In a recent interview, US President Joe Biden stated that Americans were “really, really down” as they struggled with the effects of inflation after two years of the Covid-19 pandemic.1 Across the rest of the world too, growing unrest at soaring food and energy prices, exacerbated by Vladimir Putin’s invasion of Ukraine, was a prominent theme during the second quarter. Sri Lanka faced economic meltdown and severe fuel shortages, leading to political turmoil; Peru saw riots erupt over living standards; and inflation in Turkey reached 73%,2 significantly reducing people’s spending power. Meanwhile, a wave of labor disputes spread across Europe, with walkouts over pay and working conditions disrupting the transport sector in particular.

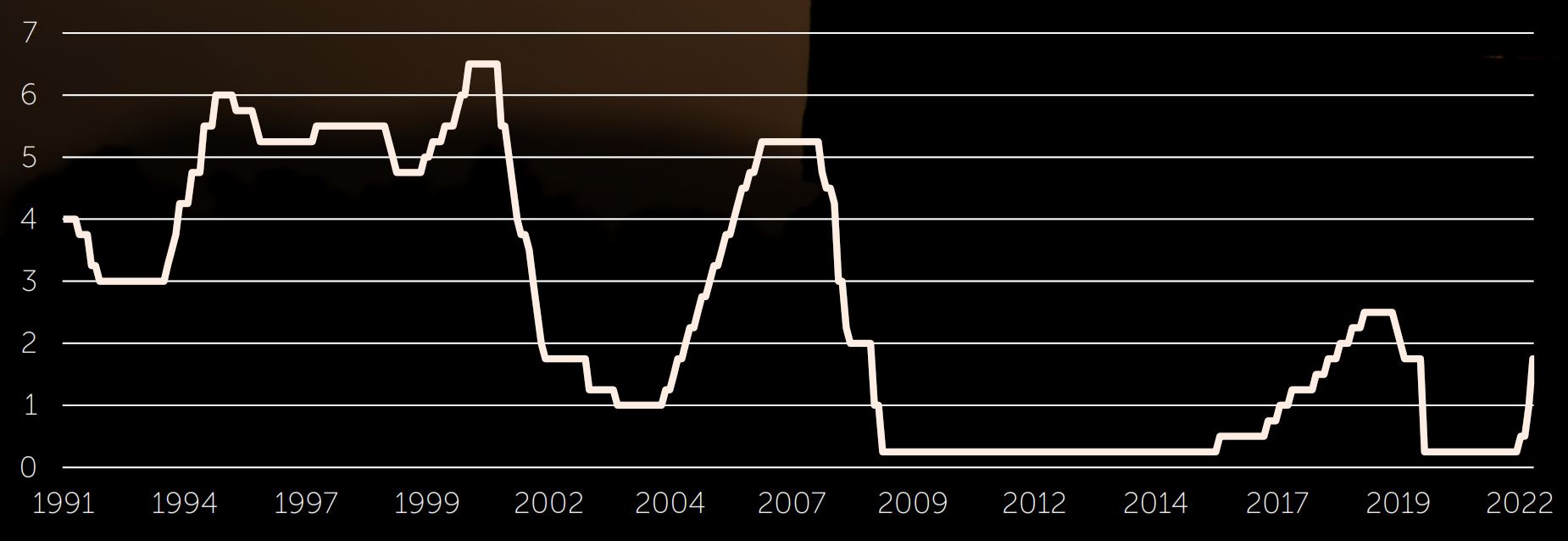

Financial-market participants also faced a troubling three months, with global equities, as represented by the MSCI AC World index in US-dollar terms, declining by more than 15% over the period.3 The S&P 500 index of US stocks experienced a seven-week losing streak during the quarter, and had fallen by more than 20% at the halfway point of the year, its worst first half since 1970.4 Equity markets were, once again, characterized by a marked rotation away from longer-duration growth stocks in areas such as technology, in favor of more defensive areas such as utilities and consumer staples. Meanwhile, government bonds came under renewed pressure, with the 10-year US Treasury yield up nearly 70 basis points over the quarter to 3.0%.5

S&P 500 Index

Source: FactSet, July 2022.

Intensifying inflationary forces were the key driver of risk sentiment: US headline consumer price inflation for May came in ahead of economists’ expectations, increasing 1% over the previous month and 8.6% year on year, while the UK and eurozone saw comparable annual rises of 9.1% and 8.1% respectively.6 The response from central banks, and the US Federal Reserve (Fed) in particular, was to accelerate the tightening cycle, which heightened fears of a greater-than-expected slowdown in growth.

