At Newton Investment Management Ltd, we consider our process for assessing the sustainability of sovereigns to be a key differentiator, both for the amount of time we have been incorporating it into our investment process (over a decade), and the way in which we compile our sovereign sustainability matrix, which serves as an investment overlay for our sustainable strategies.

A Single, Rigorous Process

The same process applies for all sovereigns, both developed and emerging markets. Our expectation is that social and governance aspects will be more robust in the developed world where the social contract is stronger, and we therefore conduct our analysis using an emerging-market lens to ensure the necessary level of rigor.

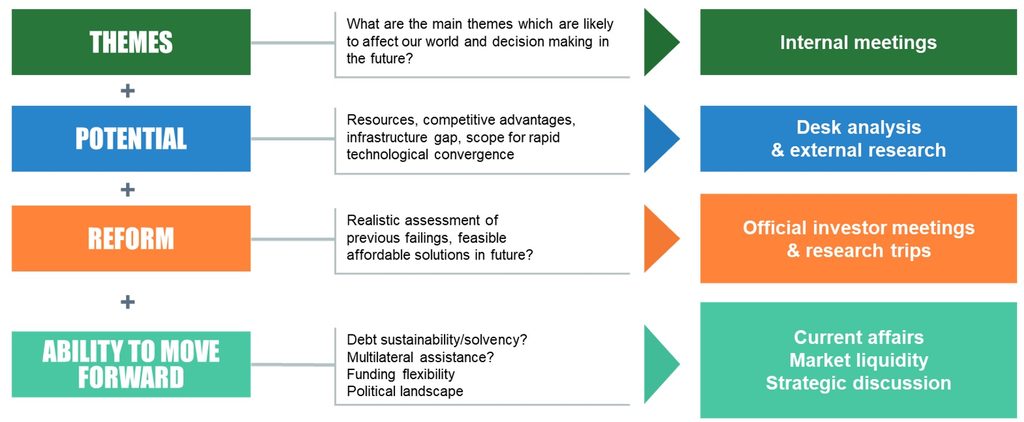

Our standard emerging-market process has been in place since the launch of the Global Dynamic Bond strategy in 2006:

Emerging-Market Sovereign Process

Source: Newton, January 2022.

Our view is that emerging markets are usually emerging from some previous maladministration or geopolitical issue and have reached a level of market sophistication. Our stated aim is not to be a ‘best-in-class’ investor, but to identify those countries which are more likely to be embarking on the journey towards developed status. Our expectation is that improvements beget further improvements and that virtuous cycles can be created. The opposite also holds true in that deteriorations can cause a downward spiral and vicious circles are created. Our emerging-market process is designed to provide the framework to consider these aspects.

We would acknowledge that sovereign sustainable investment has lagged analysis of corporate issuers, for various practical reasons including differing expectations of the accountability of the issuer – while a company is accountable to its shareholders, a government is at best answerable to its voter base and at worst to itself alone – as well as the more siloed nature of government departments.

Comparing Our Matrix to a Benchmark

This accounts for the fact that, until recently, no index existed to compare our own matrix to a benchmark standard. The J.P. Morgan ESG EMBI Global Diversified Index (JESG EMBIG) has, however, emerged as a leading contender for an acceptable emerging-market sovereign ESG (environmental, social and governance) index. It is worth noting that the index is in its infancy and processes may change as several weaknesses in the methodology have become apparent. In a joint paper published in 2021 by J.P. Morgan and the World Bank, one of the main concerns cited was an ingrained income bias.1 The report stated that average ESG scores across seven leading ESG providers were highly correlated with gross national income per capita scores. This may have the unintended consequence of creating a ‘low-income trap’ where countries with the most pressing infrastructure requirements are excluded from accessing the sovereign debt market and therefore have scant hope of developing their own domestic financial markets. To this end, in our own proprietary matrix, we have allowed sovereigns that are poorly rated but improving on an ESG basis to be deemed investible, subject to a veto by our responsible investment team.

We consider our sovereign sustainability matrix to be an extension of our emerging-market investment process, as we have been incorporating many of the ESG inputs as a cornerstone of our analysis since 2009 when a member of the team incorporated this research into an academic paper.

