In June, leaders of the world’s largest developed economies gathered in Cornwall for the Group of Seven (G7) summit, their first face-to-face meeting since the start of the coronavirus pandemic. With blue skies, a picturesque coastal setting and an itinerary that included a reception at the Eden Project, a futuristic environmental park, the summit appeared to send a post-pandemic message of cooperation, hope and recovery. However, while there was clear agreement on areas such as the need to fund ‘green’ projects in the developing world and a plan to fight future pandemics, some tensions bubbled under the surface, notably regarding exactly how to tackle the threat of an increasingly assertive China.

For much of the quarter, optimism, and the prospect of a strong economic recovery from the pandemic, also seemed to dominate investor sentiment. Most major equity markets delivered a robust performance over the three-month period, bolstered by an impressive slate of economic data, particularly from the US, and further evidence that vaccination programmes were successfully paving the way for full economic reopening. June saw the fifth consecutive month of gains for US stocks, as represented by the S&P 500 index, which climbed to a record high on the final day of the month.1

Nevertheless, financial markets were not immune from volatility as participants contended with the various uncertainties that the global economy faces in its post-Covid-19 recovery. Counted among these were the potential impact of new variants of the virus, and continuing disruption to supply chains and labour markets, but the principal anxiety related to the prospect of higher inflation, and the likely response from monetary authorities. The rise in US consumer price inflation of 5% in May compared to the previous year2 – the biggest increase since 2008 – exceeded the forecasts of many economists and served to fuel the debate over whether the surge was merely transitory or represented the start of a new, more inflationary regime.

US consumer price index

% change, year on year

Source: US Bureau of Labor Statistics, June 2021.

The growing pricing pressures and faster growth trajectory were acknowledged by the US Federal Reserve (Fed) at the June meeting of its Federal Open Market Committee (FOMC), when it indicated that it expected to start raising interest rates in 2023, a year earlier than previously forecast, and also signalled that it would soon begin to discuss when it would taper its bond-purchasing programme.

Following these comments, US stocks suffered their worst week since February,3 with markets seeing a notable rotation away from the more economically sensitive companies that had been viewed as likely to benefit from a more inflationary environment, and back into more growth-oriented areas such as technology which had lost momentum during the first few months of the year. The Fed’s perceived willingness to tackle inflation also led to sharp declines in commodity prices and a rally in government bonds as market participants feared that tighter monetary policy could upset the economic recovery. However, a more dovish tone from Fed Chair Jay Powell at a congressional appearance the following week, when he indicated a patient approach to any scaling back of monetary support, helped to calm equity markets, which resumed their upward trend into the final few days of the quarter.

In fixed income, returns from both government and corporate bonds were muted but still positive over the quarter, although year-to-date returns are still firmly negative as a result of the sell-off seen during the early part of the year. UK gilts, as represented by the FTSE Actuaries UK Conventional Gilts All Stocks Index, returned +1.7% over the quarter (-5.7% over the six months to 30 June), while overseas government bonds, as represented by the JP Morgan Global Government Bond Index (excluding the UK) produced a return of +0.9% in sterling terms (-5.6% over six months). Corporate bonds, as represented by the ICE BofA Sterling Non-Gilt Index, returned +1.7% over the quarter (-2.5% over the year to date).4

With the exception of Japanese stocks, which produced a negative return of -0.5% in sterling terms over the quarter (+0.7% over the six months to 30 June), all major equity markets delivered positive returns over the three-month period. North American equities produced a return of +8.7% over the quarter (+14.0% over six months), while Europe ex UK stocks returned +8.3% in sterling terms (+10.9% over the year to date). Meanwhile, UK equities delivered a quarterly return of +5.6% (+11.1% over six months), emerging markets returned +5.1% (+7.1%) in sterling terms, and Asia Pacific ex Japan equities produced a positive return of +5.0% over the quarter (+9.4% over six months) to UK-based investors.5

Gold delivered a return of +3.7% in US-dollar terms over the quarter (-6.8% over the year to date), while in sterling terms the precious metal produced a return +3.3% (-7.9%).6

