Key points

- Given current levels of discounts to net asset value, together with potential medium-term catalysts, we believe now is the time to reconsider investment trusts.

- We are bullish about funds invested in areas well positioned to grow into the next decade, driven by the imperatives of decarbonisation, digitalisation and upgrading ageing infrastructure.

UK-listed investment trusts are a long-standing British success story, with some trusts going back as far as 1868, half a century before similar funds appeared in the US in the 1920s.1 Currently, over 350 investment trust companies are quoted on the London Stock Exchange with assets exceeding £250 billion, accounting for around one third of the FTSE 250. These investment companies allow private and institutional investors to gain access to portfolios of less liquid assets, often generating stable and predictable cash flows derived from long-term contracted revenues with some inflation linkage. Unlike more conventional open-ended funds, they have independent boards in place to put the interests of shareholders first. For years, investment trusts have provided capital to build and maintain critical social infrastructure, from affordable housing to schools, hospitals, fire and rescue services, highways, bridges, battery energy storage systems and wind farms. With increasing government deficits, the need for the private sector to step in and invest in the required infrastructure will not stop, providing long-term opportunities for investment trusts and potentially strong risk-adjusted returns for their shareholders together with low correlations to other asset classes.

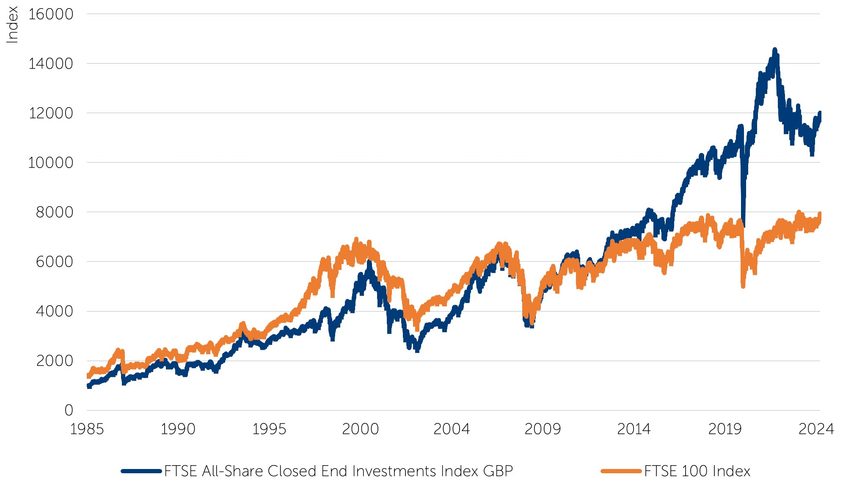

From 1986 to 2021, the total return of the FTSE All-Share Closed End Investments Index was +2,315% in sterling terms, an annual equivalent rate of +9.24%. This is 238 basis points in excess of the return from the FTSE 100 Index, which delivered +6.86% per annum.2 However, the investment trust sector has been struggling since then, delivering negative returns of -10.4% to the end of Q1 2024, while the FTSE 100 and S&P 500 indices were up +17.1% and +22.5% respectively during the same period (figure 1). Many investors have sold their shares, leading to record outflows from investment trusts. According to JPMorgan Cazenove, £4.2bn was withdrawn in 2023. This year, in Q1 2024 alone, the net outflow was £3.9bn, not far from the whole of last year’s number.3 Owing to these waves of selling, the discount between the net asset value (NAV) of the investment trusts and their market capitalisations has widened to as high as 17%, the largest discount since the 2008 global financial crisis.4 In addition, these wide discounts to NAVs prevent investment companies issuing new shares and continuing to invest. Between 2014 and 2021, over £70 billion was raised by investment company IPOs (initial public offerings) and secondary fundraising, but only £1 billion has been raised since then.5

