Investment team

Our Sustainable Global Equity Income strategy is managed by an experienced team. Our investment team of research analysts and portfolio managers works together across regions and sectors, helping to ensure that our investment process is highly flexible. Our dedicated responsible investment team is an integral part of the investment decision-making process. Guided by our global investment themes, we seek to identify opportunities and risks through research and debate.

- 23

- years’ average investment experience

- 19

- years’ average time at Newton

-

Jon Bell

Portfolio manager, global equity income

-

Robert Hay

Portfolio manager, global equity income

-

Julianne McHugh

Head of Sustainable Equities

-

Nick Pope

Portfolio manager, sustainable equity strategies

-

Zoe Kan

Portfolio manager, emerging and Asian equity income

-

John C Bailer

Deputy head of equity income, portfolio manager

-

Brian Ferguson

Portfolio manager, equity income team

-

Peter D Goslin

Portfolio manager, equity income team

-

Keith Howell Jr.

Portfolio manager, equity income team

-

Adam Logan

Portfolio manager, equity income team

-

James A Lydotes

Deputy chief investment officer, equity

Strategy profile

-

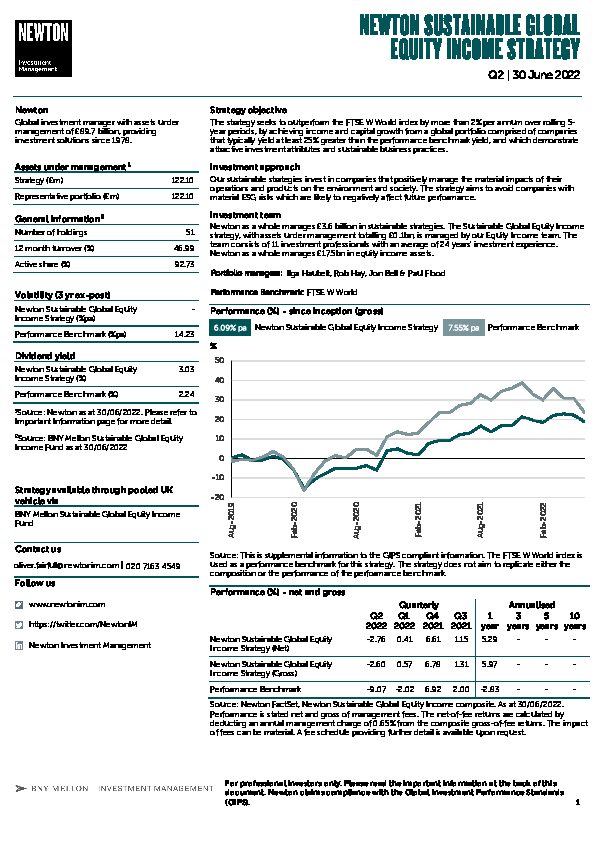

Objective

-

The strategy seeks to outperform the FTSE W World Index by more than 2% per annum over rolling 5-year periods, by achieving income and capital growth from a global portfolio comprised of companies that typically yield at least 25% greater than the FTSE W World Index yield, and which demonstrate attractive investment attributes and sustainable business practices.

-

Performance benchmark

-

FTSE W World Index

-

Typical number of equity holdings

-

70 or fewer

-

Strategy inception

-

18 July 2019

-

Strategy available through pooled UK vehicle

-

BNY Mellon Sustainable Global Equity Income Fund

View Key Investor Information Document

View prospectus

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

Newton will make investment decisions that are not based solely on ESG considerations. Other attributes of an investment may outweigh ESG considerations when making investment decisions. The way that ESG considerations are assessed and the assessment of their suitability for Newton’s sustainable strategies may vary depending on the asset class and strategy involved. For Newton’s sustainable strategies, ESG Quality Reviews are performed prior to investment for corporate investments (single name equity and fixed income securities).