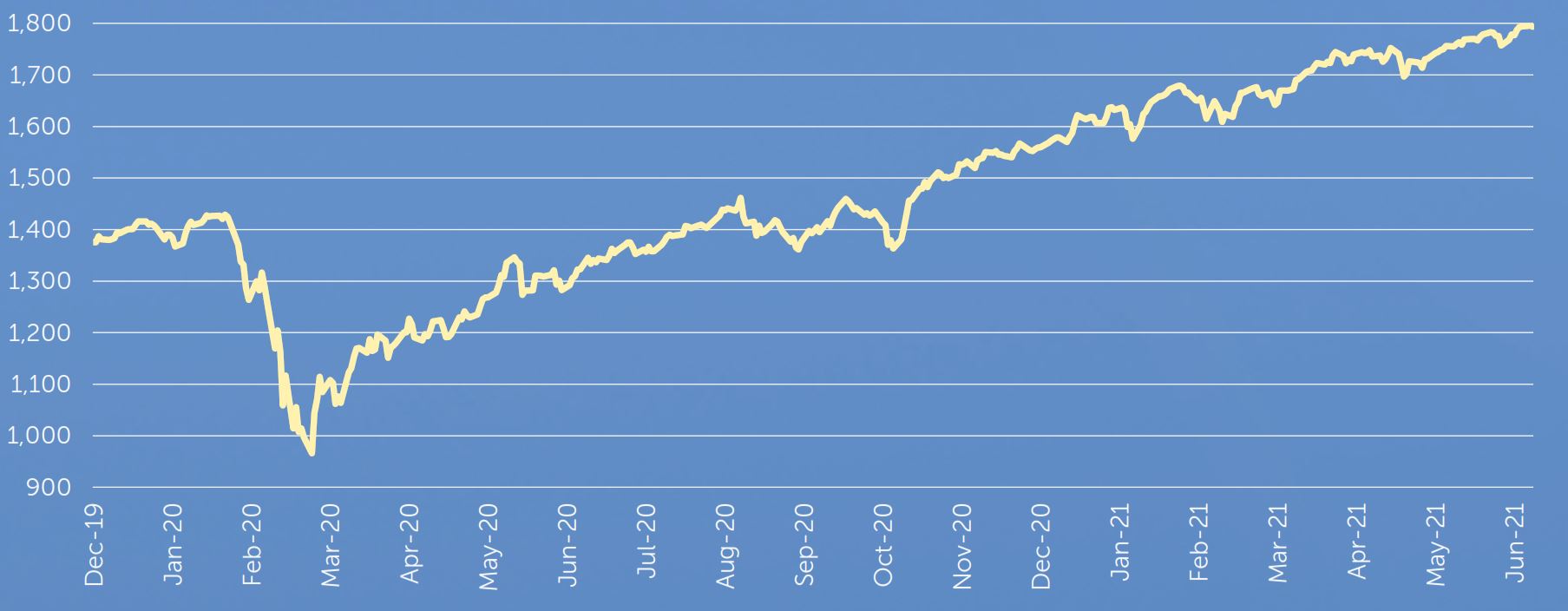

Gold price

US$ per ounce

Source: FactSet, July 2021.

A US government report on unidentified flying objects (UFOs) released in June found “no clear indications that there is any non-terrestrial explanation” for the aircraft.7 However, as it did not rule such aircraft out, the public’s long-held fascination with potential sightings of alien spaceships is unlikely to be diminished. After several decades in a disinflationary environment, inflation may have seemed something of an alien concept to many financial-market participants, but with the Fed having raised inflation projections and brought forward the timeline for tightening monetary policy at its June FOMC meeting, it has become an increasingly high-profile issue among investors.

While 13 of the 18 FOMC members now predict a first interest-rate increase in 2023, Chair Jay Powell said that the ‘dot plot’ should be taken with a “big grain of salt” since it represented the projections of individuals rather than an official forecast. The Fed is maintaining its US$120bn per month asset-purchasing programme, and has said that the economy would have to make “substantial further progress” in order for it to begin scaling back its extraordinary level of support.

While inflation has been moving above the Fed’s 2% average target, and GDP growth is now forecast to reach 7% this year,8 the Fed remains some way off its goal of full employment, with unemployment at 5.8% in May, compared to the 3.5% pre-pandemic low.9 The Fed’s policy therefore still remains very accommodative, but its perceived willingness to tackle rising inflation is likely to have implications for market outcomes.

