Our philosophy and process

- The strategy benefits from continuous and detailed collaboration between credit and equity analysts. ESG considerations are integrated throughout the research process to ensure that any material issues are captured.

- The strategy’s investment universe consists largely of investment-grade UK-based corporate bonds. A constantly evolving and forward-looking approach seeks to anticipate change and identify opportunities.

Every time we consider a security or look at an industry or country, it’s in the context of what’s happening across the world. We believe the investment landscape is shaped over the long term by some key trends, and we use a range of global investment themes to capture these.

Investment team

Our Long Corporate Bond strategy is managed by a focused, experienced fixed-income team. Our global sector analysts and investment managers are located on a single floor in London, which helps to ensure that the investment process is flexible and opportunistic. Guided by our global investment themes, the team works together to identify opportunities and risks through research and debate.

- 20

- years’ average investment experience

- 13

- years’ average time at Newton

-

Paul Brain

Investment leader, fixed income

-

Howard Cunningham

Portfolio manager, fixed income

-

Parmeshwar Chadha

Portfolio manager, fixed income

-

Jon Day

Portfolio manager, fixed income

-

Carl Shepherd

Portfolio manager, fixed income

-

Trevor Holder

Portfolio manager, fixed income

-

Scott Freedman

Analyst and portfolio manager, fixed income

-

Martin Chambers

Credit analyst, fixed income

-

Ashwin Palta

Credit research analyst, fixed income

-

Jeevan Dhoot

Credit analyst, fixed income

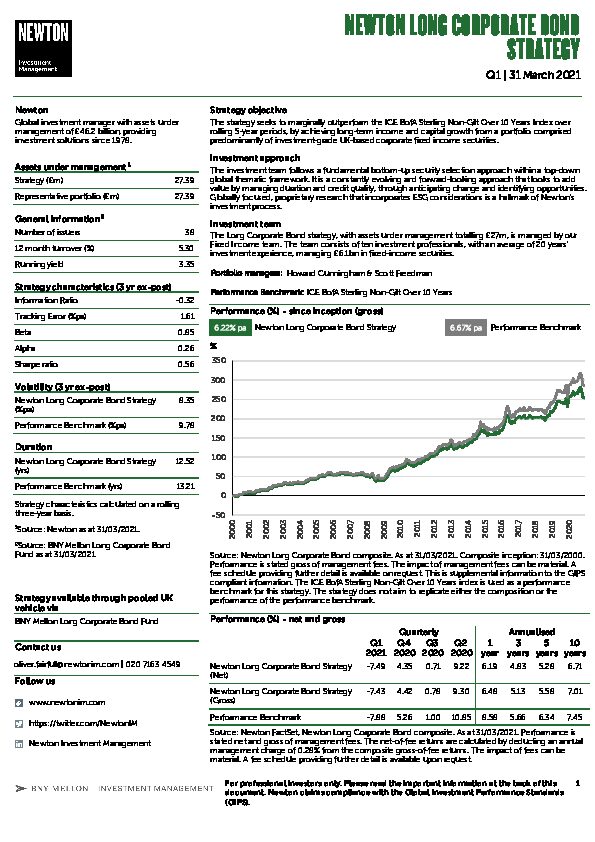

Strategy profile

-

Objective

-

To maximise returns through investment in predominantly sterling-denominated investment-grade fixed-interest securities, excluding gilts

-

Comparative index

-

Merrill Lynch (Over 10-year) Investment Grade Index

-

Performance aim

-

To outperform the comparative index by up to 1% per annum

-

Strategy size

-

Below £200m (as at 30 June 2021)

-

Strategy inception

-

Composite inception: 1 April 2000

-

-

Strategy available through pooled UK vehicle

-

BNY Mellon Long Corporate Bond Fund

View fund performance

View Key Investor Information Document

View prospectus

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.