We have written before on the blog about our preference on the emerging and Asian equities desk for innovative companies with sustainable demand drivers across a range of fast-growth industries – including the technology sector.

Technology companies with these characteristics include the manufacturers of Dynamic Random Access Memory (DRAM) and NAND flash memory chips.

These chips are commonly used to process and store data in computers, smartphones and servers. In fact, they have been essential in the development of daily activities we take for granted, such as uploading a photo to Facebook or downloading a Netflix movie, and will be a large part of enabling future technologies like driverless vehicles.

These chips are commonly used to process and store data in computers, smartphones and servers. In fact, they have been essential in the development of daily activities we take for granted, such as uploading a photo to Facebook or downloading a Netflix movie, and will be a large part of enabling future technologies like driverless vehicles.

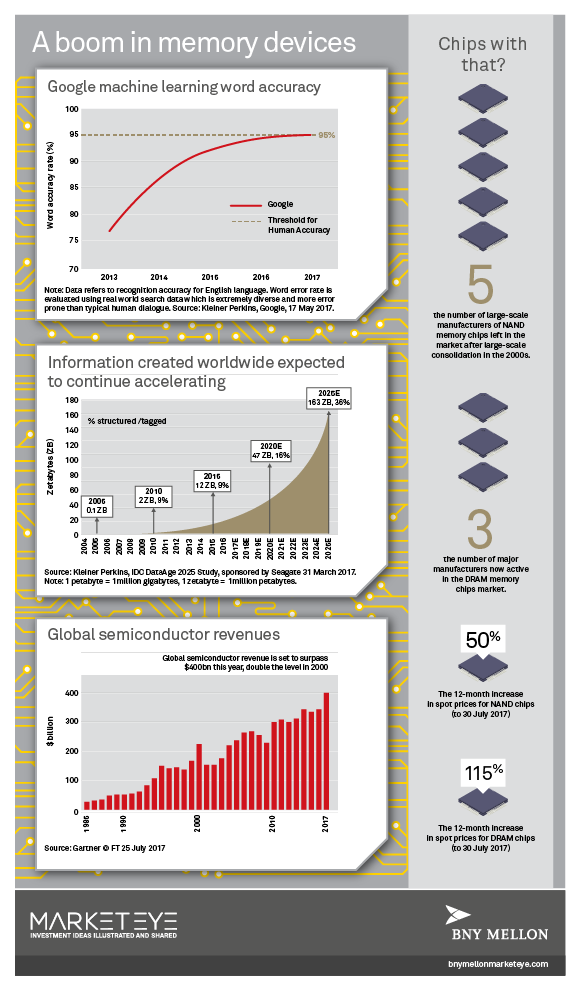

We have been following developments within this industry for decades; however, in more recent history our ‘smart revolution’ and ‘net effects’ themes have emphasised the demand drivers for memory, including the exponential growth of data and information creation globally, as well as the increasing adoption of ‘smart’ technologies such as artificial intelligence (AI). Further research carried out alongside our specialist technology analyst has given us confidence in the positive supply/demand dynamic persisting, which we believe is good news for companies involved in the sector.

Over the last 20 years, overcapacity has created wildly cyclical pricing for both DRAM and NAND devices,[1] which in turn has led to fewer manufacturers. For DRAM devices, just three global players now account for 95% of supply;[2] for NAND devices there are just five companies producing 92% of global supply.[3]

As a result, supply discipline has improved, even as demand has surged thanks to developments in AI, ‘cloud’ computing and the wider adoption of increasingly sophisticated mobile devices and gadgets. Pricing has soared as a result – with spot prices for NAND chips up 50% and DRAM spot prices up 115% over the last year.[4]

While we recognise the industry is a cyclical one, we think the current demand/supply dynamic is a positive for companies involved in the sector. However, we believe this is currently underappreciated by investors, and therefore we think there could be good upside to the share prices of select manufacturers.

[1] Dynamic Random Access Memory (DRAM) and NAND Flash memory chips are commonly used to store data in computers, smartphones and digital cameras.

[2] The Register: ‘Guess who’s getting fat off DRAM shortages? Yep, the DRAM makers’, 18 May 2017

[3] IHS Markit: ‘NAND Memory Market Tracker’, Q2 2017

[4] Dow Jones: ‘Samsung Topples Intel as World’s Biggest Chip Maker’, 30 July 2017. Data from DRAMeXchange, a publication that tracks memory chip sales and prices.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. Please note that holdings and positioning are subject to change without notice.

Comments