England’s win over Germany in the last 16 of the delayed Euro 2020 championships on 29 June was the first time the country had beaten its arch-rival in the knockout stages of a football competition since its World Cup victory in 1966.10 England, together with the other parts of the UK, has also beaten many of its European counterparts in terms of the speed of its Covid-19 vaccination rollout, which should help to drive economic momentum, even as a full economic reopening has had to be delayed owing to the increasing prevalence of a more transmissible variant of the virus.

According to data from the Office for National Statistics, in April the UK economy grew at its fastest rate since the reopening that followed the first lockdown last summer.11 Furthermore, while the UK’s recovery has so far been one of the slowest among major economies, the Confederation of British Industry (CBI) has predicted that the country’s economic output is likely to reach pre-pandemic levels as soon as the end of 2021.12 As in the US, inflation is expected to exceed 3% in the coming months, but the Bank of England views any surge in prices as likely to be “transitory”.13

In a bid to lure back tourists after numbers plummeted during the pandemic, visitors to Romania’s Bran Castle, considered to be the inspiration for the vampire’s home in Bram Stoker’s novel Dracula, have been offered a Covid-19 vaccine.14 However, data from across Europe suggests that many consumers need little enticement to return to pre-pandemic levels of activity. For example, by mid-June, travel to workplaces across the eurozone’s largest economies was only around 10% below the January 2020 level, while restaurant bookings and consumer spending in Germany are reportedly higher than in June 2019.15

Inevitably, certain sectors, such as air travel, remain subdued, but the European Central Bank (ECB) has raised its eurozone growth forecast for the year to 4.7% as economies have reopened and vaccination programmes have accelerated. Although headline inflation hit 2% in May, surpassing the ECB’s target for the first time since 2018, core inflation (excluding energy and food prices) has only reached 1.1%, and ECB President Christine Lagarde believes that any policy tightening and tapering of its bond-buying plan at this stage would be “too early” and threaten the nascent recovery.16

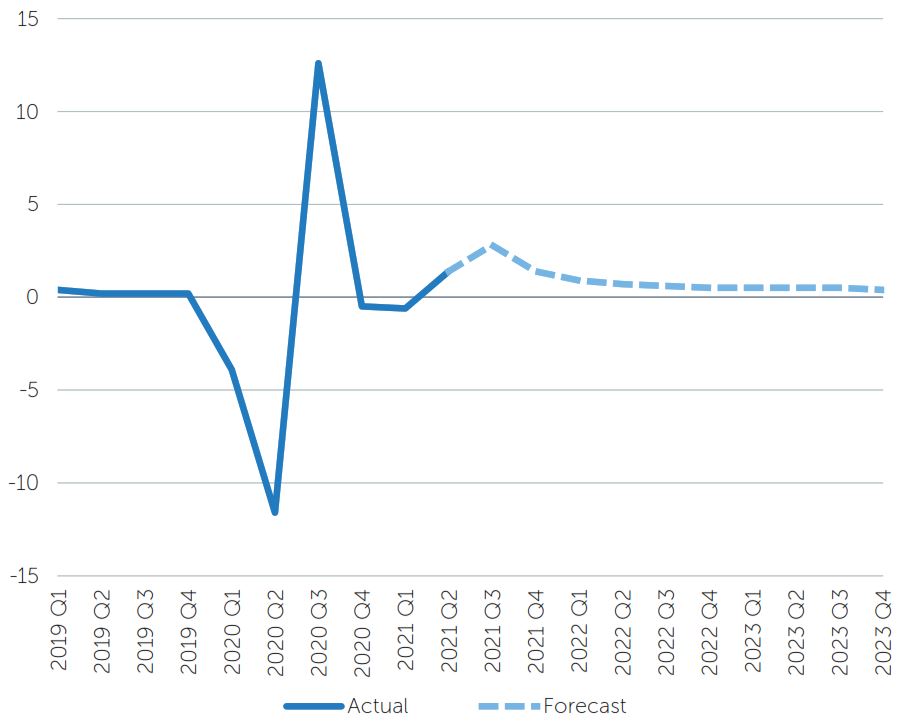

Euro area real GDP growth

Quarter-on-quarter percentage changes, seasonally and working day-adjusted quarterly data

Source: Eurosystem staff projections and European Central Bank calculations, June 2021.

