In a recent interview, US President Joe Biden stated that Americans were “really, really down” as they struggled with the effects of inflation after two years of the Covid-19 pandemic.1 Across the rest of the world too, growing unrest at soaring food and energy prices, exacerbated by Vladimir Putin’s invasion of Ukraine, was a prominent theme during the second quarter. Sri Lanka faced economic meltdown and severe fuel shortages, leading to political turmoil; Peru saw riots erupt over living standards; and inflation in Turkey reached 73%,2 significantly reducing people’s spending power. Meanwhile, a wave of labour disputes spread across Europe, with walkouts over pay and working conditions disrupting the transport sector in particular.

Financial-market participants also faced a troubling three months, with global equities, as represented by the MSCI AC World index in US-dollar terms, declining by more than 15% over the period.3 The S&P 500 index of US stocks experienced a seven-week losing streak during the quarter, and had fallen by more than 20% at the halfway point of the year, its worst first half since 1970.4 Equity markets were, once again, characterised by a marked rotation away from longer-duration growth stocks in areas such as technology, in favour of more defensive areas such as utilities and consumer staples. Meanwhile, government bonds came under renewed pressure, with the 10-year US Treasury yield up nearly 70 basis points over the quarter to 3.0%.5

S&P 500 Index

Source: FactSet, July 2022.

