It is perhaps fitting that, with the UK as split as ever over membership of the European Union (EU), the latest agreed Brexit extension runs to the end of January, thought by many (perhaps wrongly) to be named after the two-faced Roman god Janus, often referred to as the “god of beginnings, gates, transitions, time, duality, doorways, passages and endings”.

Now that the EU has extended the Brexit deadline by up to three months to January 31, 2020, and a highly unpredictable UK general election is slated for December 12 this year, one thing we can be reasonably sure of, is that there is still no certainty of light at the end of the tunnel any time soon for the UK economy.

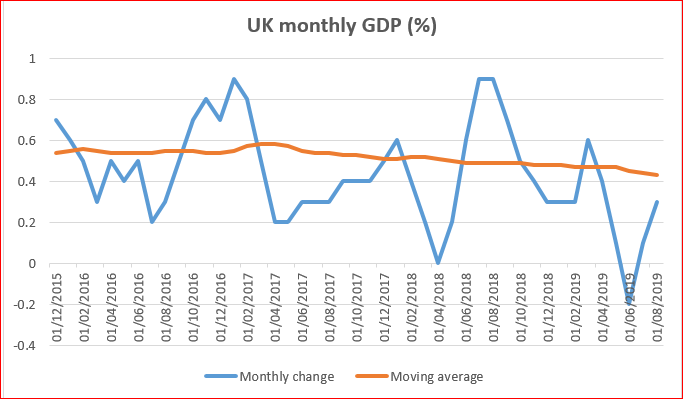

UK gross domestic product (GDP) has displayed a sawtooth pattern of ups and downs since the country’s 2016 referendum on leaving or remaining in the EU, but has certainly been losing momentum as investment has waned, as shown by the orange line in the chart below, which represents the 36-month moving average.

Source: Bloomberg, September 2019

While there was a notable pickup in GDP in the run-up to the originally proposed March 29, 2019 EU exit date owing to stockpiling, GDP then tanked once the leave date was extended. The more recent pickup this quarter, ahead of the now defunct Halloween exit deadline, seems less dramatic, and yet retailers (and probably others) are holding record stock. Those high stock levels don’t bode well for growth over the fourth quarter, and while UK employment and real incomes look relatively strong, consumer confidence remains weak.

Narrow Runway to Success

A general election is viewed by many, not least UK Prime Minister Boris Johnson and his cabinet, as the only way to break the Brexit-related impasse, but in our view there is only a narrow runway that would lead to Boris Johnson successfully implementing his Brexit deal. Below are a range of potential scenarios that could arise from the December election.

- Johnson wins a small but workable majority for his Conservative Party. This is in no way guaranteed owing to the fractured nature of UK politics and the broad scope for tactical voting; there are a number of rebel Members of Parliament (MPs) and Brexit Party candidates who could split the Conservative Party vote (not to mention the potential for political gaffes from the prime minister himself). In any case, this outcome would simply mean agreeing to an EU ‘divorce’, and not the future trading relationship. It certainly would not guarantee a close trading relationship with the EU any time soon.

- If the Conservatives win a larger majority, the staunchly anti-EU European Research Group (ERG) faction within the party might feel emboldened to push for a ‘harder’ Brexit, which would at the very least diminish the chances of a close trading relationship between the UK and the EU at the end of the Brexit transition period.

- The Conservatives become the largest party, but without an overall majority. This would make it difficult for the Conservatives to form a government, having badly let down their only potential ally, the Democratic Unionist Party (DUP), which is unhappy that Boris Johnson’s Brexit deal is likely to lead to a customs border between Northern Ireland and the rest of the UK.

- The opposition Labour Party forms a coalition or ‘confidence and supply’ government as the largest or second-largest party. This could well lead to a second Scottish independence referendum, and would still provide no immediate clarity on either Brexit or economic policy, adding further uncertainty.

- Neither main party is able to form a government. This is a distinct possibility given the potential for the DUP to once again play the role of ‘kingmaker’. With Johnson being accused of ‘betraying’ the UK Union, and the prevailing view in some quarters that Labour Party leader Jeremy Corbyn is an ‘Irish nationalist sympathiser’, there is no guarantee that the DUP would offer its support to either party.

- An outright Labour victory. Although this currently seems unlikely, it would have the potential to introduce a whole new dynamic – and further volatility.

Market Implications

If the election leads to Boris Johnson’s Brexit deal passing, we believe that sterling could easily revisit €1.20 against the euro. Should the election result make Brexit looks less likely, sterling could move even higher, and 10-year UK government-bond (gilt) yields could move to over 1.0%.

Coincidentally, €1.20 is the level to which sterling fell immediately after the 2016 referendum. At that level, it reflects the reality of Brexit, but with a ‘deal of sorts’, whereas back in 2016, it was only a probability. Meanwhile, sterling has traded lower when there have been fears of a ‘no-deal’ Brexit, and because the UK has lost its relative performance lead over the EU.

It remains uncertain whether Boris Johnson’s Brexit deal – and with it a commitment to a close future trading relationship with the EU – will be approved. This therefore points to avoiding a long sterling position. In the meantime, the UK economy continues to become more ‘zombie’-like, which should offer support for gilts for now. Our view is that it is prudent to tactically reduce gilt underweights, while staying neutral on sterling, as the UK economy will effectively remain in a state of limbo until there is a clear break from the status quo one way or the other.

Time will tell if we are closer to the end of the Brexit saga, or if, rather like the two-faced Roman god, opposing views will continue to thwart a resolution.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.