Our philosophy and process

- A constantly evolving and forward-looking approach seeks to anticipate change and identify opportunities. The strategy is conservatively managed and comprises mainly government-issued and/or guaranteed debt.

- Material and relevant ESG risks, issues and opportunities are considered as part of the investment process.

- Every time we consider a security or look at an industry or country, it’s in the context of what’s happening across the world. We believe the investment landscape is shaped over the long term by some key trends, and we use a range of global investment themes to capture these.

Investment team

Our Long Gilt strategy is managed by a focused, experienced fixed-income team. Our investment team of research analysts and portfolio managers works together across regions and sectors, helping to ensure that our investment process is highly flexible. Guided by our global investment themes, the team works together to identify opportunities and risks through research and debate.

- 21

- years’ average investment experience

- 14

- years’ average time at Newton

-

Howard Cunningham

Portfolio manager, fixed income

-

Carl Shepherd

Portfolio manager, fixed income

-

Paul Brain

Investment leader, fixed income

-

Parmeshwar Chadha

Portfolio manager, fixed income

-

Jon Day

Portfolio manager, fixed income

-

Trevor Holder

Portfolio manager, fixed income

-

Scott Freedman

Analyst and portfolio manager, fixed income

-

Martin Chambers

Credit analyst, fixed income

-

Ashwin Palta

Credit research analyst, fixed income

-

Jeevan Dhoot

Credit analyst, fixed income

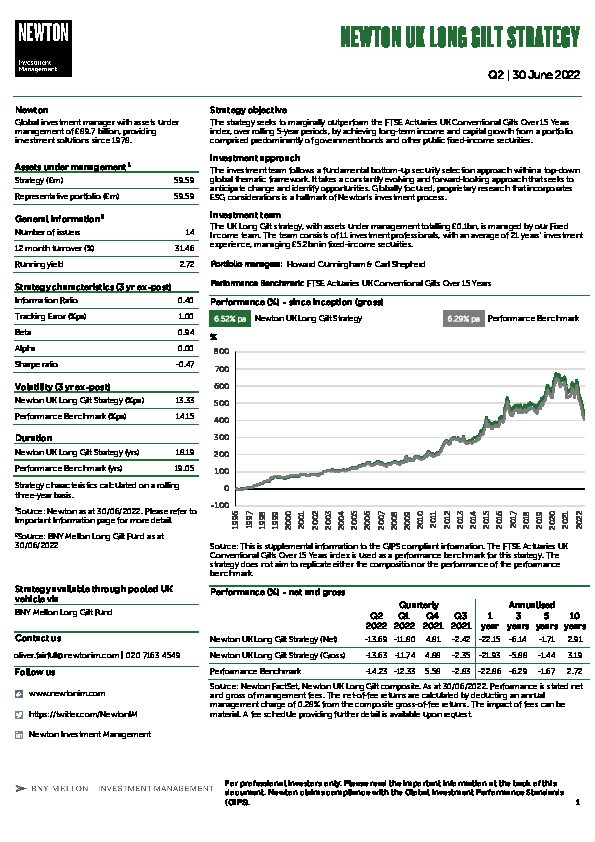

Strategy profile

-

Objective

-

The strategy seeks to marginally outperform the FTSE Actuaries UK Conventional Gilts Over 15 Years Index, over rolling 5-year periods, by achieving long-term income and capital growth from a portfolio comprised predominantly of government bonds and other public fixed-income securities.

-

Performance benchmark

-

FTSE Actuaries UK Conventional Gilts Over 15 Years Index

-

Strategy inception

-

Composite inception: 1 January 1996

-

Strategy available through pooled UK vehicle

-

BNY Mellon Long Gilt Fund

View fund performance

View Key Investor Information Document

View prospectus

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

Newton will make investment decisions that are not based solely on ESG considerations. Other attributes of an investment may outweigh ESG considerations when making investment decisions. The way that ESG considerations are assessed may vary depending on the asset class and strategy involved. The research team performs ESG quality reviews on equity securities prior to their addition to Newton’s research recommended list (RRL). ESG quality reviews are not performed for all fixed income securities. The portfolio managers may purchase equity securities that are not included on the RRL and which do not have ESG quality reviews. Not all securities held by Newton’s strategies have an ESG quality review completed prior to investment, although since 2020 it has been a requirement for all (single name) equity securities to have an ESG quality review before they are purchased for the first time.