Japan’s science ministry announced in May that, together with the private sector, it plans to develop passenger spaceships that could fly between the world’s major cities in two hours or less by the 2040s.17 With the country’s economic output having fallen by 1.3% in the first quarter of the year as a result of a renewed Covid-19 state of emergency, and a slow rollout of vaccines hindering its recovery, Japan’s economy arguably needs some rocket fuel.18

However, while the services sector has continued to suffer, exports have benefited from increased demand as the global economy begins to recover. Sentiment among large Japanese manufacturers has risen to its strongest level since the end of 2018, with the Bank of Japan’s Tankan index rising to plus 14 during the second quarter.19 A ramping up of the vaccination programme and the lifting of some virus-related restrictions should also help to drive growth during the second half of the year.

Data from China’s census for the 10 years to 2020 has shown that the country’s population grew by just 5.4% over the period, the lowest rate of increase since the country began collecting data in 1953, raising concerns over a future demographic crisis.20 Over the quarter, China also faced increasing pressure from the US Biden administration on a range of issues including its treatment of the Uyghurs and its military activity in the South and East China Seas. The US administration has also announced that it will ban Americans from investing in a large number of Chinese defence and technology companies in an effort to stop what it perceives as US capital being used to undermine its national security.

Nevertheless, China’s economy still appears robust, with the World Bank projecting that the country’s economic growth will reach 8.5% this year.21 China’s factory activity dipped to a four-month low in June, as it was affected by a number of factors such as higher raw-material costs and a global shortage of semiconductors, as well as an outbreak of coronavirus infections in Guangdong province. However, the official purchasing manager’s index remained above the 50-point mark which separates growth from contraction.22

Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.

Ronald Reagan, US president 1981-1989

1 https://www.cnbc.com/2021/06/29/us-stock-futures-are-little-changed-as-the-market-closes-out-a-winning-first-half.html

2 https://www.ft.com/content/6d9a5ae5-43fe-4f18-be49-b907a9c3a5e0

3 https://www.ft.com/content/7fa14ef2-edc0-41bb-870c-303542d6e7c8

4 Bond market returns sourced from FactSet, 01.07.21

5 Equity market returns sourced from FactSet, 01.07.21 (All sterling total returns, FTSE World Index)

6 Gold bullion returns sourced from FactSet, 01.07.21

7 https://www.bbc.co.uk/news/world-us-canada-57559179

8 https://www.ft.com/content/0bf83e29-5ee2-415e-9e03-0edb38218bf3

9 https://www.ft.com/content/f38da494-2d09-4d8e-b39f-c531ee48ef3a

10 https://www.bbc.co.uk/sport/football/51198606

11 https://www.ft.com/content/811f13ee-ccd2-4d64-9f4c-0e96d8d070dd

12 https://www.ft.com/content/d6adb73d-cd56-403e-a6d6-b352a29eec2e

13 https://www.ft.com/content/a2df9e5c-2dd4-4295-9938-890329c4e61f

14 https://www.reuters.com/world/europe/vlad-vaccinator-draculas-castle-lures-visitors-with-covid-19-jabs-2021-05-08/

15 https://www.ft.com/content/d0619910-525a-4191-9aae-a0907eb5fb99

16 https://www.ft.com/content/6c5c3c9c-e9fb-48a3-97a4-b920f38c5f25

17 https://mainichi.jp/english/articles/20210515/p2a/00m/0sc/013000c

18 https://www.ft.com/content/77670e5c-dd3e-4b4c-ba92-68605f2b3309

19 https://www.ft.com/content/7fc47efe-cae7-47ef-ab37-6f2fe1181d62

20 https://www.ft.com/content/0654a033-9981-4d02-9a3c-9670f74433bd

21 https://www.worldbank.org/en/news/press-release/2021/06/29/china-economic-activity-continues-to-normalize-though-some-risks-remain-world-bank-report

22 https://www.cnbc.com/2021/06/30/china-june-manufacturing-pmi.html

All data is sourced from FactSet unless otherwise stated. All references to dollars are US dollars unless otherwise stated.

Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Registered in England No. 01371973. Newton Investment Management is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. Newton Investment Management Limited is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton’s investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. The opinions expressed in this document are those of Newton and should not be construed as investment advice. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. To the extent that copyright subsists in any picture used in this document, Newton recognises the copyright therein. This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances. Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia. ‘Newton’ and/or the ‘Newton Investment Management’ brand refers to Newton Investment Management Limited.