After a sustained period of underperformance, many global bank share prices have continued to make record lows in the wake of the UK’s referendum vote to leave the European Union. Against that backdrop, I thought I’d share my latest views on the sector, and explain why we continue to remain cautiously positioned in banking stocks.

Banks have had a torrid time over the years since the global financial crisis, substantially underperforming the market. This has been despite the extraordinary support provided by governments and central banks, including billions in bailout funds and countless rounds of monetary policy, designed explicitly to prop up the financial assets that form the bedrock of bank balance sheets.

So, why have banks been such bad investments? And, more importantly, why do we think they will continue to be so despite already having underperformed for so long?

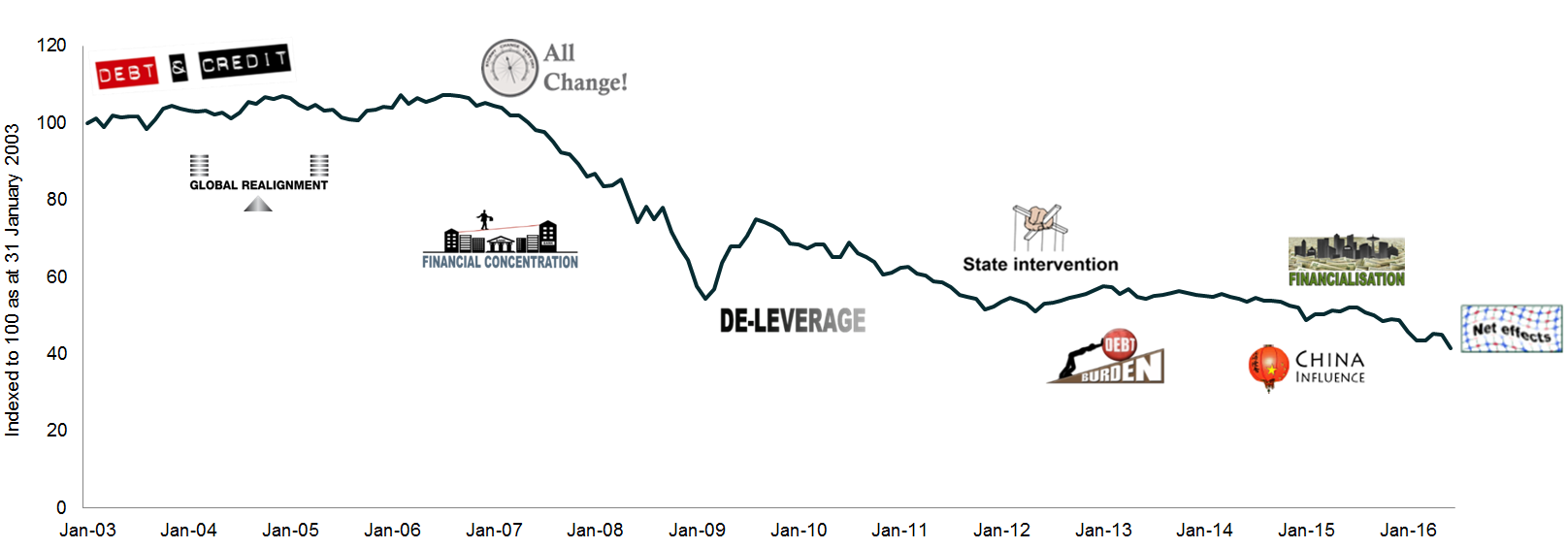

To help answer these questions we turn to our themes, which are our interpretations of the key forces driving change in the world. Our thematic framework is dynamic; it evolves and changes over time – this is illustrated in the chart below which plots the performance of the MSCI World Banks Index against the MSCI World Index and highlights some of Newton’s most pertinent thematic drivers of the last 13 years.

MSCI World Banks Index relative to MSCI World Index

Source: Bloomberg, July 2016

- Debt burden

Under one of our previous themes, ‘debt & credit’, we had been very worried about the build-up of credit in western economies before the financial crisis. The world economy has continued to pile up debt, much of it in the form of government borrowing, with total debt rising by about the same amount over the last seven years as during the seven years leading up to the crisis.[1] China alone is adding around $4 trillion in new debt every year (equivalent in size to the UK economy).[2]

Under one of our previous themes, ‘debt & credit’, we had been very worried about the build-up of credit in western economies before the financial crisis. The world economy has continued to pile up debt, much of it in the form of government borrowing, with total debt rising by about the same amount over the last seven years as during the seven years leading up to the crisis.[1] China alone is adding around $4 trillion in new debt every year (equivalent in size to the UK economy).[2]

It is this expansion of debt that has led this theme to evolve and become ‘debt burden’. The vast amount of debt which has built up globally has significant implications for banks, not least the impact on credit risk, given the over-indebtedness of many borrowers. The outlook for loan growth – a key driver of earnings growth for the sector – remains lacklustre given the indigestion of the world economy which is struggling to deal with this growing debt mountain.

