After a sustained period of revenue loss, the music industry is not only growing again, but doing so in spectacular fashion. Once the industry villain, digital distribution has recently turned industry savior thanks to legal streaming platforms.

The music industry has undergone significant changes over the last 50 years, with technological developments drastically changing the means of music production and distribution. After a prosperous period of music sales in the 1970s, 80s and early 90s, piracy decimated industry sales at the turn of the millennium. Illegal downloading sites enabled the sharing of music files for free with no regard for copyright laws, resulting in the industry’s sales falling 57%, from $14.6 billion to $6.3 billion, between 1999 and 2009.[1]

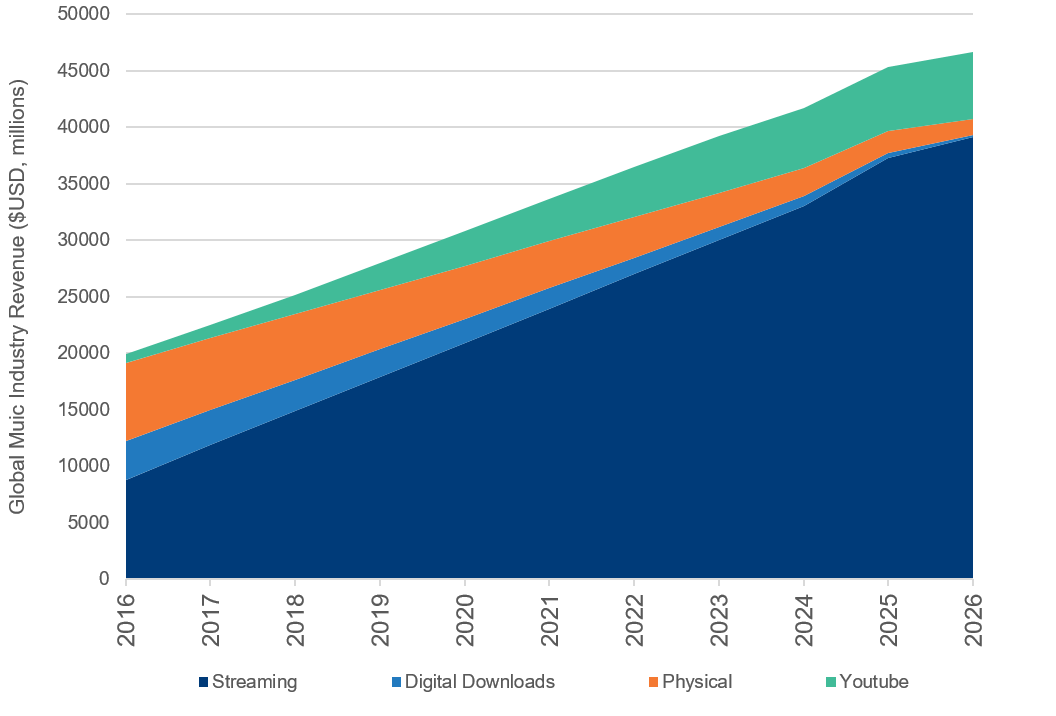

It appeared that the digital era would bring with it an end to the record label’s dominant industry position. However, revenue has recovered in recent years, owing primarily to the advent of legal streaming platforms. Ironically, the very technology that appeared to be destroying the industry has now become the main driver of industry growth. Harnessing digital distribution has been key for luring consumers back to legal methods of music consumption. Indeed, the global consumer seems to believe in the value proposition of streaming platforms, underpinned by ease of access and usability. Projections suggest that revenue will continue to increase, with streaming forming the bulk of purchases and downloads.

2016 – 2026 Forecast

Source: Newton calculations, March 2018

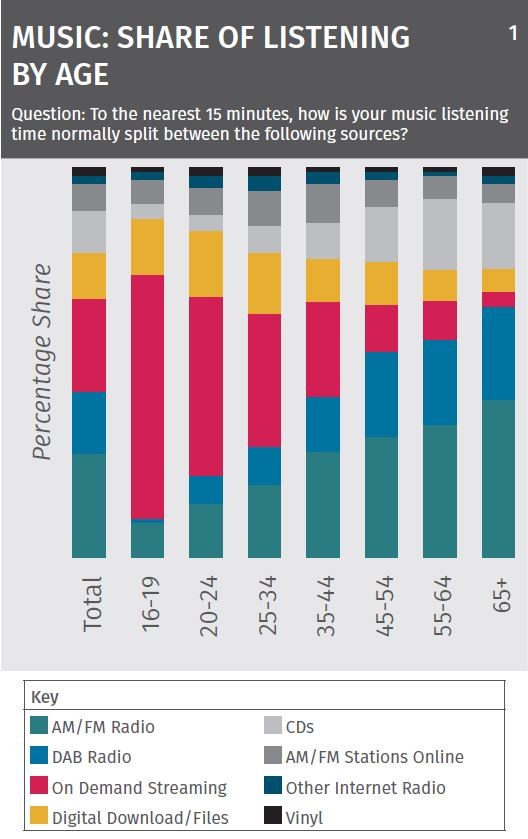

We believe that the use of streaming platforms will only increase as time goes on, owing to increasing internet penetration, demographically driven changes in listening habits, and growing awareness of streaming platforms globally, as shown in our 2016-2026 forecast.

Source: UK Music, Measuring Music 2017 report, https://www.ukmusic.org/research/measuring-music-2017/

In the context of this spectacular industry turnaround, it is important to consider who stands to benefit most from the proliferation of streaming. While the streaming platforms are the first recipients of the proceeds, they have to pay about 55% of gross sales to the master rights holders.

A path to improved margins for streaming platforms, at the expense of labels, could be to own content rather than merely diffuse the content of others. However, we believe there are many reasons that this approach is unlikely to yield the same success for streaming platforms as it did for audio-visual disruptors. First, a streaming platform without an extremely high proportion of all possible content is an unattractive proposition. Similarly, consumers want historic content, not just more recent music; the labels have history on their side. Moreover, given that music content is oligopolistic – the three major labels account for roughly 70% market share[2] – the very act of trying to usurp record-label dominance by producing original content could lead to label retaliation.

The extreme of this would result in the loss of an enormous amount of music from the streaming service’s library, rendering the platform unappealing to consumers. In aggregate, these issues leave streaming platforms beholden to the labels. A customer’s ultimate loyalty is to the music they want to consume. We therefore believe that the labels currently hold all the cards.

Investment implications

So what are the investment implications of these developments? Given the enviable market position of the three major record labels, coupled with growth in the industry, we feel the record labels are in a strong position. Beyond the top-line growth story, costs are also likely to decrease as business models become more streaming-centric, so labels are also likely to see margin expansion. However, we believe that labels are well aware that a healthy streaming ecosystem is fundamentally essential for the wellbeing of their businesses. We think it is therefore probable that the labels will allow streaming platforms to improve their margins gradually over time. As such, we feel that growth in the industry should be strong enough to allow multiple beneficiaries. We believe that these are exciting developments in media, and that they represent attractive long-term trends

[1] http://money.cnn.com/2010/02/02/news/companies/napster_music_industry/

[2] Source: UBS Global Research, September 2017

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.