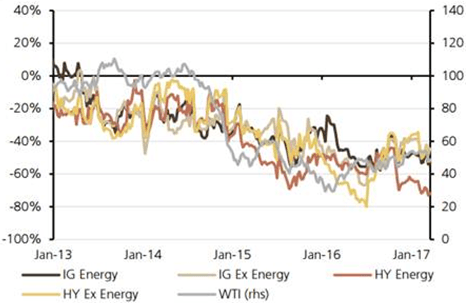

Both investment-grade and high-yield credit spreads in the energy sector continue to demonstrate significant correlation with oil prices.

6 month correlations between oil prices and corporate bonds

WTI = West Texas Intermediate oil price

Source: UBS

Despite the massive wave of defaults (c. 25%) in high-yield energy in 2016, the sector continues to account for c.16 % of total high-yield debt. Even within investment grade, the energy sector remains significant, at around 10% of total investment-grade debt. Risks still remain of ‘fallen angels’ (investment-grade companies downgraded to junk) coming into the high-yield index.

Median leverage (debt/EBITDA) levels within the high-yield energy sector are around 9 times. Both investment-grade and high-yield energy companies face significant maturities from 2018 onwards; the debt of these companies cannot be refinanced at anywhere near current rates, and earnings need to grow (which would require the oil price to reach more than $65 dollars per barrel) in order for them to do so. If one takes the view that oil prices remain bound between $45-$55, then the question becomes ‘when’ and not ‘if’ these companies will default.

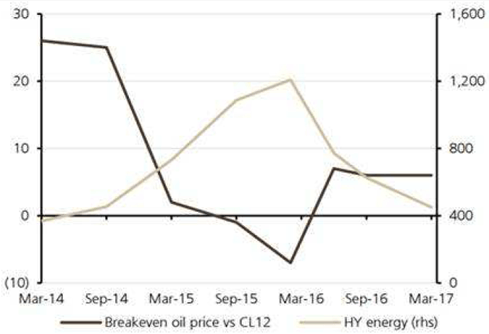

High-yield energy spreads are highly correlated with the differential between the breakeven price (currently estimated at c.$43 per barrel) of shale oil and the 12-month forward price of oil. In the past, as the below chart demonstrates, when the forward price has dipped below the breakeven price, high-yield energy spreads have widened significantly, which has usually spilled over into the wider high-yield universe.

High-yield energy spreads versus the difference between the breakeven price of shale and the 12-month price of oil (US$ per barrel)

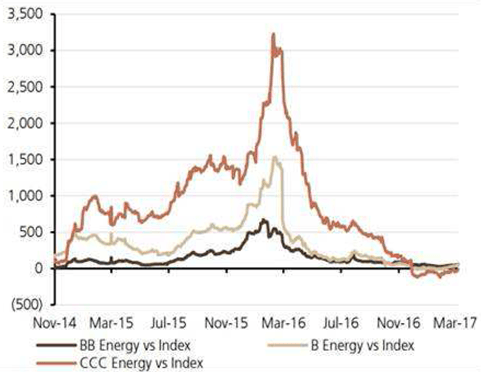

High-yield energy spreads have rallied significantly over the last year and now trade in line with, if not more tightly than, the index.

High-yield energy versus index spreads by rating

Source: UBS

Our conclusion remains that this sector is highly overvalued, and that we should continue to avoid it. Nevertheless, we think the prospect remains for a much better entry point somewhere down the road.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors.

Comments