Last year was something of a ‘perfect storm’ for higher dividend-paying companies in Asia and emerging markets, as they underperformed the market rally. Today, with bond yields having risen sharply in recent weeks, we believe the outlook is for steadily rising rates. In our view, such an environment does not preclude income stocks from outperforming, and here we list five reasons why we think now could be an opportune time to consider an Asian or emerging-market income-based approach.

1. Broader market participation

In 2017, the Asia ex Japan equity market was driven by an extremely narrow selection of technology stocks. Indeed, only 32% of stocks overall outperformed the MSCI Asia ex Japan index over the year. This was an extremely unusual situation, and this year the market leadership has broadened out. This means that many of the technology stocks which rerated in 2017 have so far underperformed in 2018. Earnings growth in the Asia ex Japan region is expected to slow from the very strong 24% last year, and much of this is down to the technology sector cooling off. Earnings growth is still expected to be double-digit and is also likely to be spread more broadly across sectors. Wider market participation is good news and should, we believe, provide opportunities for active stock pickers to pick up income stocks.

2. Attractive relative valuations

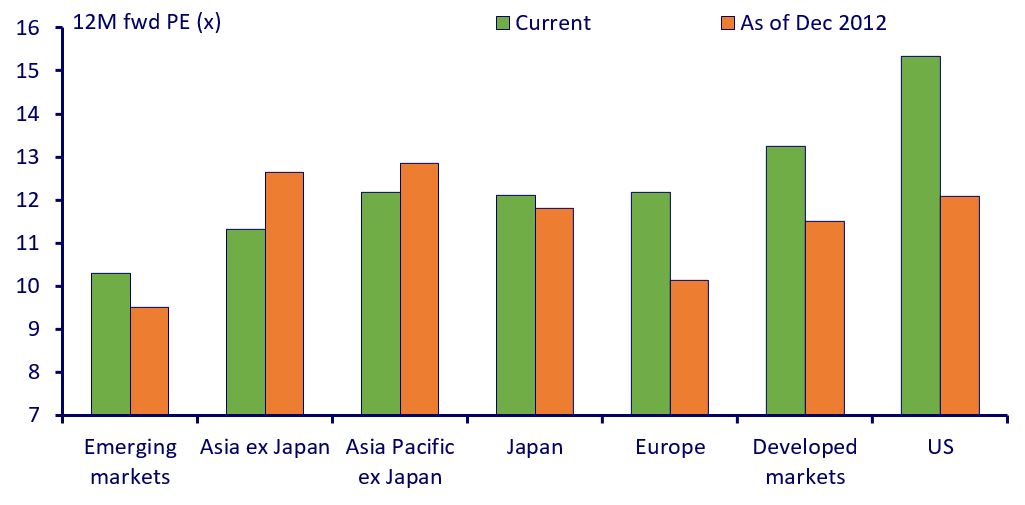

The valuations of Asian and emerging-market income stocks do appear attractive, especially when compared to those in Europe and, in particular, the US. As the chart below illustrates, high-yielding stocks in the MSCI Asia ex Japan and Asia Pacific ex Japan indices are trading at lower multiples now compared to 2012, whereas stocks in Europe and the US have rerated since then.

MSCI global high-yield: High-yield stocks have become cheaper in Asia

Source: Factset, CLSA, April 2018. MSCI global high yield = dividend yield more than 3% (2% for US and 1.5% for Japan). Bottom-up aggregated price/earnings ratio (PE) based on MSCI universe and weights.

3. Earnings-growth potential in consumer sectors

In a global growth environment, we think there is merit in those stocks with the potential for earnings growth and, ultimately, dividend-per-share growth, as we believe these are likely to outperform traditional ‘bond proxies’. Take the consumer sector in China, for example, where we have identified certain luxury auto distributors for their earnings growth outlook and sustainable dividend payout ratios. The fact that Chinese auto distributors are currently trading at far lower multiples than their global peers means that these companies trade with attractive dividend yields.

Another example of a high-yielding consumer stock is a retail pharmacy chain, where the high return on capital and strong free-cash-flow generation allow a generous payout of almost 60%. We prefer these types of companies, and those in structurally improved industries which display supply-side discipline and free cash flows which have improved on a through-the-cycle basis. We are more wary of very high-yielding stocks where the high yield is there to compensate the investor for the cyclical risk they are taking.

4. Scope for increased payout ratios

The universe of our preferred ‘yield-plus-growth’ companies is growing as companies’ ability and willingness to pay dividends increases. Payout ratios in emerging markets remain low compared to developed markets, which we think creates an opportunity. Across markets, we are seeing companies’ capital-expenditure budgets come under control and hence their free cash flows expand. Notably in South Korea, the payout ratio has moved up from 14%, where it sat in 2009-2013, to 20%. In December 2016, the Korean Stewardship Code was published, aiming to encourage more responsible investment by institutional investors. So far it has not made much impact, owing to the additional costs of monitoring compliance, but there are signs that the largest local institution might adopt the code this year. This could have a ripple effect in the industry and force the large conglomerates to improve their corporate governance standards and shareholder-return programmes.

5. Less volatile return stream

With volatility having returned to markets in 2018, income stocks which display much lower volatility than the market may become increasingly appealing for investors seeking a less volatile return stream. Despite the US 10-year Treasury yield recently breaching the 3% level, we think the relative spread between dividend equities and bond yields remains significant, especially when risk is taken into account. An income-paying equity can offer growth and pricing power, while investors are paid a dividend for holding a stock which has the potential to compound in value over time.

This is a financial promotion. Any reference to a specific country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. Please note that holdings and positioning are subject to change without notice.

Comments