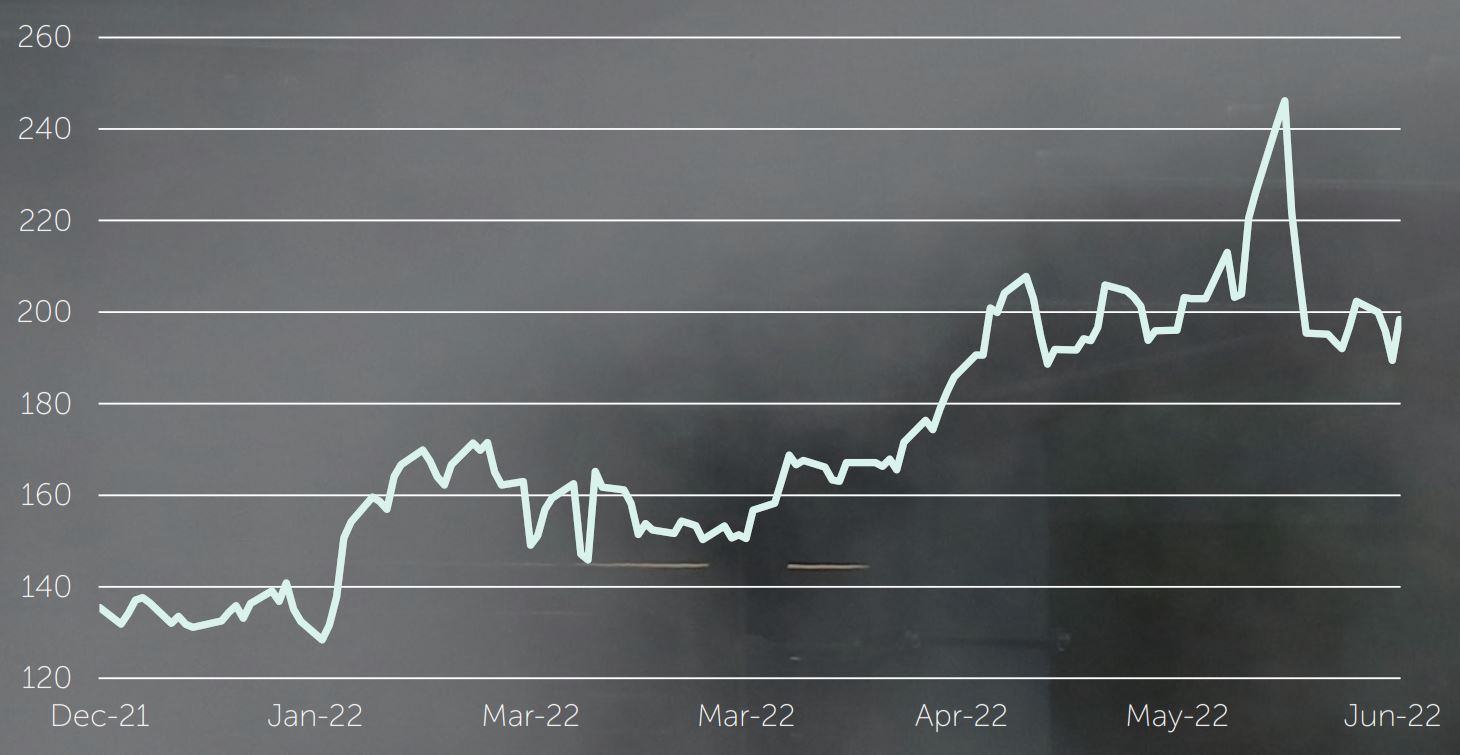

Intensifying inflationary forces were the key driver of risk sentiment: US headline consumer price inflation for May came in ahead of economists’ expectations, increasing 1% over the previous month and 8.6% year on year, while the UK and eurozone saw comparable annual rises of 9.1% and 8.1% respectively.6 The response from central banks, and the US Federal Reserve (Fed) in particular, was to accelerate the tightening cycle, which heightened fears of a greater-than-expected slowdown in growth.

Having already raised interest rates by 50 basis points in May, the Fed announced a further 75-basis-point adjustment on 15 June, taking its benchmark funds rate to a range of 1.5%-1.75%.7 This rise – the biggest since 1994 – was in contrast to earlier guidance, which had signalled a second consecutive 50-basis-point rise, and the central bank indicated that rate rises could be larger and faster than previously expected over the remainder of the year. The European Central Bank (ECB) also suggested that the pace of its rate rises would quicken, with interest rates likely to rise above zero for the first time in a decade in September.8

Speaking at the ECB’s annual conference in Portugal at the end of June, the heads of the ECB, Fed and Bank of England all reiterated the importance of swift action to curb inflation, adding that the adjustment to a new era would be painful. With the pandemic and latterly the huge geopolitical shock of the Ukraine war raising costs and fracturing supply chains, Fed Chair Jay Powell stated that the low-inflation environment “seems to be gone now”, while ECB President Christine Lagarde stressed that the forces unleashed by recent events would “change the picture and the landscape within which we operate”.9

Over the quarter, market participants also became more concerned with a slowdown in activity in China owing to the country’s zero-Covid policy and, specifically, tighter Covid-related restrictions in major cities such as Shanghai and Beijing, which threatened to exacerbate supply-chain disruption. However, Chinese shares were buoyed towards the end of the period as lockdowns were eased and China announced a flurry of policy support measures.

In fixed income, UK gilts, as represented by the FTSE Actuaries UK Conventional Gilts All Stocks Index, returned -7.4% over the quarter (-14.1% over the six months to 30 June), while overseas government bonds, as represented by the JP Morgan Global Government Bond Index (excluding the UK) produced a return of -0.2% in sterling terms (-3.5% over six months). Corporate bonds, as represented by the ICE BofA Sterling Non-Gilt Index, returned -6.7% over the quarter (-12.4% over the year to date).10

Returns from all major equity markets were negative over the three-month period, although the magnitude of the declines for UK-based investors was lessened by sterling’s weakness. Emerging-market equities fell by -2.6% over the quarter (-5.0% over six months) in sterling terms, while UK stocks returned -5.0% (-4.6% over the year to date). Meanwhile, Japanese equities delivered a negative quarterly return of -6.8% (-10.0% over six months) in sterling terms, Europe ex UK equities returned -8.6% (-15.1%), and Asia Pacific ex Japan equities declined by -9.3% over the quarter (-8.1% over six months). North American equities brought up the rear with a return of -9.5% (-11.4% over the year to date) to UK-based investors.11

