At Newton, we see our global investment themes as vital in providing perspective on the investment landscape, identifying key long-term forces of change and giving us a framework for research and debate. The themes help us try to prepare for a range of outcomes – both positive and negative – and guide us towards a focus on investments which we believe should thrive under evolving economic and financial-market conditions.

In this blog post we look at how two of our themes – ‘divergence’ and ‘fire risks’ – are influencing how we position our fixed-income strategies.

Divergence

Our ‘divergence’ theme illustrates how weak global growth, in combination with extraordinary monetary policy, has exacerbated the rising trend in inequality within countries and regions. Increasingly domestic-focused policy agendas risk significant impediments to the movement of goods, services, people and capital on a global basis. This can in turn lead to divergence in economic variables (such as GDP growth, inflation rates, interest rates and currencies), and affect supply chains and the value of global businesses.

Our ‘divergence’ theme illustrates how weak global growth, in combination with extraordinary monetary policy, has exacerbated the rising trend in inequality within countries and regions. Increasingly domestic-focused policy agendas risk significant impediments to the movement of goods, services, people and capital on a global basis. This can in turn lead to divergence in economic variables (such as GDP growth, inflation rates, interest rates and currencies), and affect supply chains and the value of global businesses.

The theme is relevant to how we have adjusted exposure to investment-grade corporate bonds.

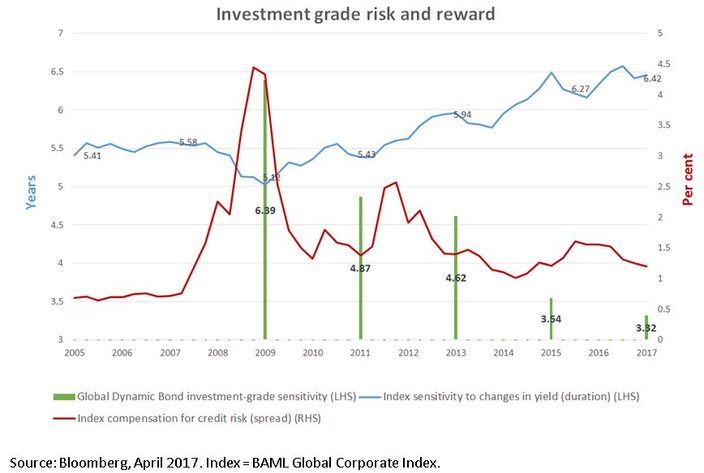

The lines on the chart below show trends for a broad global investment-grade bond index. Credit spreads (the compensation for taking credit risk instead of government-bond risk) have been falling (the red line), but risk (as measured by duration, being the sensitivity to a change in yield) has been rising (the blue line).

Rather than follow the market in accepting less return for more risk, we have been moving in the opposite direction in terms of the duration of the investment-grade component in the Global Dynamic Bond strategy. The green bars show the strategy’s duration at the end of March 2009, 2011, 2013, 2015 and 2017. What can be clearly seen is that, as the financial crisis peaked in 2009 and spreads were close to their widest point, the strategy’s investment-grade duration was higher than that of a global investment-grade index (6.39 years versus 5.12 years). However, as the risk/return has worsened, we have progressively reduced sensitivity to a rise in credit spreads by cutting average duration within the investment-grade portion, such that as at the end of March 2017 the strategy’s duration was almost half that of a typical benchmark (3.32 years versus 6.42 years).

Clearly there is a cost in terms of prospective yields attached to this risk-reduction move, but we believe it is a price worth paying to seek to ensure capital preservation should markets turn, while retaining the opportunity to step back into longer-dated investment grade at higher yields (and spreads) in the future.

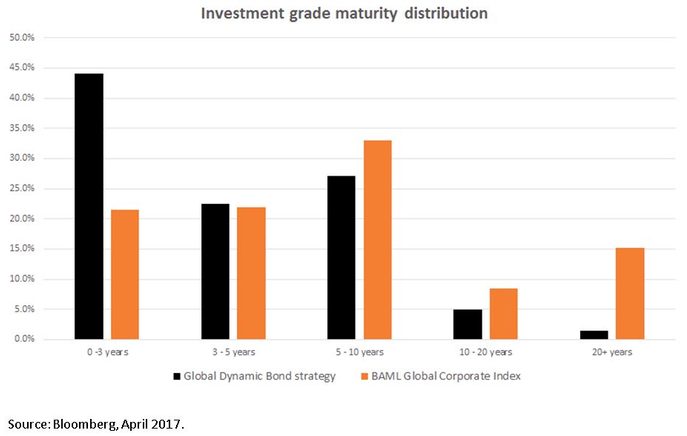

Below we show the current maturity distribution of the portfolio versus a global investment-grade index. Note that we hold approximately twice as much debt maturing within three years, and much less exposure beyond ten years, compared to a typical index. Not only is this intended to aid capital preservation, but a stream of maturing bonds also improves liquidity and can reduce the trading costs associated with a change in asset allocation.

Fire risks

Our ‘fire risks’ theme highlights the threat of unexpectedly high inflation. While deflation has been in the ascendant following the global financial crisis, the actions of central bankers have aggressively pushed against this trend. More recently, there has been a move in many economies towards greater government intervention. This could lead to tariffs on imports, with a reversal of the deflationary benefits of globalisation having the potential to push inflation temporarily higher.

Our ‘fire risks’ theme highlights the threat of unexpectedly high inflation. While deflation has been in the ascendant following the global financial crisis, the actions of central bankers have aggressively pushed against this trend. More recently, there has been a move in many economies towards greater government intervention. This could lead to tariffs on imports, with a reversal of the deflationary benefits of globalisation having the potential to push inflation temporarily higher.

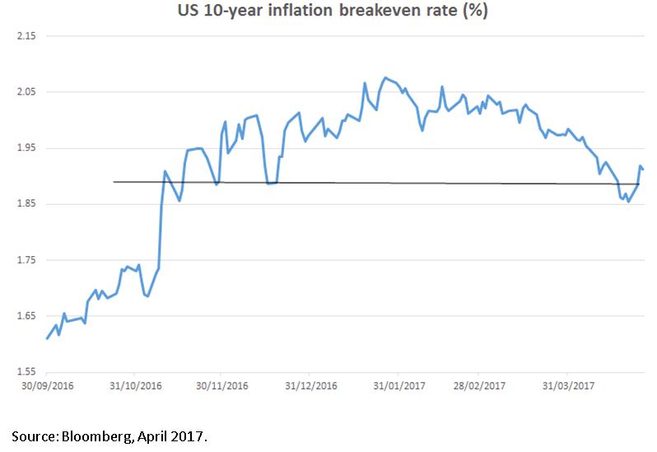

Last year, 10% of the Global Dynamic Bond strategy was invested in US Treasury Inflation-Protected Securities (TIPS), as inflation expectations rose during the year. By February this year, we had switched positions into conventional US Treasuries as we expected the peak in headline inflation would soon occur.

As can be seen from the chart below, inflation expectations (as measured by break-even rates on US 10-year Treasuries) have now come down and, we believe, are starting to get attractive once more. With underlying wage inflation creeping higher and a gradual reversal of the disinflationary benefits of globalisation coming out of the system, the base level of each country’s headline inflation rate is likely to be higher than it was before. We are therefore building up a position in TIPS once again, and have also recently purchased European inflation-linked debt.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors.

Comments