Figure 1: FTSE All-Share Closed End Investments Index total return since 1986

Source: Bloomberg

Reasons why investors have reduced exposure to investment trusts

1 Higher interest rates

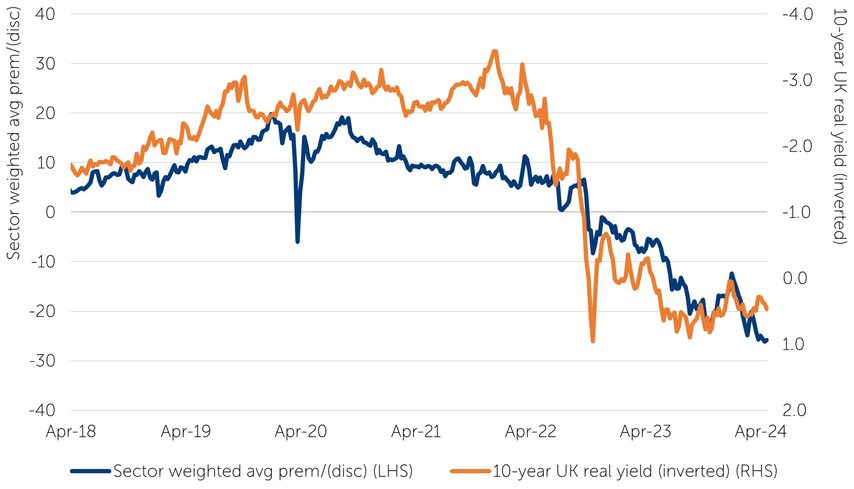

To fight a worldwide surge in inflation following the Covid-19 pandemic, central banks led one of the most aggressive tightening cycles in decades.6 Between March 2022 and July 2023, the US Federal Reserve (Fed) raised the federal funds target rate by 525 basis points. The discount of the UK-listed investment trusts started widening shortly after the Bank of England began raising rates in December 2021 (figure 2). Higher discount rates had two impacts. First, investment trusts own assets with long-term concessions, sometimes over several decades. The net present value of these long-term cash flows is therefore highly sensitive to the discount rate used by the valuer. Currently, it is not unusual to see a +0.5% increase in the discount rate from the base case negatively affecting the NAV by more than 5%. While it is true that this impact tends to be offset by higher long-term inflation rate assumptions, increasing the inflation-linked revenues, it often does not fully match the NAV decline. Secondly, one of the key attributes of investment trusts is that they provide a long-term secure dividend income. Rising bond yields have increased the competition for capital for investors searching for income.

Figure 2: Sector derating led by rate concerns

UK-listed investment trusts – average premium/discount to net asset value vs. UK 10-year real yield (inverted)

Source: Barclays Research as at May 2024

2 Liability-driven investment (LDI) crisis

With a steep rise in gilt yields following the September 2022 UK mini-budget, highly leveraged LDI pension funds had to quickly sell assets to cover LDI losses. That caused a brief liquidity crunch, forcing the Bank of England to intervene to calm the gilt market and avoid the collapse of the most levered funds. In the aftermath of this crisis, many LDI funds reassessed their liquidity criteria and reduced their exposure to real assets. In particular, these funds sold investment trusts which are relatively more liquid than other unlisted assets, allowing them the ability to reduce their overall exposure as they looked to move towards buyout as the rise in interest rates turned pension deficits into a surplus.

3 Cost disclosure

Investment trusts have expenses like any other listed company, and investors take these expenses into account when buying a company’s shares. However, the way UK policymakers have interpreted PRIIPS (packaged retail investment and insurance products) and MiFID (Markets in Financial Instruments Directive) rules has resulted in those expenses being included in the ongoing cost figures (OCFs) of open-ended funds. This has led to some open-ended funds selling to avoid the risk of their costs looking artificially high. In addition, it has led to confusion among the industry on what the actual costs are. The UK is the only country in the world that applies this methodology, putting UK companies at a disadvantage to their international peers. This leads to less capital investment to help the UK build out its ‘green’ economy at a time when the US has a very attractive policy, with the Inflation Reduction Act (IRA) attracting inward investment and competing for capital for similar projects in the UK. These rules are distorting the competition for capital to such an extent that some UK investment companies are considering delisting from London to relist in Switzerland where such rules do not apply,7 disadvantaging the UK’s position as a competitive financial centre.

Why we believe now is the time to reconsider investment trusts

The Alternative Investment Fund Designation Bill was debated for a third time at the House of Lords on 10th May 2024.5 This bill would exclude closed-ended investment companies listed on a UK-recognised exchange from the Alternative Investment Fund Manager Regulations (AIFMR) and the PRIIPS and Consumer Composite Investments (CCI) regulatory disclosure requirements. The support from every side of the House looks strong. In addition, the government has communicated that it is treating this as a priority. We therefore believe that the cost disclosure issue could be solved by the year end and provide a boost to UK investment trusts.

Concerning US interest rates, we believe that that while US inflation may remain sticky, it is unlikely to reaccelerate, so the Fed should be able to follow the path of interest-rate cuts that it has outlined to the market. Even if the timing of rate cuts has been pushed out by investors recently, we believe that the Fed will cut when the data gives it the latitude to do so. On a three-year view, investment trusts are likely to benefit from a lower-rate environment owing, on one hand, to NAV upgrades pointing to lower discount rates applied and, on the other hand, to the higher relative spread between the average dividend yield of investment trusts and bond yields, such as the UK gilt 10-year real yield.

Bullish on the sector

With the improvement on cost disclosure, most of the LDI crisis behind us and the likelihood of a lower-rate environment making investment trusts more attractive relative to bond yields, we believe inflows will return to the asset class. In our view, the current discounts to NAV increase the expected levered rate of return significantly and provide a good entry point for investors. For example, the three largest positions in Newton’s Multi-Asset Diversified Return strategy are using an average levered portfolio discount rate of 9%. However, the share price implied discount rate is more than 11.5%. The average dividend yield for these three investment trusts is 7%, with a dividend cover of 1.6x. One has sufficient visibility on cash flows to cover a growing dividend for the next 20 years with no need for additional investment.

With a long-term view, we are bullish on the overall investment trust sector and, in particular, about the closed-ended funds which are invested in areas well positioned to grow into the next decade, driven by the imperatives of decarbonisation, digitalisation and upgrading ageing infrastructure.

