Our philosophy and process

- The Real Return fund is a conviction-based strategy with no regional, sector or performance reference constraints. It adopts a forward-looking approach that seeks to anticipate change, manage risk, and identify opportunities.

- Its simple structure, with a stable core of predominantly traditional return-seeking assets, and a layer of risk-offsetting positions, aim to dampen volatility and preserve capital.

Smart revolution

Machines and networks are becoming more intelligent. This is disrupting the labour market, as machines increasingly replace humans in the workplace. ‘Smart revolution’ considers the implications commercially, socially and politically.

State intervention

Authorities have engaged in ever-greater policy intervention and regulation to shore up economic growth. We believe ‘state intervention’ has increased misallocation of capital, caused volatility in markets and inflated asset prices – and we think that calls for a stock-specific approach.

Financialisation

Cheap money has caused rapid growth in a sector already supported by deregulation. ‘Financialisation’ investigates the implications of finance dominating economic activity, instead of serving it.

Transcript

You can imagine the portfolio like this:

At the core, the emphasis is on traditional assets to generate capital growth and drive long-term returns.

Then there is an outer layer – stabilising assets and hedging positions to try to counteract risks and dampen volatility.

And this is how we construct it:

In the core, might be equities, infrastructure and renewables.

In the outer layer we use a diverse range of instruments, including commodities, bonds, simple derivative strategies and currencies.

We alter the proportions of the core and outer layer according to our evolving view on the investment landscape.

We think there’s a key advantage to active management. We can seek out returns in rising markets and try to minimise the downfall in falling markets.

Its composition is guided by the perspective of our global investment themes. They are our interpretation of the forces driving long-term change in the world.

Our Real Return strategy takes a simple, transparent approach to try to deliver, solid, stable returns for our clients.

Investment team

Our Real Return strategy is managed by an experienced team with a wide range of backgrounds. Our global sector analysts and investment managers are located on a single floor in London, which helps to ensure that the investment process is flexible and opportunistic. Guided by our global investment themes, the team works together to identify opportunities and risks through research and debate.

- 19

- years’ average investment experience

- 13

- years’ average time at Newton

-

Suzanne Hutchins

Portfolio manager, Real Return team

-

Aron Pataki

Portfolio manager, Real Return team

-

Andy Warwick

Portfolio manager, Real Return team

-

Philip Shucksmith

Portfolio manager, Real Return team

-

Matt Brown

Portfolio manager, Real Return team

-

Lars Middleton

Portfolio manager, Real Return team

-

Brendan Mulhern

Global strategist, Real Return team

-

Catherine Doyle

Investment specialist

-

Chris King

Investment team support

Strategy profile

-

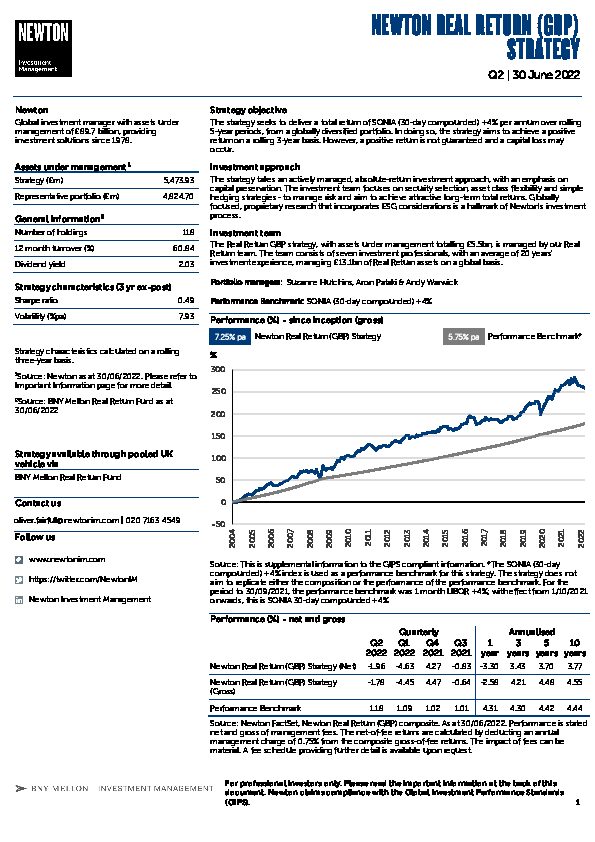

Performance benchmark*

- The strategy aims to deliver a minimum return of SONIA (30-day compounded) +4% per annum over 5 years before fees.* In doing so, the strategy aims to achieve a positive return on a rolling 3-year basis. However, a positive return is not guaranteed and a capital loss may occur.

-

Volatility

-

Expected to be between that of bonds and equities over the long term

-

Strategy size

-

£13.3bn (as at 30 June 2021), including GBP, EUR, USD and AUD strategies

-

Strategy inception

-

Composite inception: 1 April 2004

-

Typical assets

-

Selective exposure to

- Equities

- Corporate bonds

- Government bonds

- Cash

- Derivatives

-

Other assets via tradeable securities

- Real estate

- Commodities

- Currencies

- Infrastructure

- Renewable energy

- Other ‘alternative’ strategies

-

-

-

Strategy available through pooled UK vehicle

-

BNY Mellon Real Return Fund

View fund performance

View Key Investor Information Document

View prospectus -

-

* Please note that on 1 October 2021, the performance benchmark for this strategy changed from 1-month GBP LIBOR +4% to SONIA (30-day compounded) +4%.

Read more about the transition from LIBOR to SONIA in relation to onshore UK pooled funds

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.