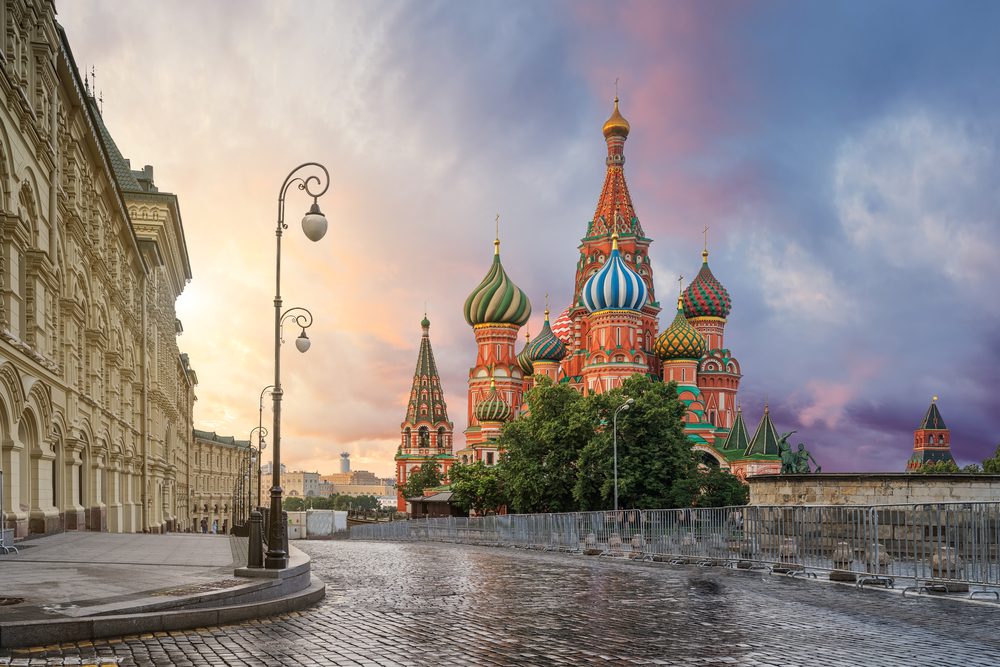

A recent research trip gave us the opportunity to meet local businesses and strategists to assess the real opportunities and challenges facing Russia as it gears up to host the 2018 FIFA World Cup.

After the landslide re-election victory of Vladimir Putin in March, economic focus has fallen on his stated aim of increasing Russia’s per-capita GDP by 50% by the middle of the next decade. Putin aims to achieve this by boosting non-resource revenues, and increasing productivity and human capital via spending on areas such as education, health care and technology, as well as through wider moves to boost infrastructure and foster entrepreneurialism.

However, these ambitious plans have been overshadowed by the international political fallout from the recent UK/Russia poisoning scandal which saw Russian diplomats expelled from more than 20 countries. Russian involvement in the ongoing Syrian conflict has also been heavily criticized by Western leaders,[1] as has Russia’s alleged role in political and economic cyberwarfare.

Souring Relationships

While the long-term impact of existing economic sanctions imposed on Russia and the current diplomatic crisis remains unclear, souring relations with the West could further discourage much needed foreign direct investment, given that there is already anxiety about the health of the Russian economy.[2]

Russia faces a number of domestic economic challenges, not least its dependence on energy production, its strikingly low levels of entrepreneurialism, and its reliance on old, heavyweight companies that do little to stimulate growth. It has also been slow to invest in education to get young people into the workplace, and has not invested enough in health care. People in Russia tend to have very short working lives and the level of productivity in the country is very low.

While many feel Putin owes the electorate major reform which can genuinely benefit the Russian people – as a reward for their loyalty – doubts persist over his commitment to change. According to a strategist we spoke to, with close ties to the president, hundreds of presidential orders are still issued most weeks, maximizing bureaucracy (and associated spending), while limiting the resources available to take real action. Putin has effectively been in power since 2000 and the Russian political system can, at times, seem more like a monarchy then a democracy.

Football Fever

Nevertheless, the Russian president’s stated economic priorities include fostering a more entrepreneurial society, reducing the state’s share in the economy, doubling health-care spending, improving the affordability of mortgages for ordinary Russian people, and making fresh investment in infrastructure. Against this backdrop, the upcoming 2018 FIFA World Cup – to be hosted by Russia – may prove an interesting test case for the country. From an economic standpoint, the tournament has prompted significant new spending on infrastructure through new stadiums, and the likely boost in spending from tourists and Russians travelling to matches could bring some real short-term benefits.

While Western sentiment is currently very negative toward Russia, the World Cup could provide a good opportunity for overseas visitors to speak to people on the ground and gauge if Russia really is the hotbed of intrigue some have claimed. At a personal and social level, the tournament should give at least some opportunity for relations to improve between ordinary people from Russia and other participating countries, politics aside.

[1] Presidential address to the Russian Assembly, March 1, 2018.

[2] https://www.cnbc.com/2018/04/10/invest-in-russia-at-your-own-risk-after-us-sanctions-strategist-says.html, April 10, 2018.

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. ‘Newton’ and/or the “Newton Investment Management” brand refers to the following group of affiliated companies: Newton Investment Management Limited, Newton Investment Management (North America) Limited (NIMNA Ltd) and Newton Investment Management (North America) LLC (NIMNA LLC). NIMNA LLC personnel are supervised persons of NIMNA Ltd and NIMNA LLC does not provide investment advice, all of which is conducted by NIMNA Ltd. NIMNA LLC and NIMNA Ltd are the only Newton companies to offer services in the U.S. In the UK, NIMNA Ltd is authorized and regulated by the Financial Conduct Authority in the conduct of investment business and is a wholly owned subsidiary of The Bank of New York Mellon Corporation. Registered in England no. 2675952. NIMNA Ltd is registered as an investment adviser under the Investment Advisers Act of 1940. NIMNA Ltd investment business described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Certain information contained herein is based on outside sources believed to be reliable, but their accuracy is not guaranteed. Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2006 The Bank of New York Company, Inc. All rights reserved. Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of MBSC Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds and (iii) associated persons of MBSC Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.