Decarbonisation

The European Commission estimates that electricity consumption will increase by 60% by 2030 (from the 2022 level) owing to the Covid-19 recovery and electrification of cars and home heating. A heat pump can double the electricity consumption of a typical household, while adding both an electric vehicle and a heat pump can triple it. Power generation capacity needs huge investment in order to meet European Union renewable energy targets. Wind and solar power generation capacity must increase from 400 GW in 2022 to at least 1,000 GW by 2030.8 Globally, according to the International Renewable Energy Agency, annual average investment in renewable power generation needs to almost triple to US$1,300 billion by 2030 versus US$486bn invested in 2022.9 This supports investment opportunities into wind and solar farms as well as battery energy storage systems.

Digitalisation

The data centre industry has experienced exponential growth over the last decade, driven by increasing demand for cloud services and the expanding use of connected devices globally. Generative artificial intelligence (AI) has the potential to accelerate the growth of data generation in the next decade. Consumers and businesses are expected to generate twice as much data over that period as all the data created over the last ten years.10 Storage capacity in data centres will need to grow at a five-year compound annual growth rate (CAGR) of 18.5% to follow this trend.11 For AI alone, infrastructure investments in data centres, subsea fibre-optic networks and other components of ‘the plumbing of the internet’ are expected to grow at more than 40% per annum to US$420 billion by 2029.12

Upgrading ageing infrastructure

By lowering logistics costs and delivery times, investments in infrastructure can boost consumer demand and be a large economic multiplier. Yet, for many years, Western governments have underspent, resulting in an infrastructure funding gap estimated at US$15 trillion by 2040.13 Recently, we have seen governments react and increase available funds such as in the US with the Infrastructure Bill passed in 2021 with the support of both the Democrats and Republicans.14 With a total of US$550 billion in new federal spending, the bill includes US$110 billion for roads and bridges, US$25 billion for airports and US$73 billion to update ageing grids. In the UK, the government’s National Infrastructure Strategy and Construction Pipeline has estimated that up to £650 billion investments in infrastructure are needed over the coming decade.15 This creates large opportunities for investment trusts exposed to that theme.

Sources:

1. The First Global Emerging Markets Investor: Foreign & Colonial Investment Trust 1880-1913, David Chambers (University of Cambridge) and Rui Esteves (University of Oxford) https://www.econsoc.hist.cam.ac.uk/docs/CWPESH%20number%206%20July%202012.pdf

2. Bloomberg, 31 December 1985 to 31 December 2021, FAINVC and UKX indices, GBP

3. “M&A and buybacks remove £3.9bn from trusts in first quarter”, Citywire, 5 April 2024 https://citywire.com/investment-trust-insider/news/m-and-a-and-buybacks-remove-3-9bn-from-trusts-in-first-quarter/a2439804

4. “Hedge funds circle struggling UK investment Trusts”, Financial Times, 5 April 2024 https://www.ft.com/content/390c442c-01cc-4046-bba9-b60e31389371

5. Hansard Friday, 10 May 2024 https://bills.parliament.uk/bills/3518/stages/18673

6. “The Most Aggressive Tightening Cycle in Decades”, Statista, 14 December 2023, https://www.statista.com/chart/28437/interest-rate-hikes-in-past-tightening-cycles/#:~:text=Between%20March%202022%20and%20July,the%20fastest%20in%20four%20decades.

7. “Will investment trusts flee the country over cost disclosures”, Yahoo Finance, 8 April 2024. https://uk.finance.yahoo.com/news/investment-trusts-flee-country-over-153909964.html

8. “European Commission, Questions and Answers on the EU Action Plan for Grids”, 28 November 2023 https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_6045

9. “Tripling renewable power and doubling energy efficiency by 2030: Crucial steps towards 1.5°C”, Irena,https://www.irena.org/Digital-Report/Tripling-renewable-power-and-doubling-energy-efficiency-by-2030

10. “Data Centers 2024 Global Outlook”, JLL https://www.us.jll.com/en/trends-and-insights/research/data-center-outlook

11. “Revelations in the Global Storage Sphere 2023”, John Rydning, IDC #US49346223, Aug 2023

12. “Global Artificial Intelligence (AI) Infrastructure Market – Industry Trends and Forecast to 2029”, Data Bridge Market Research, https://www.databridgemarketresearch.com/reports/global-ai-infrastructure-market

13. “Forecasting infrastructure investment needs and gaps”, Infrastructure Outlook https://outlook.gihub.org/?utm_source=GIHub+Homepage&utm_medium=Project+tile&utm_campaign=Outlook+GIHub+Tile

14. “Senate Passes $1 Trillion Infrastructure Bill, Handing Biden a Bipartisan Win”, The New York Times, 10 August 2023 https://www.nytimes.com/2021/08/10/us/politics/infrastructure-bill-passes.html

15. “Transforming Infrastructure Performance: Roadmap to 2030”, Gov.co.uk, 13 September 2021 https://www.gov.uk/government/publications/transforming-infrastructure-performance-roadmap-to-2030/transforming-infrastructure-performance-roadmap-to-2030

IMPORTANT INFORMATION This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. MAR006174 Exp 05/2029

Comments