Main points:

*QE is a more effective tactic than interest-rate cuts for this crisis

*The flow of money is the problem, rather than the cost of money

*Sterling has strengthened and gilt yields have fallen since the MPC’s intervention

The Bank of England Monetary Policy Committee (MPC) made its second emergency intervention yesterday, and it looked necessarily big and bold, given the extraordinary current economic backdrop.

While the cut in interest rates to 0.1% was widely expected, it may be the last – unless circumstances deteriorate even more markedly. This is because new Bank of England governor Andrew Bailey is on record as saying that he regards 0.1% as the “lower bound”, while other MPC members have previously suggested that the lower bound is close to, but above, zero.

Flow of money

Regardless of the actual boundary line, interest-rate cuts should be viewed as largely of symbolic value, rather than being an effective way to combat this kind of crisis; it is not so much the cost of money but the flow of money (and credit) that is the problem currently.

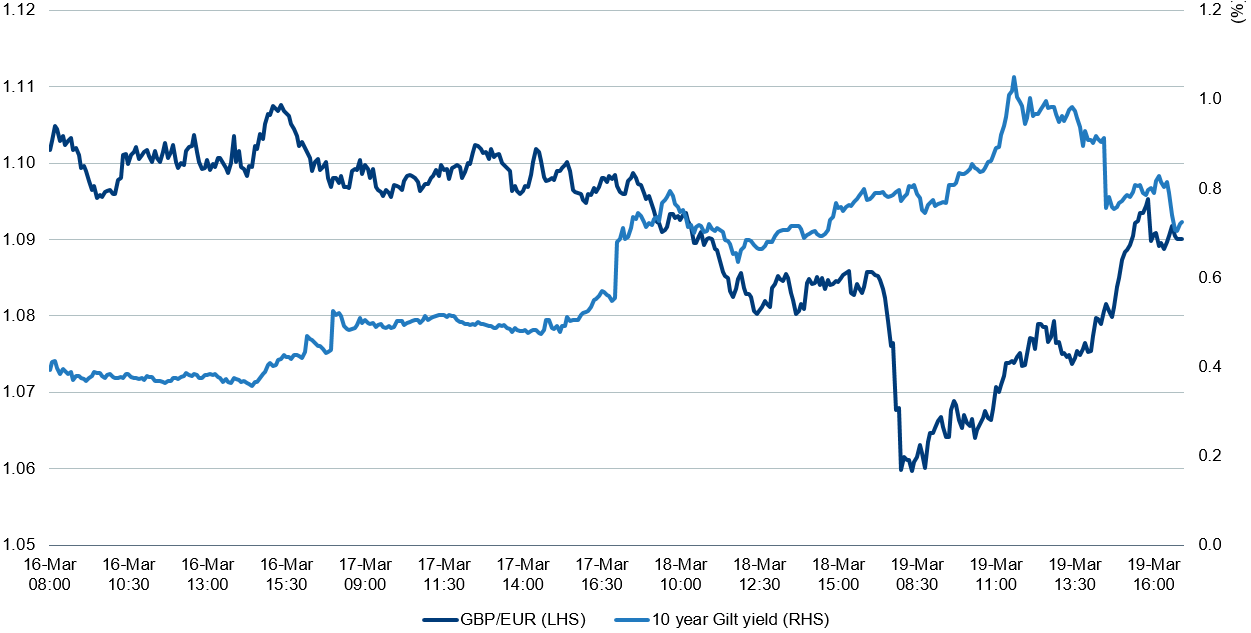

With this in mind, the announcement of a further £200bn in quantitative easing (QE) should be more helpful. That is as big as any previous QE package, and it will be executed as soon as operationally possible, as opposed to previous QE rounds, which were implemented evenly over weeks/months, in accordance with a prearranged timetable. Clearly the MPC’s aim is to ‘take back control’ of gilt yields, which had risen violently in reaction to the substantial fiscal packages announced (and the knock-on effect on gilt issuance), and threatened to make the cost of these measures very expensive. The chart below shows that sterling had been slumping and gilt yields leaping prior to the announcement, but both have recovered somewhat since.

Movement of sterling versus euro, and 10-year gilt yields, 16-19 March 2020

Source: Source: Bloomberg, 20/3/20

Gilt-buying programme

The MPC explicitly stated that the majority of the £200bn would be spent on buying gilts. Some will go towards corporate bond purchases, and we suspect more will need to be diverted to that channel eventually. For the moment, however, authorities are focused on stabilising the benchmark off which corporate bonds are priced.

Gilt yields continued to rise yesterday, prior to the announcement, but then dropped a little, as desired, before declining further today (Friday). Sterling began a slight recovery against the US dollar, off 35-year lows, and has maintained that strength today, as these moves should help to support the economy through this sharp economic shock. We doubt this will be the end of volatility for sterling assets (or other financial assets), but taken together with fiscal and monetary responses from other major economic blocks, it should help to calm markets.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice.

Comments