Gold delivered a negative return of -6.7% in US-dollar terms over the quarter (-0.8% over the year to date), while in sterling terms the precious metal produced a small positive return of +0.7% (+10.3%).12

In spite of a tight labour market and increasingly aggressive attempts by policymakers to weaken demand, the US economy continued to register robust jobs growth during the quarter. May saw 390,000 further jobs added, with the unemployment rate – at 3.6% – just 0.1% above its level before the Covid-19 pandemic took hold in February 2020.13

Fed Chair Jay Powell has stated that the central bank’s monetary tightening will involve “some pain”, but believes that the economy can achieve a “softish” landing, with annual GDP growth forecast to slow to 1.7% and unemployment to reach 3.9% in 2023.14 However, 70% of leading economists recently surveyed by the Financial Times in conjunction with the Initiative on Global Markets at the University of Chicago’s Booth School of Business predict that the US will enter a recession in 2023.15

One uncertainty is the potential economic and financial-market impact of the Fed’s quantitative tightening initiative – its move to reduce its enormous US$9 trillion balance sheet – which began in June when the central bank stopped reinvesting the proceeds of some maturing bonds. In addition to having a tightening effect, the move is also likely to affect liquidity and could unsettle bond markets.

There were several signs during the quarter that the cost-of-living crisis was already starting to bite in the UK, with the country facing a toxic combination of record energy price increases and a broad rise in the prices of other goods and services; according to the Bank of England, inflation could top 11% by October.

UK consumer price index

% change, year on year

Source: FactSet, July 2022.

The country’s economy contracted by 0.3% in April, after two months without growth.16 Retail sales declined in May, while the consumer confidence index, which measures people’s perceptions of their personal financial situation and general economic conditions, fell to its lowest level since records began in 1974,17 suggesting that the mood was even gloomier than at the height of the 2008 global financial crisis or the Covid-19 pandemic in 2020. In addition, the purchasing managers’ index of business expectations saw the largest monthly decline in June since the start of the pandemic.

The Bank of England raised interest rates by only 25 basis points at its June meeting to take the benchmark rate to 1.25%, with the majority of its Monetary Policy Committee believing that more drastic action was not required to control inflation in an already weakening economy.18

In Europe, Germans are able to travel the breadth of their country for just €9 a month over the summer using local and regional public transport, thanks to a government initiative to address spiralling living costs. According to ECB President Christine Lagarde, the Ukraine war has hit Europe harder than most other regions in terms of higher energy and food prices. The bloc also faces the prospect of Russia cutting off or limiting gas supplies as winter approaches, which would damage industry and send energy prices even higher. While inflation has soared, the eurozone economy grew by just 0.2% in the first quarter of 2022.19

Spread between German and Italian 10-year government bond yields

Basis points

Source: FactSet, July 2022.

In addition to paving the way for a rate-rising cycle, the ECB confirmed in early June that it would end its remaining €20bn-per-month bond purchases at the start of July. However, the announcement of these plans resulted in bond-market turbulence, with yields rising and the gap in the cost of borrowing between Germany and more vulnerable member states such as Italy and Spain widening, which instilled fears of a repeat of the debt crises that threatened the eurozone a decade ago. To counter these concerns, the ECB is accelerating plans to create a new ‘anti-fragmentation’ tool, although details have so far remained sketchy.

While Japan sweltered in June under its strongest heatwave since records began in 1875,20 there were few signs of the country’s economy heating up, as its GDP shrank at an annualised rate of 1% during the first quarter, hampered by continuing Covid-19 restrictions and rising commodity prices.21

Although inflation has risen in Japan (2.5% in the year to April), it has not been on the same scale as in other parts of the world. Nevertheless, the political sensitivity of price increases was highlighted in June when Haruhiko Kuroda, the governor of the Bank of Japan, was forced to apologise after claiming that consumers had become “more tolerant” of price rises.22

While other major central banks have sought to combat inflation by raising interest rates, the Bank of Japan kept its policy of yield-curve control (intended to maintain yields on Japanese government bonds close to 0%) unchanged at its 17 June meeting, despite being forced to buy a large quantity of bonds during the month as the cap came under pressure from rising global interest rates. The widening gap between Japanese and US bond yields has resulted in the yen falling significantly against the dollar this year. However, although Japan is heavily exposed to the cost of imported commodities, a weaker yen will benefit the country’s many exporters of manufactured goods, as well as Japanese holders of overseas assets.

