In October, William Shatner, the 90-year-old actor best known for his portrayal of Captain Kirk in Star Trek, became the oldest person to fly to space, and the latest in a growing number of ‘tourists’ opting to experience weightlessness and spectacular views from more than 60 miles above Earth. The sub-orbital flight, which lasted just ten minutes, ended with a straightforward parachute-assisted touchdown in the desert.

Meanwhile, in the final quarter of 2021, financial-market participants saw inflation soar to its highest level in decades (the US consumer price index rose 6.8% year on year in November).1 Against that backdrop, they contemplated whether the US Federal Reserve (Fed) and other policymakers would be able to engineer a ‘soft landing’ that would ease inflationary pressures without stifling the rebounding economy and recovering labour market.

Markets had to contend with other anxieties during the final three months of the year, not least the emergence of a new Covid-19 ‘variant of concern’, designated Omicron by the World Health Organisation, which quickly spread across the globe and led to dramatic – if temporary – falls in risk-asset prices in late November. Disruption to supply chains, and the resulting upward pressure on prices, remained a major worry, although US companies reported strong third-quarter earnings, with overall profits up around 40% compared to the previous year – well above consensus estimates.2 Geopolitical tensions also rose during the fourth quarter, as Russia built up a large military presence near its Ukrainian border.

Despite these uncertainties and the significant volatility experienced towards the end of the year, most global equity markets ended the final quarter of 2021 firmly in positive territory, with the MSCI AC World index of global equities posting quarterly gains which cemented double-digit returns for the third successive calendar year. The US 10-year Treasury yield, meanwhile, moved slightly lower over the quarter.

Accommodative monetary policy was undoubtedly a factor in helping to push equity markets higher, but all eyes were on the Fed and other central banks for signs as to the pace at which they might withdraw stimulus and tighten policy during 2022. In a press conference which followed the Federal Open Market Committee’s (FOMC) December meeting, Fed Chair Jerome Powell admitted that inflationary problems had been “larger and longer-lasting than anticipated, exacerbated by waves of the virus.” At the meeting, the FOMC announced that it would begin to taper its bond-purchasing programme by US$30 billion per month from January, double the figure that had been announced only a month earlier. Furthermore, the latest ‘dot plot’ of individual FOMC members’ interest-rate projections indicated that three rate rises were now expected during 2022, a big shift from the previous (September) update in which only half of the officials had expected any ‘lift-off’ in rates over the next 12 months. Powell also indicated that with robust economic data, and the country much closer to “full employment”, he did not expect a “very extended wait” before rate rises could begin.3, 4

In fixed-income markets, returns were mixed over the quarter. UK gilts, as represented by the FTSE Actuaries UK Conventional Gilts All Stocks Index, returned +2.4% over the quarter (-5.2% over the 12 months to 31 December), while overseas government bonds, as represented by the JP Morgan Global Government Bond Index (excluding the UK) produced a return of -1.6% in sterling terms (-5.7% over 12 months). Corporate bonds, as represented by the ICE BofA Sterling Non-Gilt Index, returned +0.4% over the quarter (-3.0% over the calendar year).5

