests, that tighter lending environment has an impact on more leveraged corporate bonds, especially if their issuers’ profits decline.

Source: Bloomberg, March 15, 2023

C&I refers to the commercial and industrial sectors.

‘Financialization’ and ‘Big Government’

Looking to the longer term, we believe we can interpret events such as SVB’s collapse by drawing on our thematic research. When we talk about ‘regime change’ in markets, we are referring to trends identified by two of our macro themes: financialization and big government. The move from ‘free money’ to ‘expensive money’ is a de-financialization trend which we believe could lead to a significant derating of financial assets.

When we consider areas such as technology start-ups, cryptocurrency, private capital markets and real estate, we believe the system can ‘break’ if things develop too quickly. We anticipate that we will see more ‘breakages’ this year, potentially in the leveraged loans market, for example. As asset managers, we used to talk about inflation being everywhere after the global financial crisis, but not on the narrow horizon of the central banks. We experienced asset-price inflation and goods-price deflation. Today, we are starting to see exactly the opposite.

Moving Towards Recession?

While the financial system is derating, the real economy has continued to do quite well, and thus central banks are obliged to do something about the inflationary consequences. In turn, this can cause things to malfunction in the financial system. Governments, on the other hand, are meddling in the real economy more than they have done in recent memory (our big government theme) and run the risk of exacerbating the inflationary backdrop by maintaining fiscal spending at elevated levels. This increases the de-financialization trend as central banks are forced to raise rates.

What could change from here? We believe there are some signs that asset markets and the global economy could come back in sync. We see signs of fiscal spending that seeks to fix employment issues (the UK budget on March 15, for example) and thereby reduces the need for higher rates. Unfortunately, however, the biggest current concern for us is that tighter money supply causes a recession, thus derating both the economy and asset prices at the same time. We believe that we may be starting to witness this process.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.