- Financialisation

Unprecedentedly low interest rates and an ever-flattening yield curve, engineered by central banks, continue to take their toll on banks’ net interest margins,[3] which are a core driver of profitability. We increasingly see economies becoming ‘financialised’, whereby finance dominates the economic landscape rather than serves consumers and businesses. Central banks have used ever-lower interest rates (we believe unsuccessfully) as a way to stimulate economic growth. This has created all sorts of distortions, with the added growing risk of policy errors. Banks, by their nature, are at the centre of these risks.

Unprecedentedly low interest rates and an ever-flattening yield curve, engineered by central banks, continue to take their toll on banks’ net interest margins,[3] which are a core driver of profitability. We increasingly see economies becoming ‘financialised’, whereby finance dominates the economic landscape rather than serves consumers and businesses. Central banks have used ever-lower interest rates (we believe unsuccessfully) as a way to stimulate economic growth. This has created all sorts of distortions, with the added growing risk of policy errors. Banks, by their nature, are at the centre of these risks.

- State intervention

Another feature has been the regulatory environment. Our ‘state intervention’ theme highlights the recent trend of governments seeking to tax the financial industry for its past wrongdoings with huge litigation penalties. While this has negatively affected the net worth of many global banks, it has also influenced their behaviour, with a retrenchment that has seen many banks become extremely wary of cross-selling additional financial products to customers, thereby dampening the growth in fee and commission revenues.

Another feature has been the regulatory environment. Our ‘state intervention’ theme highlights the recent trend of governments seeking to tax the financial industry for its past wrongdoings with huge litigation penalties. While this has negatively affected the net worth of many global banks, it has also influenced their behaviour, with a retrenchment that has seen many banks become extremely wary of cross-selling additional financial products to customers, thereby dampening the growth in fee and commission revenues.

Of course, ‘state intervention’ has broader ramifications for the sector as regulators have sought to safety-proof the banking system by requiring banks to hold a lot more capital than before. The fall in leverage has occurred across the global banking landscape, and while the benefit in terms of improved financial-system safety is clear, it has also meant (all else being equal) lower returns to shareholders and lower dividends as banks have had to retain their earnings to build up capital levels. While the improvement in bank balance sheets over the last few years has been significant, we expect regulators to be incrementally prudent given the riskiness of the backdrop in terms of high debt levels, low economic growth and experimental monetary policy.

- Net effects

Our ‘net effects’ theme draws attention to the technological innovation which is taking place across industries all over the world, and banking is no exception to this. Innovation is an area of great opportunity for banks as they re-engage with customers through digital channels and improve cost efficiency as branch networks are streamlined and processes become digitised.

Our ‘net effects’ theme draws attention to the technological innovation which is taking place across industries all over the world, and banking is no exception to this. Innovation is an area of great opportunity for banks as they re-engage with customers through digital channels and improve cost efficiency as branch networks are streamlined and processes become digitised.

However, incumbent operators face a number of challenges in dealing with the pace of technological change; many are burdened with outdated systems which require a prolonged period of very costly and operationally very risky investment to be made fit-for-purpose for the new environment. Technology also makes it easier for new competitors to enter the banking fray, as we have seen with the likes of peer-to-peer lending companies and new payment service providers.

Finding opportunities

While this paints a very downbeat picture of the banking sector, there are a number of potentially attractive investment opportunities among banks which are less exposed to the issues I’ve highlighted – those that have strong balance sheets to withstand the gyrations of the distorted financial environment, that have simple business models and that embrace technological change. We continue to tread carefully, but remain alert to finding these investment opportunities.

[1] See: http://www.mckinsey.com/global-themes/employment-and-growth/debt-and-not-much-deleveraging

[2] Source: Newton, July 2016

[3] The spread between the interest a bank offers on deposits from customers and the interest received on loans, divided by the bank’s asset base.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that portfolio holdings and positioning are subject to change without notice.

Comments