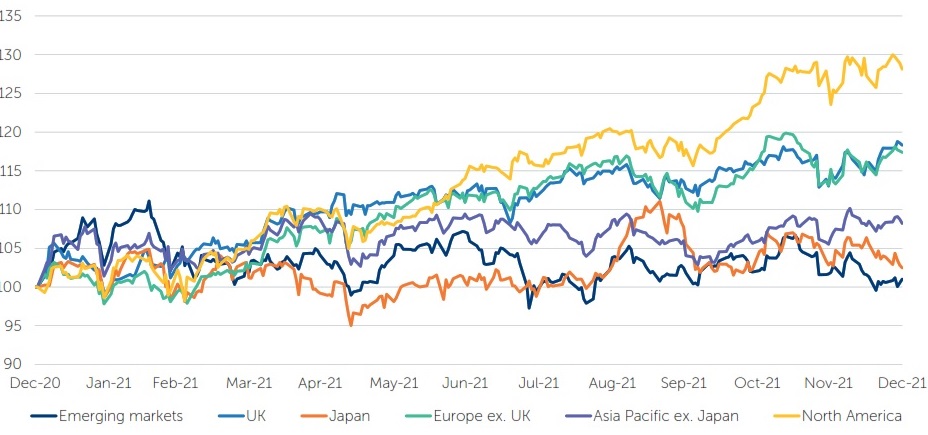

In equity markets, North American stocks produced a strong positive return of +9.5% in sterling terms over the quarter (+28.1% over the 12 months to 31 December), followed by Europe ex UK stocks with +5.1% (+17.4% over 12 months) and UK equities with +4.2% (+18.3%). Asia Pacific ex Japan stocks were also in positive territory, returning +2.1% over the quarter in sterling terms (+8.2% over the calendar year), but both emerging-market and Japanese equities delivered negative returns, the former returning -1.4% over the quarter (+1.0% over 12 months) and the latter -4.9% (+2.5%) to UK-based investors.6

Equity markets

Total returns (£), rebased to 100 at 31.12.20

Note: all indices are FTSE series.

Source: Factset, January 2022

Against the increasingly uncertain backdrop, gold made gains over the quarter, returning +3.7% in US-dollar and +3.2% in sterling terms. However, over the 12-month period the precious metal was still one of the worst-performing asset classes, returning -4.1% in US-dollar terms and -3.2% in sterling terms.7

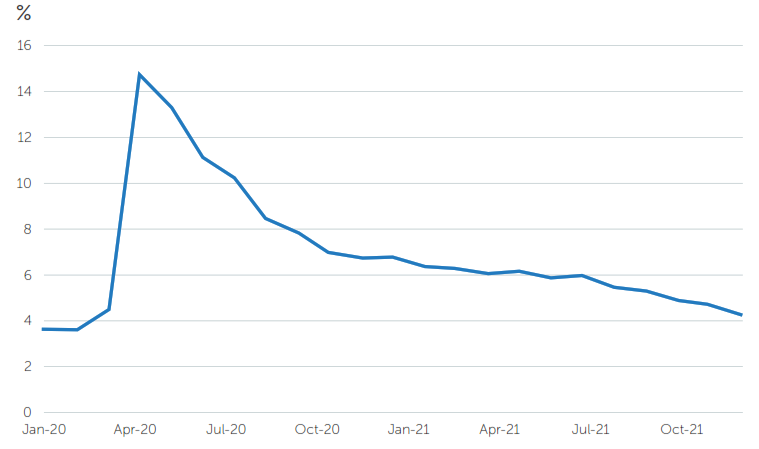

As the US geared up to celebrate Thanksgiving in November, passenger air travel experienced its busiest day since the start of the pandemic, with around 88% of the traffic on the equivalent day in 2019.8 Key data releases were also indicative of a sustained economic recovery, with the unemployment rate continuing to fall, reaching 4.2% in November, while in the week of 4 December, state employment offices received 184,000 initial jobless claims, the lowest level since 6 September 1969.9 Meanwhile, consumer spending remained resilient in spite of a big jump in consumer price inflation, with October retail sales particularly strong, up 1.8% on the previous month.

US unemployment rate

Source: US Bureau of Labor Statistics, Bloomberg, December 2021.

Although the Biden administration’s US$1 trillion bipartisan infrastructure plan was finally signed into law in November, the larger US$1.7 trillion ‘Build Back Better’ bill that planned to make record investments in social services was scuppered in December when centrist Democratic senator Joe Manchin, whose vote was essential for the bill to move forward, said he could not support it in its current form. Although talks on the bill could resume, its scope is likely to be reduced. While the possibility of increased fiscal stimulus could be supportive for markets, participants had been concerned about the bill’s provisions for higher corporate taxes.

In the UK, the Bank of England (BoE) surprised market participants in December when its Monetary Policy Committee (MPC) voted 8-1 in favour of raising interest rates from 0.1% to 0.25%, the first increase in over three years.10 With the BoE’s revised forecast indicating that inflation could reach as high as 6% by April 2022, Governor Andrew Bailey cited the very tight labour market and persistent inflation pressures as reasons why the BoE had to act. The MPC stated that further “modest” rises would be needed in the coming months to keep inflation under control. It also voted unanimously to end its quantitative-easing programme as planned at the end of December.

The rate rise came only days after data from the Office for National Statistics (ONS) showed that the UK economy barely grew in October, with supply-chain disruption affecting areas such as manufacturing and construction.11 Meanwhile, the rebound in many services such as restaurants had faltered even before the impact of the Omicron Covid-19 variant and potentially tighter pandemic restrictions could be felt. Separate ONS data also highlighted the continuing impact that Brexit was having on the UK economy, with the UK’s goods imports and exports to the European Union (EU) falling in October compared with the previous month, while trade with non-EU countries expanded strongly.

In Europe, Covid-related restrictions were tightened in several economies as cases soared during the quarter, with some countries such as Austria and the Netherlands reimplementing full-scale lockdowns. Meanwhile, Germany’s Bundesbank cut its 2021 and 2022 growth forecasts in December as supply-chain bottlenecks hampered the country’s large manufacturing sector and new Covid restrictions weighed on services businesses.

Against this backdrop, the European Central Bank (ECB) took a more cautious approach towards the withdrawal of crisis support, in contrast to its US and UK counterparts. While announcing that its €1.85 trillion Pandemic Emergency Purchase Programme would end net purchases in March, it boosted its older asset-purchase programme with a commitment to continue bond purchases for at least ten months, and said that it would not raise interest rates in 2022. Although the ECB predicted that inflation would increase to 3.2% in 2022, it forecast that it would then fall to 1.8% in 2023 and 2024, with President Christine Lagarde stating that monetary accommodation was “still needed” for inflation to stabilise at the ECB’s 2% target over the medium term.12

Fast-food retailer McDonald’s was forced to ration the sale of its fries in Japan during December as the supply-chain crunch, together with flooding near the port of Vancouver, caused delays to the supply of potatoes. However, a 7.2% increase in Japanese industrial output in November, compared with the previous month, offered hope that the country’s automotive sector could finally be overcoming its semiconductor-chip supply issues.13

According to figures released by the government in December, Japan’s economy shrank by more than 3% year on year in the third quarter as Covid-related restrictions led to a sharp drop-off in consumption during the period in which the country hosted the Olympic Games.14 Echoing the moves of other central banks, the Bank of Japan announced plans to scale back its emergency economic support programme in December, but maintained its ultra-loose monetary policy as consumer price inflation remained at close to 0%.15

The Financial Times reported that a growing number of China’s wealthy individuals are choosing to invest their extra cash in luxury watches rather than property,16 as the real-estate sector faces a downturn following the collapse of developer Evergrande and President Xi Jinping’s resolve to end housing speculation. Prices of new homes dropped by 0.3% in November, which was the third consecutive month of declines. This is not the first time that the Chinese Communist Party has pursued regulatory action against industries deemed as having become too comfortable or affluent at the expense of the wider population, with technology companies also targeted earlier in the year in the name of ‘common prosperity’.