Having already raised interest rates by 50 basis points in May, the Fed announced a further 75-basis-point adjustment on June 15, taking its benchmark funds rate to a range of 1.5%-1.75%.7 This rise – the biggest since 1994 – was in contrast to earlier guidance, which had signaled a second consecutive 50-basis-point rise, and the central bank indicated that rate rises could be larger and faster than previously expected over the remainder of the year. The European Central Bank (ECB) also suggested that the pace of its rate rises would quicken, with interest rates likely to rise above zero for the first time in a decade in September.8

Speaking at the ECB’s annual conference in Portugal at the end of June, the heads of the ECB, Fed and Bank of England all reiterated the importance of swift action to curb inflation, adding that the adjustment to a new era would be painful. With the pandemic and latterly the huge geopolitical shock of the Ukraine war raising costs and fracturing supply chains, Fed Chair Jay Powell stated that the low-inflation environment “seems to be gone now”, while ECB President Christine Lagarde stressed that the forces unleashed by recent events would “change the picture and the landscape within which we operate”.9

Over the quarter, market participants also became more concerned with a slowdown in activity in China owing to the country’s zero-Covid policy and, specifically, tighter Covid-related restrictions in major cities such as Shanghai and Beijing, which threatened to exacerbate supply-chain disruption. However, Chinese shares were buoyed towards the end of the period as lockdowns were eased and China announced a flurry of policy support measures.

In fixed income, government bonds, as represented by the JP Morgan Global Government Bond Index, produced a return of -8.4% in US-dollar terms (-14.1% over the six months to June 30). Corporate bonds, as represented by the ICE BofA Global Corporate Index, returned -8.5% over the quarter (-15.4% over the year to date).10

All major equity markets saw double-digit declines over the three-month period. UK equities fell by -10.5% over the quarter (-8.8% over six months) in US-dollar terms, while Asia Pacific ex Japan stocks also returned -10.5% (-15.5% over the year to date). Meanwhile, emerging-market equities delivered a negative quarterly return of -11.3% (-17.5% over six months) to US-based investors, Europe ex UK equities returned -14.2% (-20.4%), and Japanese equities declined by -14.6% over the quarter (-20.1% over six months). North American equities brought up the rear with a return of -16.7% (-20.7% over the year to date).11

Gold delivered a negative return of -6.7% in US-dollar terms over the quarter (-0.8% over the year to date).12

In spite of a tight labor market and increasingly aggressive attempts by policymakers to weaken demand, the US economy continued to register robust jobs growth during the quarter. May saw 390,000 further jobs added, with the unemployment rate – at 3.6% – just 0.1% above its level before the Covid-19 pandemic took hold in February 2020.13

Fed Chair Jay Powell has stated that the central bank’s monetary tightening will involve “some pain”, but believes that the economy can achieve a “softish” landing, with annual GDP growth forecast to slow to 1.7% and unemployment to reach 3.9% in 2023.14 However, 70% of leading economists recently surveyed by the Financial Times in conjunction with the Initiative on Global Markets at the University of Chicago’s Booth School of Business predict that the US will enter a recession in 2023.15

One uncertainty is the potential economic and financial-market impact of the Fed’s quantitative tightening initiative – its move to reduce its enormous US$9 trillion balance sheet – which began in June when the central bank stopped reinvesting the proceeds of some maturing bonds. In addition to having a tightening effect, the move is also likely to affect liquidity and could unsettle bond markets.

