A few months ago, the Financial Times (FT) published an article in which it suggested that diesel cars may well be more environmentally efficient than electric vehicles (EVs).[1] The article includes a chart which shows that EVs in China, the US and Germany all have higher carbon costs than a diesel car over a ten-year period, which flies in the face of much of the accepted wisdom around EVs being better for the environment.

This is clearly worth exploring, given that EVs are thought to be playing a critical role in helping the world to ‘go green’ while maintaining standards of living. We took a step back to consider the big picture and what factors might have been glossed over in the creation of this chart.

In order to make this graph, we believe the FT has made three assumptions that are false. First, it seems that this chart assumes there will be no improvement in electrical power grids over the next ten years, which is unlikely given that grids have been improving steadily over the last decade. Next, the graph does not take into account the fact that 25% of the energy used at the factory where the cells for the Tesla Model 3 (the EV used in the FT’s comparison) are manufactured comes from solar panels. It also assumes that the CO2 production costs are the same for both traditional cars and EVs. However, while the vehicle bodies are similar, the assembly line is 50% shorter for EVs and there are no engine plants dedicated solely to EV manufacturing.

If we adjust for these assumptions, the total emissions of the Tesla Model 3 75kWh would be 11% lower.[2]

Furthermore, while the chart is accurate on the face of it, it is only true for the specific models of cars that the data have been based on: the electric Tesla Model 3 versus the diesel Mercedes C220d. As with everything, not all cars, even from the same company, are made equal, with different makes and models displaying all sorts of different characteristics, including carbon costs. Therefore, while the above is not completely misleading, it rests on comparing a heavily carbon-intensive EV against an efficient diesel engine.

There are two key factors to consider when evaluating the carbon-intensiveness of EVs:

- The size of the battery

- Where the battery was manufactured

Why Size Matters

While the data is limited, a report from IVL does suggest that emissions are scaled to battery weight and kWh (kilowatt hours) in an almost linear fashion.[3] This means that bigger batteries result in higher CO2 emissions, which has clear implications for the total emissions of an EV. However, the Tesla Model 3 tends to have a 50-75 kWh battery, and the Tesla Model X has a 100 kWh battery, both of which are among the bigger EV batteries you can buy. Lots of EVs are available that have batteries which are well below 50 kWh, with the new Mini Electric sporting a 32.6kWh battery, and many others sitting in the 24-45 kWh range.[4][5] To use a 75 kWh battery as a comparison is definitely choosing a battery on the upper end of the size scale, and ignores the fact that most EV sales relate to cars with much smaller battery packs and subsequently lower emissions.

This is particularly relevant when you consider that many people buy EVs as second cars for short journeys, while retaining fuel-guzzling petrol and diesel cars for long-haul drives that EV batteries would not be able to complete on a single charge. Given that most of the carbon emissions associated with EVs occur during the manufacturing process, you need to drive a certain number of electrically fueled miles (in lieu of using a petrol or diesel car) before you have offset the (carbon) production costs. As we’ve demonstrated, bigger batteries result in higher manufacturing emissions, and most EVs that are being used as a second car for quick trips will not drive enough miles to offset the higher carbon emissions required to produce the bigger battery. This means that, while EVs remain the greener option in general, it is important to consider how many miles you are likely to drive, and choose an appropriately sized battery pack.

Location, Location, Location

While the carbon costs of mining and refining are fairly similar across different batteries, the site of manufacturing is a different story. Around 50% of emissions are caused by the manufacture of the battery, so where the energy for that manufacturing comes from is of paramount importance when analyzing an EV’s environmental impact.[6] Each country uses a different energy mix to fuel its national grid, with Poland still relying heavily on coal, while Sweden, for example, uses a high proportion of renewables. For electricity produced in Sweden in 2016, the grams of CO2 produced per kWh were a mere 13.3. In Poland, it was 773.3 grams for each kWh added to the grid.[7] Other heavy emitters include Estonia (795.9 gCO2/kWh) and Cyprus (657.6 gCO2/kWh), while Lithuania and France only produce 13.8 and 55.1 grams of CO2 per kWh respectively.

This translates into a carbon cost of cell and pack manufacturing per kWh (excluding mining/refining) of 7kg in Sweden and 169kg in Poland! That is 8 metric tons of CO2 difference between the two countries for a 50kWh battery pack.

Our model assumes that the total electricity mix used on site by the battery-cell manufacturers is the same as the annual production average of the country. However, the energy mix consumed can be different from the energy mix generated. On the one hand, large additional demand for electricity could be served by the marginal power plant (which is often coal even in Europe). On the other hand, some battery manufacturers might only source green electricity supported by guarantees of origin. As most car manufacturers have committed to carbon neutrality, they are likely to put pressure on battery producers to include renewable electricity, and to lower the total CO2 cost of the battery pack production.

Nevertheless, our model allows us to initiate the debate. Given that climate change is a global issue, this raises questions about whether Poland, Estonia and Cyprus should manufacture EV batteries in the first place. If all batteries were manufactured in Sweden, it would lower the carbon cost of making EV batteries tremendously, which seems worth discussing as reduced carbon emissions are a large reason behind the introductions EVs in the first place.

What Does This Look Like in Practice?

