Our environment and infrastructure themes group recently presented to our wider investment team some of its latest thinking around our construction and reconstruction theme, which looks at opportunities and risks in the area of infrastructure investment.

Our environment and infrastructure themes group recently presented to our wider investment team some of its latest thinking around our construction and reconstruction theme, which looks at opportunities and risks in the area of infrastructure investment.

Infrastructure investment appears to have been a great source of interest for investors in the wake of Donald Trump’s election as U.S. president, with his campaign pledge to spend $1 trillion on U.S. infrastructure projects clearly playing on their minds.

Away from President Trump’s Twitter feed and speeches, China is a more pressing concern in our view.

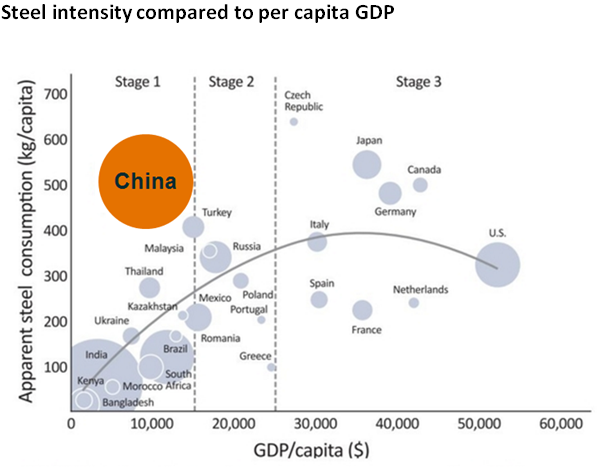

While China is trying to rebalance to become a more consumption-driven economy, overcapacity in the construction industry remains a big issue in the region. As the chart below shows, the country is considerably overbuilt in relation to GDP. Worryingly, if a slowdown in GDP growth occurs, we expect the Chinese government to try to plug the gap with further building.

Source: Cornerstone, June 2015: http://cornerstonemag.net/urbanization-steel-demand-and-raw-materials/

Some of the figures surrounding construction in the country are astounding – for example, China used more concrete between 2011-2013 than the US did in the 20th century![1] Even taking different building practices in the US into account, we believe this is remarkable.

How has this come about? China is a single party state with aggressive growth targets and quick and easy access to central finance, and the country has rapidly embraced technological development. Like children desperate for a parent’s attention, provinces compete among themselves to impress the authorities in Beijing.

One example of the sheer speed of the country’s construction industry, and the lengths provinces have gone to in order to stand out, is the Ark Hotel in the city of Changsha, which currently holds the record for the fastest construction time for a building of its height. The 15-storey, 183,000-square-foot hotel was completed in a record 15 days, with the main structural components of the building finished in just 46 hours. You can watch a time-lapse video of the construction process here:

As such, with overcapacity remaining a problem and rebalancing of the economy continuing, we believe it is best to avoid businesses related to Chinese construction, including materials and building companies.

[1] https://www.washingtonpost.com/news/wonk/wp/2015/03/24/how-china-used-more-cement-in-3-years-than-the-u-s-did-in-the-entire-20th-century/?utm_term=.e972718f2fda

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.