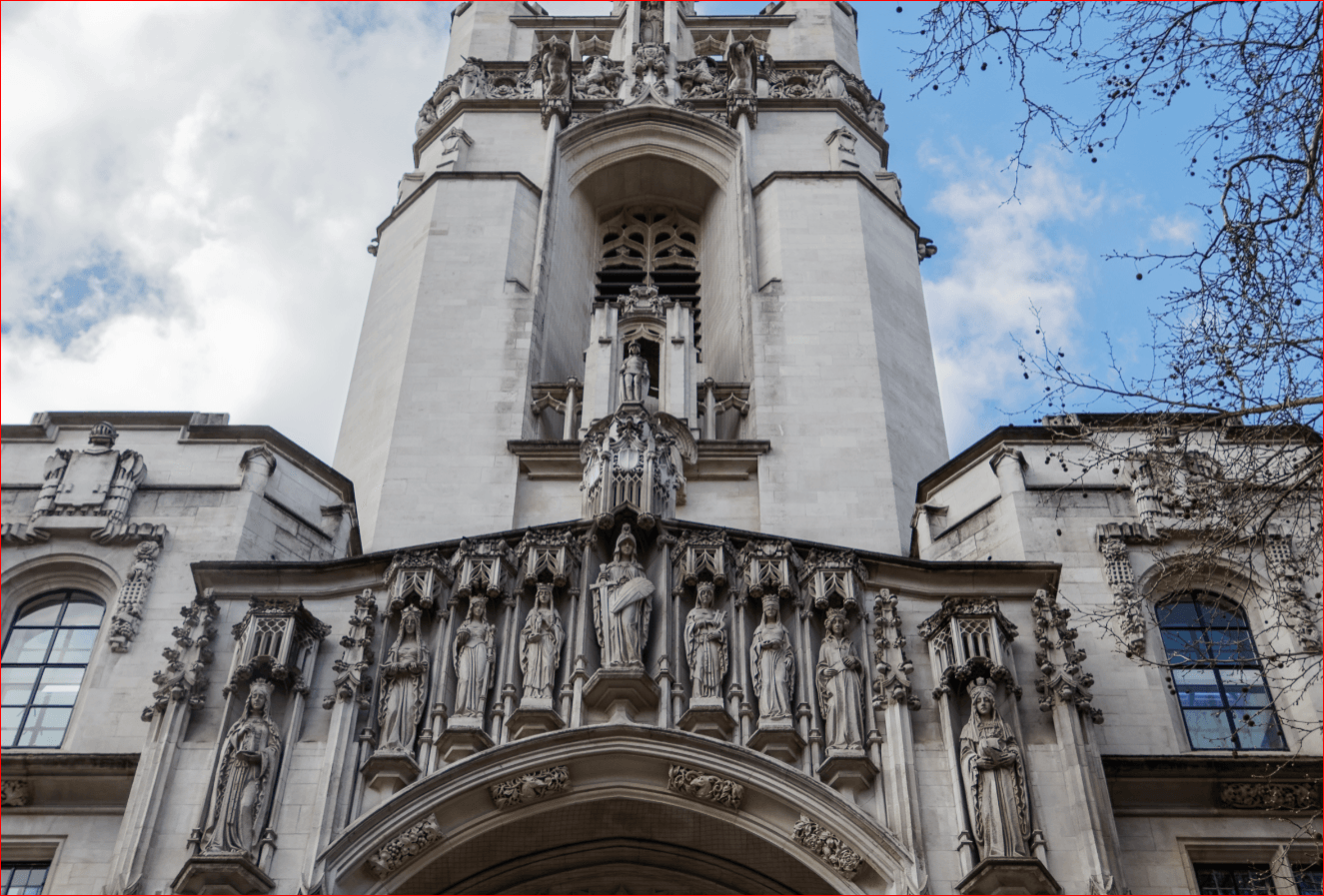

The UK Supreme Court, the highest legal body in the land, ruled on Tuesday that the government’s prorogation (suspension) of Parliament was ‘unlawful’. Straight after the ruling, soon-to-retire Speaker of the House John Bercow confirmed that the House of Commons would resume business, as it did yesterday morning (Wednesday).

The ruling is viewed by some UK commentators as legally and constitutionally significant, in that the Supreme Court (which came into existence in 2009 to replace the centuries-old system of law lords) has been tested on a constitutional issue for the first time. Its ruling was unanimous, with all 11 justices upholding the verdict, which was widely viewed as a damaging defeat for Prime Minister Boris Johnson.

Recriminations

Recriminations have continued to echo around Westminster well after the verdict was announced, with vitriolic exchanges dominating the chamber. The government will potentially have to be more circumspect about so-called constitutional ‘creativity’ from now on, and questions over the integrity of Mr Johnson and some of his colleagues, who have been accused of effectively misleading the Queen and the UK population, will linger.

All of this comes in the context of little material progress being made towards agreement on the terms of the UK’s withdrawal from the European Union (EU). Recent UK legislation (the ‘Benn Act’) demands that the country request an extension to the Brexit deadline from the EU, currently set for 31 October, in the absence of a deal before then. However, there is a growing suspicion in some quarters that many in the Johnson administration are intent on pursuing a ‘no-deal’ Brexit, and it is worth bearing in mind that the negotiations with the EU have taken on more than a passing resemblance to a game of ‘chicken’, in which both sides wait for the other to blink first.

All eyes on the Queen’s Speech…

Furthermore, there have been signs of a willingness to compromise on the part of the EU itself, and by the Democratic Unionist Party, which could yet offer the UK government some hope of a last-minute deal. However, the sense of anger over the government’s perceived disregard of Parliament and long-established precedents is unlikely to enhance the chances of agreement on any new proposals, especially since Mr Johnson no longer enjoys a working majority in the House of Commons.

All eyes will now turn towards the government’s Queen’s Speech, and its proposed new legislative agenda, which is scheduled to be delivered to both houses on 14 October – just ahead of the crunch EU summit on 17 October, at which the government hopes to achieve a last-ditch withdrawal deal. In the meantime, the government will focus on its attempts to find an alternative to the so-called Irish ‘backstop’, while the rhetorical repercussions of its recent judicial defeat will continue to ring in its ears around the debating chamber.

Market implications

Sterling rallied mildly on the verdict, continuing its gently upward trend since the so-called Benn Act was passed by Parliament two weeks ago. However, we do not consider the outlook clear enough to make any significant changes to our portfolios at this time, and we will continue to favour internationally focused UK companies with little domestic exposure.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. Please note that holdings and positioning are subject to change without notice.

Important information

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments