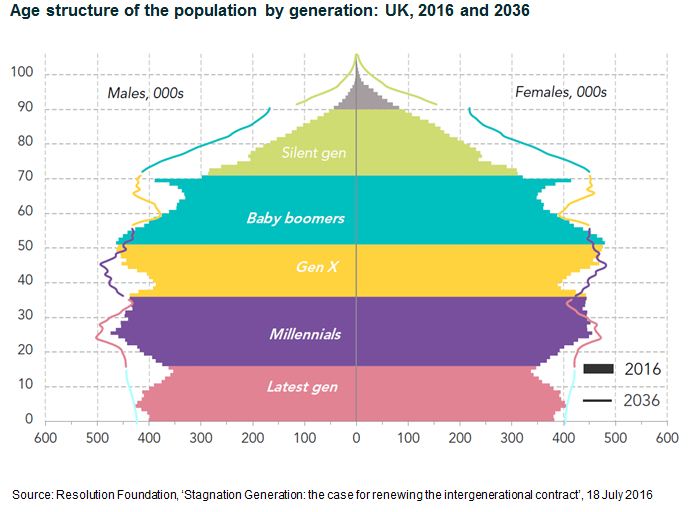

The ‘millennial’ generation – broadly defined as the cohort born between 1980 and the late 1990s – is now the largest working-age demographic in the UK, and will represent some 75% of the global workforce by 2025.[1] This generation has faced financial pressures in several areas. The income of the average 22-30 year old remains 8% lower than it was in 2008, according to the Institute for Fiscal Studies. Furthermore, many millennials may need decades to pay off their student debt, not to mention soaring house prices which have led to millennials being labelled ‘generation rent’.

Against a backdrop of financial strain, it is easy to understand why millennials might view saving for a retirement pension as futile. In addition, while earlier generations benefited from a more stable working environment and final salary pension schemes, arrangements for younger workers are less generous and the onus is on the saver to ensure contributions are sufficient.

Fintech to the rescue?

So how could this disengaged cohort, many of whom seemingly prefer to spend their money now instead of saving for the future, be nudged into making a start? One answer could lie in the world of financial technology. Millennials are a tech-savvy generation, having grown up with the internet, and expect to be able to manage most aspects of their lives online. ‘Robo’-advice and innovative new apps such as those associated with micro-investing, which encourage people to save a very small amount of money regularly, have been suggested as a way to help young people save for their future.

The ESG effect

Another means of engaging millennials, and one in the hands of investment managers rather than technology wizards, is through environmental, social and governance (ESG) factors. With millennials directly affected by the fallout from the global financial crisis, many are likely to be cynical of the financial services industry and have come to the view that things might have turned out differently had companies been managed more responsibly. A further issue is climate change, which is likely to have been an important part of the curriculum for an 18-year old today.

The trend towards increasingly personalised DC pensions means individuals may play a greater role in making choices in future. When millennials realise there is no one acting in a fiduciary capacity on their behalf, they may in time take matters into their own hands and opt to move their money to asset managers that address their concerns over sustainability, social responsibility and ethics.

A familiar retirement trajectory

Despite different priorities and financial concerns, the underlying long-term savings needs of millennials – in particular the need to grow and preserve capital in order to deliver a sustainable income in retirement – remain similar to those of the previous generation. The desire to grow the pot in the accumulation phase, preserve capital as retirement approaches, and move to an income-paying focus when entering retirement is as relevant as ever. The challenge for investment managers will be to deliver flexible investment solutions with clear charging structures that can restore trust and help to advocate the need to save for the long term in the face of increasing longevity.

[1] Source: Office of National Statistics, UK; Bank of America Merrill Lynch, Generation Next – Millennials Primer, 22 May 2015

Comments