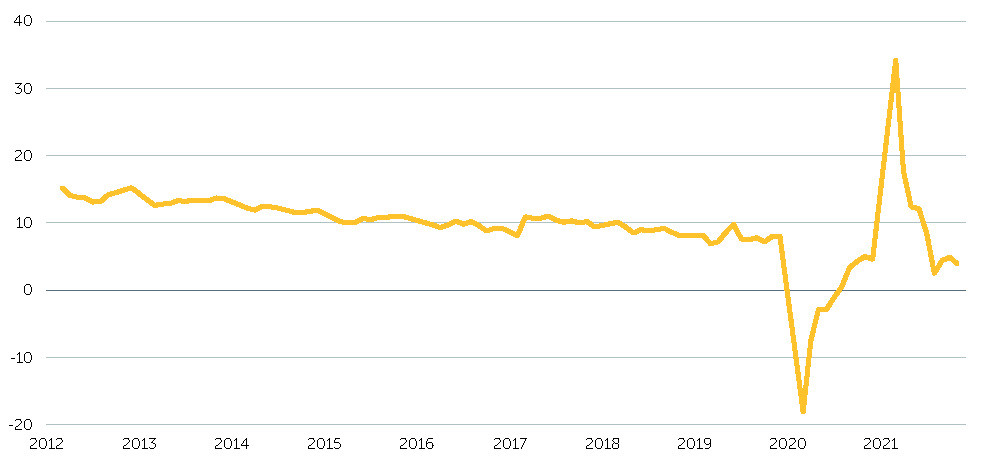

With the Chinese government reaffirming its commitment to strict coronavirus prevention measures, other economic data also indicated slowing momentum, with retail sales rising by 3.9% year on year in November, well below economists’ forecasts of 4.7%.17 In contrast to the Fed’s hawkish tone, the People’s Bank of China acted to ease its policy settings by cutting the reserve requirement ratio for commercial banks.

China retail sales

% change year on year

Source: Factset, January 2022

Risk… risk is our business. That’s what this starship is all about. That’s why we’re aboard her

Captain James T. Kirk, Star Trek The Original Series – Return to Tomorrow (1968)

1 Source: US Bureau of Labor Statistics, 10 December 2021.

2 https://www.ft.com/content/676e153e-5e84-42dc-a512-fa131c2944b2

3 https://www.federalreserve.gov/newsevents/pressreleases/monetary20211215a.htm

4 https://www.ft.com/content/834e773c-0bf6-4510-87d3-123a5d040c05

5 Bond market returns sourced from FactSet, 01.01.22

6 Equity market returns sourced from FactSet, 01.01.22 (All sterling total returns, FTSE World Index)

7 Gold bullion returns sourced from FactSet, 01.01.22

8 https://edition.cnn.com/travel/article/pandemic-air-travel-record-thanksgiving/index.html

9 https://www.ft.com/content/8166d2c4-7bd3-4dd4-b60a-72090188f7f4

10 https://www.ft.com/content/eb35ea37-fb8b-43a7-9d30-d985c58e62d7

11 https://www.ft.com/content/448021f3-2a69-4a6b-87e3-33c3abc847f9

12 https://www.ft.com/content/03a30484-b265-4a88-a861-de1784305d40

13 https://www.ft.com/content/cc75c59a-daa8-4647-966d-6aec51a82a4c

14 https://www.ft.com/content/4605ad4e-e21e-475c-a415-582692795e0f

15 https://www.ft.com/content/065199df-8f36-431f-af67-9837cb1428ca

16 https://www.ft.com/content/a9a34f94-9a49-4938-ae9e-ec4e6d2f4838

17 https://www.ft.com/content/c931f98a-5030-4c78-a5c0-97fe80faca31

All data is sourced from FactSet unless otherwise stated. All references to dollars are US dollars unless otherwise stated.

These opinions should not be construed as investment or other advice and are subject to change. This document is for information purposes only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Issued in the UK by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Registered in England No. 01371973. Newton Investment Management Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN. 'Newton Investment Management Group' is used to collectively describe a group of affiliated companies that provide investment advisory services under the brand name 'Newton' or 'Newton Investment Management'. Investment advisory services are provided in the United Kingdom by Newton Investment Management Ltd (NIM) and in the United States by Newton Investment Management North America LLC (NIMNA). Both firms are indirect subsidiaries of The Bank of New York Mellon Corporation ('BNY Mellon'). Newton Investment Management Limited is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton Investment Management Limited’s investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. To the extent that copyright subsists in any picture used in this document, Newton recognises the copyright therein. This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances. Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws. Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.