As we have mentioned before, our current macro view is that bond markets are in the middle of a transition year. This is owing to the gradual U.S. monetary tightening process currently underway, which has a negative impact on different sectors of the bond market at different stages in the economic cycle.

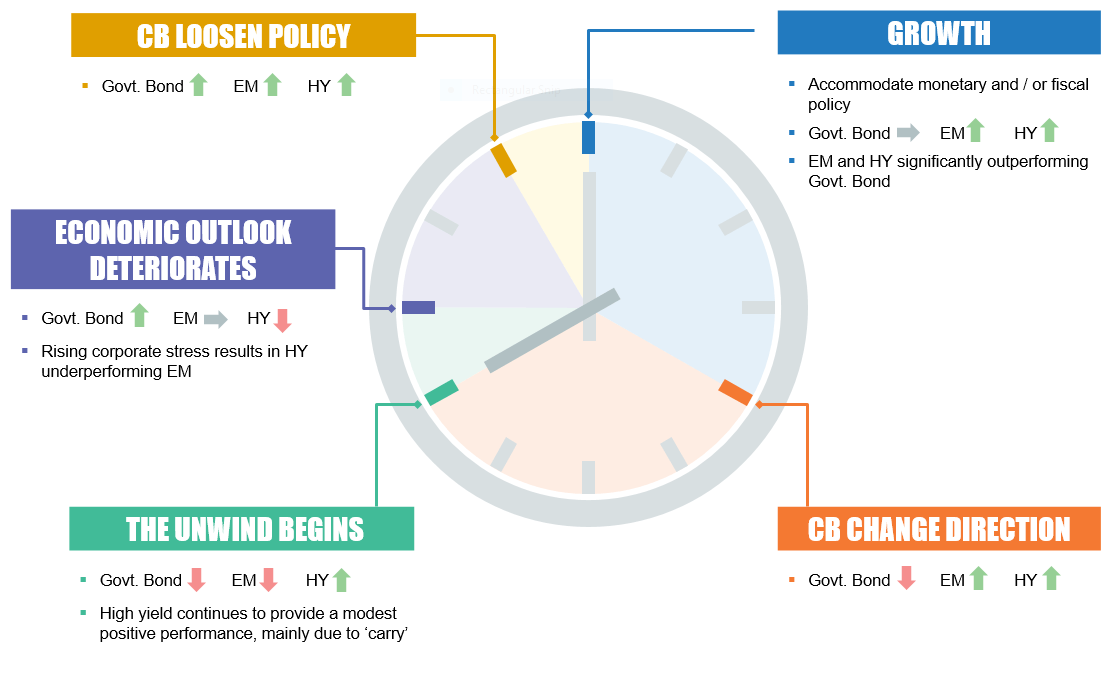

First to feel the negative impact of the tightening were developed-world government bonds, followed by emerging-market sovereign bonds. Finally, the effects ripple out into the real economy and thus to high-yield corporate bonds. To help map out how this process plays out, we have put together the clock below, to show which parts of the bond market are affected, and at what ‘time’ in the market cycle.

Prior to 2016, we were at midday on the clock – the growth stage – when economic growth was strong and monetary policy was loose. Then the Treasury market started to react to the Federal Reserve’s (Fed) decision to raise rates and talk of reducing its balance sheet, which sparked a sell-off in U.S. Treasuries in the second half of 2016. This period equates to 4pm on the clock below. We have been experiencing stage three – the unwinding of U.S. monetary policy (8pm on the clock) – since the beginning of this year, as the tightening of U.S.-dollar liquidity causes stress in emerging-market countries exposed to U.S. borrowing. Stage four, at 9pm on the clock, is the point at which U.S. Treasuries rally and credit sells off as the economic outlook deteriorates. At this stage, we think high-yield bonds (and probably equity markets) are likely to be in decline on the negative outlook.

Our best guess is that this could occur in the fourth quarter of 2018 as the market becomes concerned about 2019 economic growth forecasts, and is able to make an educated guess as to when the Fed will stop raising rates.

As the clock below shows, the tightening cycle is gradual, but eventually there will be a price to pay for assets that have run ahead of growth.

Telling the time in bond markets

CB = central banks; EM = emerging-market sovereign bonds; HY = high-yield corporate bonds.

Source: Newton, 2018

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.