The high-yield bond market could be at a turning point, but will it prove a tactical setback or something more serious?

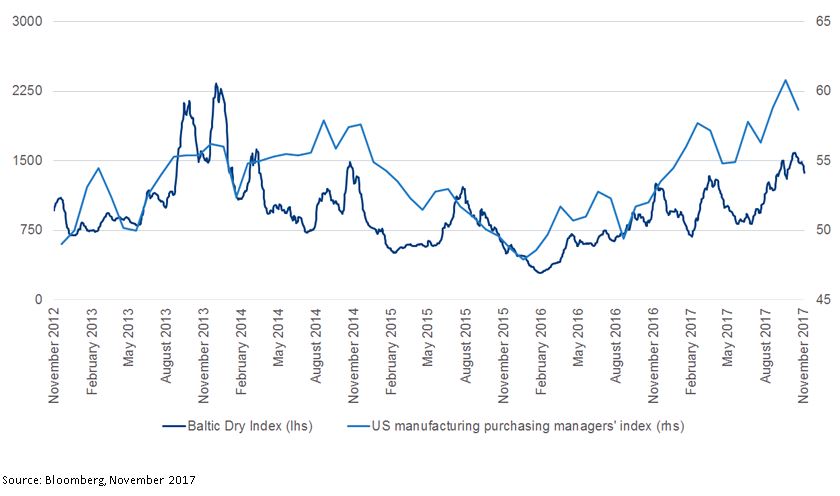

As always, time will tell. The recent support for risk assets appears to stem from the fact that global economic growth still looks good, with multiple regions growing at the same time. Furthermore, trade and optimism are strong, as illustrated by the chart below which shows the Baltic Dry Index (providing an assessment of the price of moving major raw materials by sea, and therefore a view on global trade) and the U.S. manufacturing purchasing managers’ index.

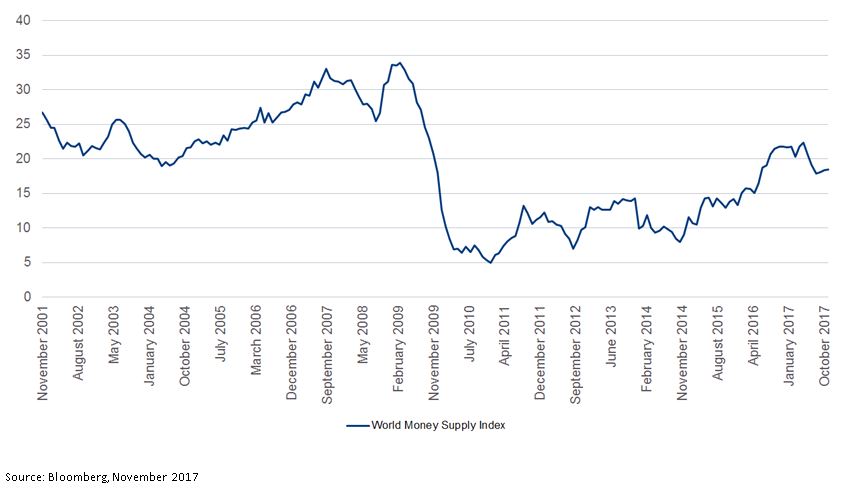

However, the global money supply looks to be rolling over (as the chart below highlights), which we think could lead to cooling of demand.

The positive connection between the benign economic growth outlook and risk assets appears to us to have been strong. As the chart below illustrates, the high-yield bond market total-return index has risen 30% from its lows of February 2016. With central banks reducing their monetary stimulus, and in some cases tightening monetary policy, the possibility of these risk assets losing momentum and even pulling back sharply must be significant.

Our main concern is that in some instances corporate leverage is very high. In such cases, it may not take much of a hit to operating profits for those companies which are currently ‘darlings’ of the equity and high-yield markets to become ‘dogs’. This means, we believe, that credit risk for a number of individual companies is high even if the overall market has seen buying support and there are limited concerns about wholesale defaults.

After such a good run, and where risk levels have risen, we believe it is prudent to trim back exposure. Across our fixed-income strategies, we have been reducing credit exposure while still participating in the market. This may mean avoiding sectors where operating profits are challenged, as well as individual companies that have too much leverage or whose valuations appear stretched.

Normally, increasing exposure to government bonds can be beneficial as risk assets retrench. However, given the tightening of monetary policy, we see the major government-bond markets currently as offering little in the way of returns. Therefore, we are maintaining a higher cash weighting. At some point, we anticipate that the potential decline in economic growth is likely to start to become the main driver, which we think should enable government bonds to rally.

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.