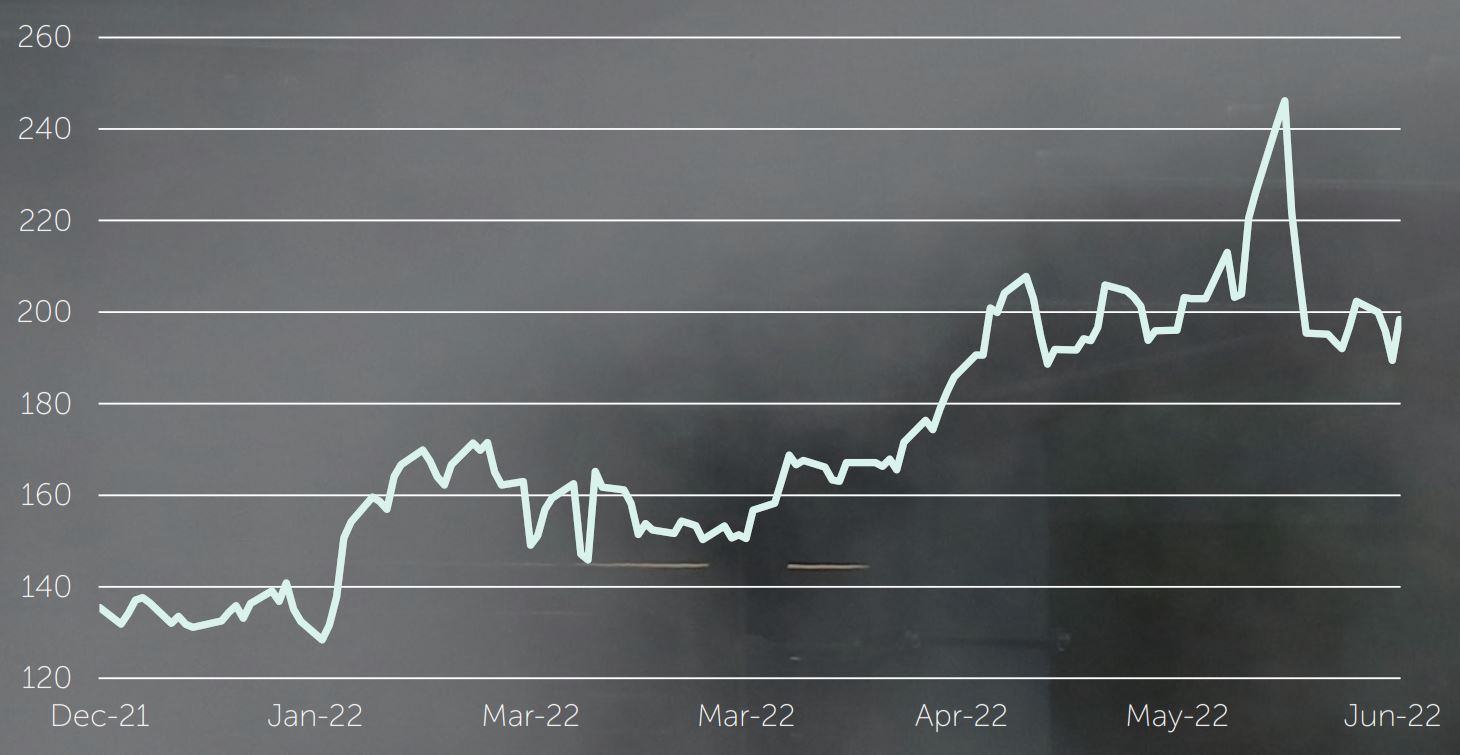

There were several signs during the quarter that the cost-of-living crisis was already starting to bite in the UK, with the country facing a toxic combination of record energy price increases and a broad rise in the prices of other goods and services; according to the Bank of England, inflation could top 11% by October.

UK Consumer Price Index

% change, year on year

Source: FactSet, July 2022.

The country’s economy contracted by 0.3% in April, after two months without growth.16 Retail sales declined in May, while the consumer confidence index, which measures people’s perceptions of their personal financial situation and general economic conditions, fell to its lowest level since records began in 1974,17 suggesting that the mood was even gloomier than at the height of the 2008 global financial crisis or the Covid-19 pandemic in 2020. In addition, the purchasing managers’ index of business expectations saw the largest monthly decline in June since the start of the pandemic.

The Bank of England raised interest rates by only 25 basis points at its June meeting to take the benchmark rate to 1.25%, with the majority of its Monetary Policy Committee believing that more drastic action was not required to control inflation in an already weakening economy.18

In Europe, Germans are able to travel the breadth of their country for just €9 a month over the summer using local and regional public transport, thanks to a government initiative to address spiraling living costs. According to ECB President Christine Lagarde, the Ukraine war has hit Europe harder than most other regions in terms of higher energy and food prices. Europe also faces the prospect of Russia cutting off or limiting gas supplies as winter approaches, which would be likely to damage industry and send energy prices even higher. While inflation has soared, the eurozone economy grew by just 0.2% in the first quarter of 2022.19

Spread Between German and Italian 10-Year Government Bond Yields

Basis points

Source: FactSet, July 2022.

In addition to paving the way for a rate-rising cycle, the ECB confirmed in early June that it would end its remaining €20bn-per-month bond purchases at the start of July. However, the announcement of these plans resulted in bond-market turbulence, with yields rising and the gap in the cost of borrowing between Germany and more vulnerable member states such as Italy and Spain widening, which instilled fears of a repeat of the debt crises that threatened the eurozone a decade ago. To counter these concerns, the ECB is accelerating plans to create a new ‘anti-fragmentation’ tool, although details have so far remained sketchy.

While Japan sweltered in June under its strongest heatwave since records began in 1875,20 there were few signs of the country’s economy heating up, as its GDP shrank at an annualized rate of 1% during the first quarter, hampered by continuing Covid-19 restrictions and rising commodity prices.21

Although inflation has risen in Japan (2.5% in the year to April), it has not been on the same scale as in other parts of the world. Nevertheless, the political sensitivity of price increases was highlighted in June when Haruhiko Kuroda, the governor of the Bank of Japan, was forced to apologize after claiming that consumers had become “more tolerant” of price rises.22

While other major central banks have sought to combat inflation by raising interest rates, the Bank of Japan kept its policy of yield-curve control (intended to maintain yields on Japanese government bonds close to 0%) unchanged at its June 17 meeting, despite being forced to buy a large quantity of bonds during the month as the cap came under pressure from rising global interest rates. The widening gap between Japanese and US bond yields has resulted in the yen falling significantly against the dollar this year. However, although Japan is heavily exposed to the cost of imported commodities, a weaker yen will benefit the country’s many exporters of manufactured goods, as well as Japanese holders of overseas assets.