With the persistence of China’s zero-Covid strategy, it appears that the country’s 2022 growth target of 5.5% is likely to be missed by a significant margin. As Shanghai and Beijing exit severe lockdowns, there remains scope for some recovery, but this is unlikely to mirror the strong rebound seen in the second half of 2020 after the first lockdowns.

There have been signs that China’s crackdown on the technology sector could be easing, after authorities appeared to be wrapping up probes into ride-hailing, lorry-hailing and recruitment platforms that began last year. In addition, a growing pipeline of modest stimulus measures should offer some support to the wider economy, with larger fiscal measures by local governments, including the issuance of special bonds, a key element of the policy response.

However, scope for additional action from the People’s Bank of China is likely to be constrained by policy divergence with the Fed. Furthermore, a significant additional relaxation of Covid rules appears unlikely, given a lack of progress in vaccinating the country’s vulnerable elderly population and the wish for stability during the Chinese Communist Party’s Congress in November, when Xi Jinping is likely to gain a third term as president.

Everything changes and nothing stands still.

Heraclitus (c. 540-480 BC)

1 In rare interview Biden says Americans ‘really, really down’, BBC News, 17 June 2022

2 Turkey’s inflation soars to 73%, a 23-year high, as food and energy costs skyrocket, CNBC, 3 June 2022

3 Source: FactSet, 1 July 2022

4 US stocks suffer sharpest first-half drop in more than 50 years, Financial Times, 30 June 2022

5 Source: FactSet, 1 July 2022

6 Source: FactSet, 1 July 2022

7 Federal Reserve FOMC statement, 15 June 2022

8 ECB takes hawkish turn to counter record-high inflation, Financial Times, 9 June 2022

9 Central bank chiefs call end to era of low rates and moderate inflation, Financial Times, 29 June 2022

10 Bond market returns sourced from FactSet, 1 July 2022

11 Equity market returns sourced from FactSet, 1 July 2022 (All sterling total returns, FTSE World Index)

12 Gold bullion returns sourced from FactSet, 1 July 2022

13 US economy posts solid jobs growth despite tight labour market, Financial Times, 3 June 2022

14 Fed raises benchmark rate by 0.75 percentage points to tame scorching inflation, Financial Times, 15 June 2022

15 US set for recession next year, economists predict, Financial Times, 12 June 2022

16 Sterling falls to 2-year low against dollar after UK economy contracts, Financial Times, 13 June 2022

17 UK consumer confidence falls to lowest level since records began, Financial Times, 24 June 2022

18 Monetary Policy Summary and minutes of the Monetary Policy Committee meeting, Bank of England, 16 June 2022

19 Weak EU growth and Covid-hit China raise prospect of global downturn, Financial Times, 29 April 2022

20 Japan swelters in its worst heatwave ever recorded, BBC News, 29 June 2022

21 Japan recovery buffeted by Covid restrictions and Ukraine war, Financial Times, 18 May 2022

22 BoJ’s Kuroda forced to retract claim consumers tolerant of price rises, Financial Times, 8 June 2022

23 IMF chief warns global economy faces ‘biggest test since second world war’, Financial Times, 23 May 2022

All data is sourced from FactSet unless otherwise stated. All references to dollars are US dollars unless otherwise stated.

These opinions should not be construed as investment or other advice and are subject to change. This document is for information purposes only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Issued in the UK by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Registered in England No. 01371973. Newton Investment Management Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM) and Newton Investment Management North America LLC (NIMNA). NIMNA was established in 2021 and is comprised of the equity and multi-asset teams from an affiliate, Mellon Investments Corporation.