Our ‘abundance’ theme highlights a number of challenges for companies, which we think investors need to be conscious of. In the world of clothing retail, for example, is the fight to maintain pricing power and differentiate products in an arena of intense competition.

Our ‘abundance’ theme highlights a number of challenges for companies, which we think investors need to be conscious of. In the world of clothing retail, for example, is the fight to maintain pricing power and differentiate products in an arena of intense competition.

However, we believe this world of abundance also throws up a number of opportunities. We think of these as hidden gems, often obscured by the vast quantity of ‘stuff’. The opportunities relate to businesses which can successfully circumnavigate the issues associated with our ‘abundance’ theme to outshine their competitors.

In clothing retail, we believe the hidden gems to be companies which are following one or more of six key strategies to differentiate themselves:

What is fast fashion?

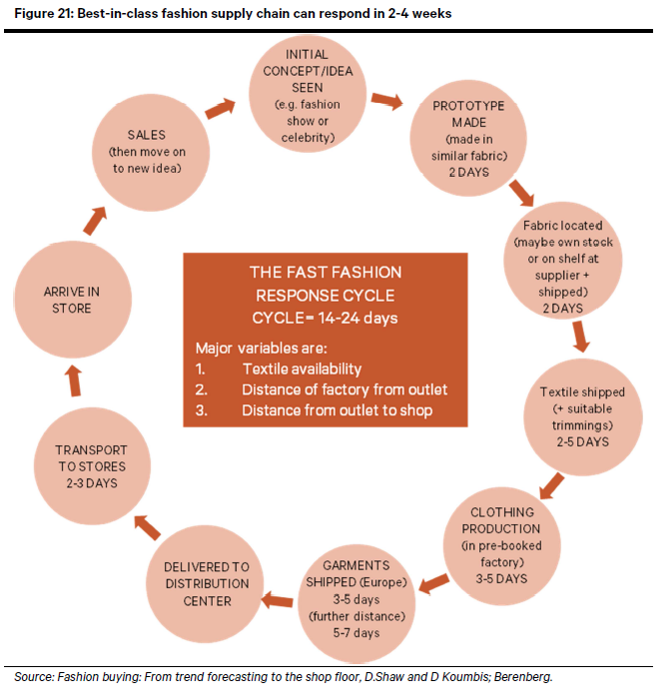

Fast fashion is a unique and innovative method of bringing cutting-edge trends to market as quickly and cheaply as possible, squeezing the time it takes from designing an item to getting it to consumers in stores. The best-in-class brands can respond to trends and complete this cycle in just a couple of weeks.

How does it work?

Fast fashion is made possible by innovations in supply-chain management which have considerably shortened the product cycle. The graphic below shows a generic example of the fast fashion cycle:

The key elements of this process are:

- Factory location: Proximity sourcing (in the case of one highly successful European fast-fashion retailer sourcing in Europe rather than Asia) is vital to keeping the manufacturing process quick and nimble so it can react to the latest trends.

- Items made in small batches: Only small amounts of items are produced, limiting risk if an item is unsuccessful and creating a feeling of exclusivity.

- Store inventory turnover: Far removed from the traditional fashion calendar of releasing four collections a year, some stores receive multiple deliveries of new products each week, with die-hard fans knowing when to visit to get their hands on the latest items. Fast turnover also fosters shoppers’ impulse to buy.

- Feedback loop: A strong technology backbone is also vital to enable the company to track products through the supply chain; for example, RFID (radio-frequency identification) allows retailers to understand stock levels at the click of a button. This leads to better availability and lower discounts. In addition, one pioneer of fast fashion employs high-quality managers who are empowered to provide on-the-ground feedback on the success of items back to designers. According to this group’s CEO, success is even more dependent on the accuracy of being able to deliver exactly what the consumer wants rather than the speed with which it can bring products to market.

- Store location: It’s all about creating aspirational ‘cathedrals of consumption’ in city centres, rather than smaller stores on the outskirts.

Why does it work?

Fast fashion is a growing trend in an impatient world with ever-evolving tastes. In the UK, our appetite for new clothes is voracious, but purchases don’t keep their novelty for long; a recent report found that in 2016 the UK bought 1.13 million tonnes of clothing, but sent over a quarter of that (300,000 tonnes) to landfill.[1]

From an investment point of view, we believe fast fashion sidesteps ‘abundance’ and the huge amount of choice the shopper faces. It does this by creating a hunger in the consumer to purchase an item then and there. The continuous turnover in stores provokes a fear in the buyer that, if they hesitate, the chance to capture that must-have item will disappear forever.

What are the barriers to entry?

So, with brands desperate to capture the consumer’s attention and differentiate themselves from the competition, are we likely to see more retailers trying their hand at fast fashion?

While for some fast fashion retailers, the ‘destination’ store is key to their marketing efforts, we believe that the prevalence of online shopping and the infrastructure which supports this means real-estate investment may no longer be a barrier to entry. However, where new entrants could struggle is in establishing the infrastructure to manufacture at scale within a short time frame.

Unlike the ‘blink-and-you-miss-it’ styles in which fast fashion allows shoppers to indulge , in our view fast fashion is one trend with staying power.

[1] http://www.wrap.org.uk/sustainable-textiles/valuing-our-clothes

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. Please note that holdings and positioning are subject to change without notice.

Comments