With the persistence of China’s zero-Covid strategy, it appears that the country’s 2022 growth target of 5.5% is likely to be missed by a significant margin. As Shanghai and Beijing exit severe lockdowns, there remains scope for some recovery, but this is unlikely to mirror the strong rebound seen in the second half of 2020 after the first lockdowns.

There have been signs that China’s crackdown on the technology sector could be easing, after authorities appeared to be wrapping up probes into ride-hailing, lorry-hailing and recruitment platforms that began last year. In addition, a growing pipeline of modest stimulus measures should offer some support to the wider economy, with larger fiscal measures by local governments, including the issuance of special bonds, a key element of the policy response.

However, scope for additional action from the People’s Bank of China is likely to be constrained by policy divergence with the Fed. Furthermore, a significant additional relaxation of Covid rules appears unlikely, given a lack of progress in vaccinating the country’s vulnerable elderly population and the wish for stability during the Chinese Communist Party’s Congress in November, when Xi Jinping is likely to gain a third term as president.

Everything changes and nothing stands still.

Heraclitus (c. 540-480 BC)

1 In rare interview Biden says Americans ‘really, really down’, BBC News, June 17, 2022

2 Turkey’s inflation soars to 73%, a 23-year high, as food and energy costs skyrocket, CNBC, June 3, 2022

3 Source: FactSet, July 1, 2022

4 US stocks suffer sharpest first-half drop in more than 50 years, Financial Times, June 30, 2022

5 Source: FactSet, July 1, 2022

6 Source: FactSet, July 1, 2022

7 Federal Reserve FOMC statement, June 15, 2022

8 ECB takes hawkish turn to counter record-high inflation, Financial Times, June 9, 2022

9 Central bank chiefs call end to era of low rates and moderate inflation, Financial Times, June 29, 2022

10 Bond market returns sourced from FactSet, July 1, 2022

11 Equity market returns sourced from FactSet, July 1, 2022 (All US-dollar total returns, MSCI index series)

12 Gold bullion returns sourced from FactSet, July 1, 2022

13 US economy posts solid jobs growth despite tight labour market, Financial Times, June 3, 2022

14 Fed raises benchmark rate by 0.75 percentage points to tame scorching inflation, Financial Times, June 15, 2022

15 US set for recession next year, economists predict, Financial Times, June 12, 2022

16 Sterling falls to 2-year low against dollar after UK economy contracts, Financial Times, June 13, 2022

17 UK consumer confidence falls to lowest level since records began, Financial Times, June 24, 2022

18 Monetary Policy Summary and minutes of the Monetary Policy Committee meeting, Bank of England, June 16, 2022

19 Weak EU growth and Covid-hit China raise prospect of global downturn, Financial Times, April 29, 2022

20 Japan swelters in its worst heatwave ever recorded, BBC News, June 29, 2022

21 Japan recovery buffeted by Covid restrictions and Ukraine war, Financial Times, May 18, 2022

22 BoJ’s Kuroda forced to retract claim consumers tolerant of price rises, Financial Times, June 8, 2022

23 IMF chief warns global economy faces ‘biggest test since second world war’, Financial Times, May 23, 2022

Important Information

All data is sourced from FactSet unless otherwise stated. All references to dollars are US dollars unless otherwise stated.

This is a financial promotion and has been issued by Newton Investment Management North America LLC (NIMNA). NIMNA is a registered investment adviser and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). NIMNA was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. NIMNA is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management" ("Newton"). Newton currently includes NIMNA and Newton Investment Management Ltd. ("Newton Limited").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. Statements are correct as of the date of the material only. You should consult your advisor to determine whether any particular investment strategy is appropriate.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance. The indices referred to herein are used for comparative and informational purposes only and have been selected because they are generally considered to be representative of certain markets. Comparisons to indices as benchmarks have limitations because indices have volatility and other material characteristics that may differ from the portfolio, investment or hedge to which they are compared. The providers of the indices referred to herein are not affiliated with NIMNA, do not endorse, sponsor, sell or promote the investment strategies or products mentioned herein and they make no representation regarding the advisability of investing in the products and strategies described herein. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements.

This material is for institutional investors only. This publication or any portion thereof may not be copied or distributed without prior written approval from the firm.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including NIMNA and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management North America.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Canadian Provinces: Alberta, British Columbia, Manitoba and Ontario and is availing itself of an exemption under sections 38 or 80 of the Commodity Futures Act (Ontario). The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.