Core Versus Sustainable Strategies

The main differences between the emerging-market sovereign component of our core and sustainable strategies can be attributed to the factor of time. Specific market conditions may be favourable for a sovereign which may not necessarily fit our sustainable criteria over a given period of time. These conditions could include a competitive advantage, a commodity abundance or a superior debt-coverage ratio. This may lead to an opportunity for investment in our core strategies, although inevitably there will be a trade-off versus the inherent underlying risks, which may include poorer transparency and governance, hence their exclusion from our sustainable strategies.

Flexibility in the Process

In our sovereign sustainability process, we attribute a greater weight to measures such as voice and accountability, and we incorporate freedom-of-press metrics. It is clear that over the longer term, the most effective way a citizen can change their circumstances and the maladministration of government is through a democratic process. While there is a certain stability or continuity afforded to non-democratic forms of government, a transition of power is usually volatile, carries uncertainty and can be violent. Our ability to exercise a degree of judgement is reflected in some anomalies in the JESG EMBIG where, somewhat counterintuitively, certain issuers such as Belarus have a larger weighting in the ESG index than they do in the non-ESG emerging-market counterpart.

In summary, our sustainable sovereign matrix embeds a level of flexibility and judgement to take account not just of a sovereign’s existing standing, but also its direction of travel. We believe that, coupled with the expertise of our responsible investment team, the rigor of our process, designed by our fixed-income emerging-market specialists, provides us with a real differentiator versus our peers and is further evidence of the robustness of our sustainable fixed-income approach.

Sources:

1 Gratcheva et al (2021) “A New Dawn – Rethinking Sovereign ESG”, JP Morgan and World Bank (https://openknowledge.worldbank.org/handle/10986/35753), June 7, 2021.

Newton Investment Management Ltd (NIM) will make investment decisions that are not based solely on ESG considerations. Other attributes of an investment may outweigh ESG considerations when making investment decisions. The way that ESG considerations are assessed may vary depending on the asset class and strategy involved. The research team performs ESG Quality Reviews on equity securities prior to their addition to NIM’s Research Recommended List (RRL). ESG Quality Reviews are not performed for all fixed income securities. The portfolio managers may purchase equity securities that are not included on the RRL and which do not have ESG Quality Reviews. Not all securities held by NIM’s strategies have an ESG Quality Review completed prior to investment, although since 2020 it has been a requirement for all (single name) equity securities to have an ESG Quality Review before they are purchased for the first time. For NIM’s sustainable strategies, ESG Quality Reviews are performed prior to investment for corporate investments (single name equity and fixed income securities).

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

Important information

This is a financial promotion. This article is for institutional investors only. Material in this article is for general information only. The opinions expressed in this article are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Any reference to a specific country or sector should not be construed as a recommendation to buy or sell this country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Newton manages a variety of investment strategies. Whether and how ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved, as well as the research and investment approach of each Newton firm. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions.

Issued by Newton Investment Management Limited. ‘Newton’ and/or the ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM) and Newton Investment Management North America LLC (NIMNA). In the United Kingdom, NIM is authorized and regulated by the Financial Conduct Authority (‘FCA’), 12 Endeavour Square, London, E20 1JN, in the conduct of investment business. Registered in England no. 1371973. NIM and NIMNA are both registered as investment advisors with the Securities & Exchange Commission (‘SEC’) to offer investment advisory services in the United States. NIM’s investment business in the United States is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Both firms are indirect subsidiaries of The Bank of New York Mellon Corporation (‘BNY Mellon’).

Newton provides discretionary and non-discretionary investment advice to institutional clients, including US and global pension funds, sovereign wealth funds, central banks, endowments, foundations, insurance companies, registered mutual funds, other pooled investment vehicles and other institutions. Its current office locations include London, Boston, New York and San Francisco.

This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorized. Certain information contained herein is based on outside sources believed to be reliable, but their accuracy is not guaranteed. The opinions expressed in this document are those of Newton and should not be construed as investment advice.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds and (iii) associated persons of BNYMSC (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms.

In Canada, Newton Investment Management Limited is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Ontario and Quebec and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.