We outline our thoughts on the prospects for global fixed-income markets as we move towards a low-carbon economy.

Key Points

- Fixed income is facing the twin threats of inflation and the withdrawal of monetary stimulus in 2022.

- We anticipate a more stable safe-haven environment for yields in the second half of the year.

- We believe the role fixed-income markets will have in funding the transition away from carbon-intensive economies will become increasingly important.

- Capital expenditure required to aid the energy transition is huge; we believe global monetary policy needs to remain accommodative to maintain access to low-cost funding.

- Private capital will be key as government balance sheets will struggle to sustain the necessary level of investment required.

- Sustainable finance has been growing quickly, but it is still small, and much more is required for the world to reach net zero.

While fixed-income markets continue to provide some positive investment opportunities, they are also facing a range of potential threats in 2022, particularly from inflation and the removal of monetary stimulus by central banks. We expect that these concerns will be particularly influential in government-bond markets until the second quarter of next year, but from that point on we would anticipate a more stable safe-haven environment for yields.

To add to the pressing issues facing bond investors, the Intergovernmental Panel on Climate Change’s (IPCC) Gap Report for 2021 warns that the world is on track for 2.8 degrees Celsius of warming by the end of the century based on current policies, which is spurring further growth in the number of net-zero commitments helping to accelerate ‘green’ spending.

Huge Capex, Growing Debt…

Additional spending requirements to achieve net-zero carbon emissions range from the low to high single-digit trillion dollars per year; to provide some context on the scale of the challenge ahead, the world’s 2,000 largest non-financial companies are expected to have paid out US$3.7 trillion in 2021 on business-as-usual capital expenditure.

Whichever way you cut it, this is a huge amount of additional capital that needs to be funded, and global debt to GDP is only going to increase further as a result. For us, this increases the need for global monetary policy to remain accommodative to maintain access to low-cost funding. However, it is cheaper to act now than to have to deal with the consequences of inaction.

We believe the next step will be the further internalizing of ‘externalities’: companies will have to pay a price for carbon emissions – a cost which society bears today. This has material implications, in that the acceleration of cost pressures for higher emitters will increase credit risk, thereby limiting access to capital that can be acquired at attractive interest rates. As climate regulations increase, we may see more stranded assets, while business models and carbon-intensive companies are likely to see steeper credit curves (higher spread compensation for debt with longer maturity). This will not just be the case for companies, but for countries too, with sovereign credit risk being an important consideration when seeking access to markets for funding.

Fixed Income’s Role in the Transition Increasingly Important

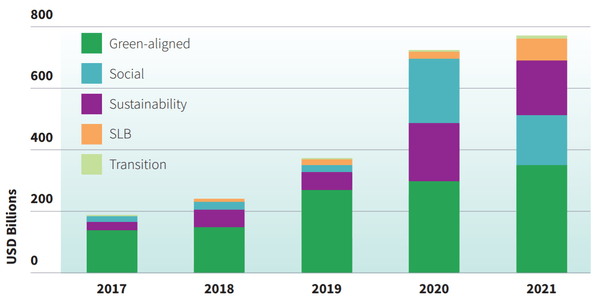

In terms of key opportunities, we believe the role fixed-income markets have in funding the transition away from carbon-intensive economies will become increasingly critical. Most of this funding is expected to be financed by debt from governments, international development agencies and companies, rather than via equity. We expect it increasingly to come through ‘labeled’ bonds (bonds with specific environmental, social and governance (ESG) or sustainability objectives), such as green, social, sustainable and sustainability-linked bonds (see chart below), as well as through ‘vanilla’ bonds. Private capital will be key as government balance sheets will struggle to sustain the necessary level of investment required, which will be needed for all sectors and countries – not just the most carbon-intensive ones.

There are already some big central-bank stimulus programs in place, but we believe these are just a start. Sustainable finance has been growing quickly, but it is still small, and much more will be required for the world to achieve net zero. Take the labeled-bond market, for example; although it has reached US$1.5 trillion in outstanding issuance, this only represents 1.2% of the global bond market.

Increasing Accountability of Stakeholders

There is the risk that a slight premium that can exist for green bonds today could potentially limit the growth of the market, but the demand for green products continues to grow. Over the next few years, we think there will be less need for bond issuance to be in labeled-bond form. The increasing accountability of all stakeholders, including governments, companies, investors and asset owners, should mean less need for labels but more emphasis on differences in the cost of capital between issuers.

While investors must be on their guard against the threat of ‘greenwashing’ or overstating the environmental impact of products, we believe this growth in demand for labeled-bond issuance and other sustainable fixed-income assets will continue to gather pace. Our view is that thorough due diligence and careful continuing analysis of ESG factors for issuers from a holistic perspective, rather than a single project and asset focus, can help investors avoid greenwashing pitfalls. And it is not just investors putting pressure on companies; net-zero policy is driving banks to expect clients to demonstrate a credible carbon-reduction plan as part of the ‘greening’ of their loan books.

Pivotal Role

While the wider backdrop of monetary and fiscal policy will be important given the likely increasing quantum of debt, we believe both central banks and fixed-income investors can and will play an increasingly pivotal role in directing capital to projects that can help move the planet to a potentially more equitable, lower-carbon way of life.

To avoid a proliferation of different standards, it will be important to encourage cohesive regulation to enhance the role of the financial system. We believe the private sector needs to have rigid frameworks in place to give some confidence around potential returns on capital. There is a potential risk that diversion of financial and labor resources to potentially less productive efforts could contribute to creating inflation.

We must remember that there are social consequences to funding the climate transition, such as a change in the profile of skills demanded from the workforce, so green targets should not be considered in isolation, without a view on realizing a just transition. In our view, public finance needs to align with climate goals and economic development objectives; mainstream capital also needs to be mobilized alongside green capital.

The shape of the fixed-income market is changing; we expect to see a future in which fixed-income markets play an increasingly important role in servicing society in positive ways.

A Growing Market…

ESG-Labeled Bond Issuance

Source: Climate Bonds Initiative, October 20211. Note: SLB stands for sustainability-linked bonds.

Sources:

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Newton manages a variety of investment strategies. Whether and how ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved, as well as the research and investment approach of each Newton firm. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.

Comments