The regionalization and localization of supply chains can amplify their resiliency and sustainability, creating potential long-term opportunities for investors.

Key Points

- Current environmental and geopolitical conditions are causing headwinds for automobile manufacturers, urging these companies to rethink traditional supply chains.

- Deglobalization, regionalization and localization move into the spotlight as companies seek to lessen their reliance on China.

- We believe there are compelling positive implications for sustainability when localizing the supply chain.

- In our view, building resilient and sustainable supply chains should create attractive long-term opportunities for investors.

Mobility is rapidly evolving as the industry speeds toward the transition to electric vehicles (EVs), spurring interest and increased investment as companies vie for green supremacy. As this transition evolves, so will the EV supply chain, which strongly differs from that of the traditional internal combustion engine (ICE). While most manufacturers and component suppliers have adapted to and mastered the complexity and relative immobility of supply chains, current environmental and geopolitical headwinds are causing many companies to rethink this process and reinvent how – and where – they manufacture products, ushering in a potential new age of deglobalization, regionalization and localization. This catalyst for change should encourage investors to take a long-term view. Ultimately, we believe building resilient and sustainable supply chains can enable a resilient and sustainable future and thus create the attractive long-term opportunity for investors.

China’s Supply Chain Dominance

Today’s world is propelled by fossil-fuel internal combustion engines, where supply chains are highly globalized with component parts sourced from many countries to produce the final product. This highly complex dynamic can create supply chains with a multitude of risks or weak links that can affect efficiency and reliability. However, with the rise in popularity of EVs, so too comes potential for more streamlined and efficient supply chains. For example, a full electric passenger vehicle has around 20 moving parts while internal combustion engines have 2000 parts.

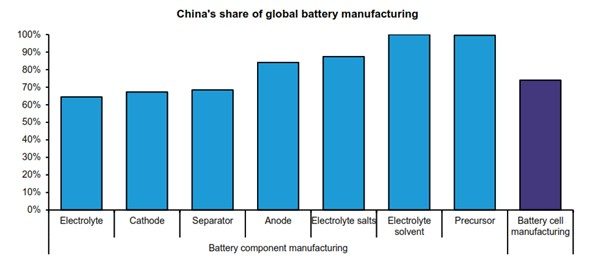

China dominates the supply chain of EV batteries

Source: Bloomberg and Bernstein analysis, April 2022.

Currently, the majority of EV battery manufacturing capacity is located in Asia, with the largest share in China. While the initial end of lockdowns in China provided some near-term relief to the mobility supply chain as factories reopened, the respite was short-lived. Broadly, many companies across the globe are seeking to reduce or diversify their supply-chain dependence on China for two main reasons: geopolitical risk and innovation. More recently, recurrent lockdowns in China have proven there could be long-term headwinds to continuing production in the country, causing companies to seek supply-chain redundancies in alternate locations in search of resiliency. In particular, auto manufacturers are focusing on deglobalization and planning for further insourcing of key components, such as in-house e-powertrains, software and battery cell production. These companies aren’t stopping at relocating production; some are also beginning to consider the enhancement of their raw-material procurement by forming “offtake” agreements with mining companies for the key battery metals. Companies aren’t alone in their interest to diversify their efforts beyond China as governments also try to move away from overseas production, evidenced by the European Union’s green new deal.

Deglobalization or Something More?

China’s early focus on developing the EV supply chain is a key reason for its outsized role in manufacturing. However, over the next decade, we expect that China’s dominance should decline as localization of battery factories increases in Europe, North America and the rest of the world.

As these companies begin to move away from their reliance on China as a hub of production, many investors can become overly focused on the prospect of deglobalization, but we believe this is only part of a broader narrative. There are actually three issues at hand: deglobalization, regionalization and localization. Regionalization has already begun, mostly in part due to former US President Trump’s tariffs, which have acutely affected the technology industry. Additionally, in a move towards localization, certain Chinese lithium ion battery manufacturers are considering greenfield projects in various regions around the world, including the US, allowing them to supply US original equipment managers (OEMs) more efficiently.

We believe the localization of select links in the supply chain should create new opportunities for investors, including a more dynamic portfolio and mobility universe over time.

A Sustainable Future Through Supply Chains

The global transition to EVs can offer numerous environmental, social and governance (ESG) benefits, including the obvious environmental advantage of lower emissions due to the introduction of the battery-powered propulsion system. Additionally, the regionalization and localization of supply chains will naturally lower emissions related to transportation as companies lessen their dependence on the shipment of products from one side of the globe to the other. Instead, companies can build, source and sell regionally or locally.

We also believe there are compelling positive implications for sustainability. Localizing companies can create opportunities to increase the resiliency of supply chains through dual sourcing, where companies can still source materials or components from other countries, while enhancing their level of control with local production practices. This can allow EV companies to be nimble and not wholly dependent upon one region, especially during times of geopolitical unrest.

However, localization can still present challenges, as local policies and restrictions can sometimes limit the ability to reshore manufacturing plants and factories. From start to finish, the battery supply chain is complex and there are environmental and sustainability concerns with the mining and processing of key metals. For example, a large US-based EV manufacturer previously ran into numerous issues while attempting to build battery plants on US soil. The country’s environmental requirements to build such a factory are stringent and require specific permits from individual municipalities. Ironically, these very restrictions created the initial push of globalization and moving manufacturing to countries, such as China, with lower regulatory friction.

Developing a more robust recycling system to help offset negative effects of battery manufacturing could rectify some ESG and sustainability concerns. Further to this cause, there is a need to enhance materials processing so that it utilizes renewable energy sources. At the end of the day, the ultimate, somewhat lofty, goal is to create a closed-loop system, where metals can be recycled, and fewer mining activities are required. In the mid- to long-term, we believe that recycling could be the key to sustainability and forming a truly circular eco-system.

Opportunities Linked to the Great Transition

The EV supply chain remains in the very earliest of stages, given the relative early days of mass-market EVs, but nonetheless continues to evolve, undergoing a great transition itself. Between localizing links in the supply chain to the integration of certain ESG principles, there are many factors at play and opportunities that active managers with long-term views can seize. This multi-decade theme is in its infancy with many knowns and unknowns on the horizon.

There are also some difficult realities with which the EV supply chain must contend. Mining and processing of key metals is a dirty business, and a closed-loop recycling system may be unrealistic. Additionally, it will take a very long time, if ever, for particular regions to localize certain areas of the supply chain, making it near impossible to bring the entire manufacturing process in-house. Finally, localizing pieces of the supply chain will generate some friction due to more stringent local regulations in places like Europe and the US. Conversely, there are some areas where we are more optimistic, including localization of battery assembly production by both the OEMs and cell manufacturers.

Early-stage themes, such as the mobility supply-chain revolution, allow focused investors to dig deep and take truly differentiated viewpoints, while seeing the potential pitfalls native to a nascent trend. We believe that a more resilient and sustainable future is on the horizon as supply chains enhance their flexibility through localization and regionalization.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Newton manages a variety of investment strategies. Whether and how ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved, as well as the research and investment approach of each Newton firm. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions. For additional Important Information, click on the link below.

Important information

Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management" ("Newton"). Newton currently includes NIMNA and Newton Investment Management Ltd. ("Newton Limited").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. Statements are correct as of the date of the material only. You should consult your advisor to determine whether any particular investment strategy is appropriate.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including NIMNA and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management North America.

This material is for institutional investors only. This publication or any portion thereof may not be copied or distributed without prior written approval from the firm.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.