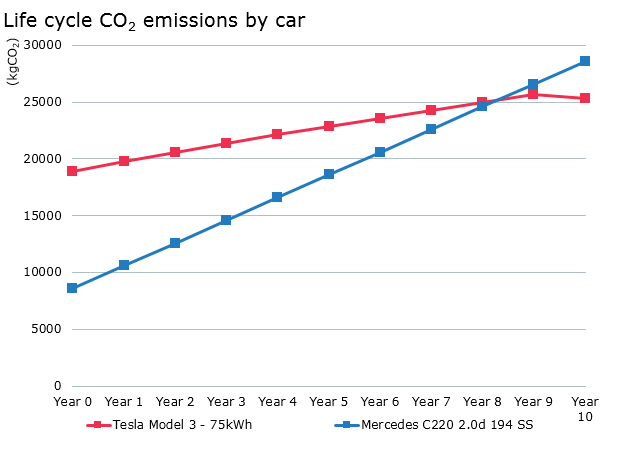

If we take the FT’s model (using the data for Germany), but adjust for the earlier assumptions, we can see that the Tesla Model 3 ends up producing fewer carbon emissions after ten years on the road, despite higher emissions during production, with it taking 8.3 years of use to become more carbon-efficient than the diesel car.

Source: Newton data, July 2019

However, this still depends on one scenario. The FT graph uses research published by IVL, which is seen as the best available. IVL states that: “Based on our review, greenhouse gas emissions of 150-200 kg CO2-eq/kWh battery looks to correspond to the greenhouse gas burden of current battery production.” Therefore, a 75kWh battery emits between 11.25 and 15 metric tons of CO2 as written in the FT article. But the IVL research also says that “this review shows that, assuming the current level of emissions from manufacturing, the electricity mix of the production location greatly impacts the total results.”

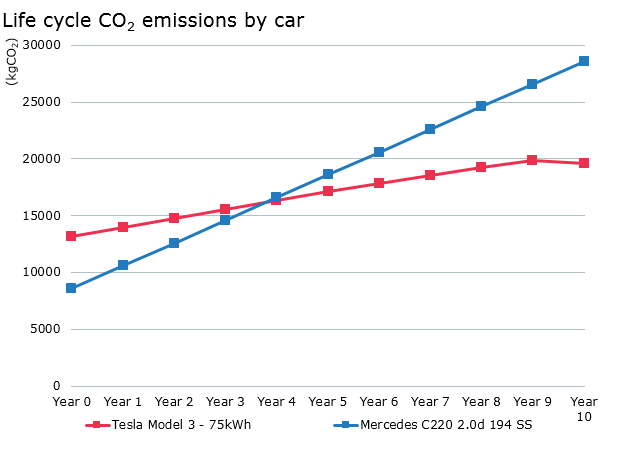

Therefore, if we take the same scenario but change the battery manufacturing location from the US to Sweden, you can see that the total CO2 emissions over ten years are now 32% less than from a car with an internal combustion engine. In addition, the increased carbon costs during production are offset after only 3.8 years.

Source: Newton data, July 2019

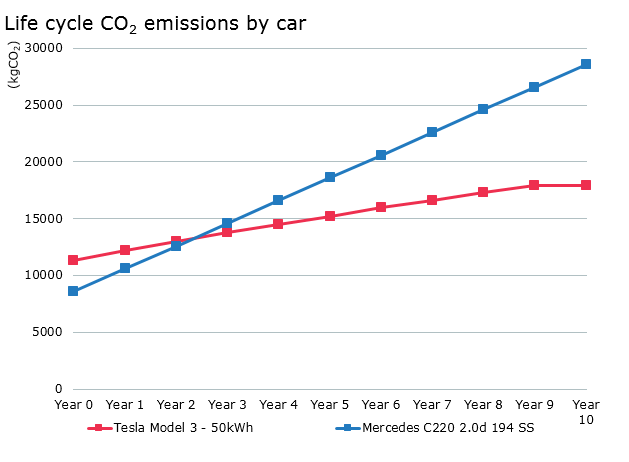

Now, if we say that the German drivers buy the Model 3 with a 50 kWh battery pack rather than a 75 kWh hour pack, the CO2 total is 37% lower, and the offset time is 2.3 years.

Source: Newton data, July 2019

Finally, if we compare this data with a Mercedes gasoline model, as these make up the bulk of European sales compared to diesel versions, total CO2 emissions are 45% lower, and the increased production carbon costs are offset after a mere 1.7 years.

Source: Newton data, July 2019

This paints a radically different picture to that of the FT’s original analysis. We believe that, in most scenarios, EVs will lead to fewer CO2 emissions than traditional diesel and petrol cars, and therefore remain a key piece of the transition towards a cleaner planet, and a potential investment opportunity. However, this does highlight the necessity of reading the fine print, and ensuring that an EV is truly better for the planet than a traditional car. A Tesla Model X with a battery from Poland that is only used for very short trips is unlikely to be a better choice from an environmental perspective! This also raises important questions about the manufacturing location of EV batteries – there may be easy wins in terms of reducing carbon emissions even further, which seems relevant to explore as we try to create transport that supports a greener future.

[1] https://www.ft.com/content/010f4eb2-6765-11e9-a79d-04f350474d62

[2] Newton data

[3] The Life Cycle Energy Consumption and Greenhouse Gas Emissions from Lithium-Ion Batteries, IVL, 2017

[4] https://ev-database.uk/car/1059/Toyota-Prius-Plug-in-Hybrid

[5] https://insideevs.com/features/341926/electric-cars-battery-capacity-and-efficiency-in-depth-analysis-graphs/

[6] The Life Cycle Energy Consumption and Greenhouse Gas Emissions from Lithium-Ion Batteries, IVL, 2017

[7] https://www.eea.europa.eu/data-and-maps/indicators/overview-of-the-electricity-production-2/assessment-4

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.

Comments