How a multi-asset credit approach could help superannuation funds seeking better yields and diversification.

- In an unsupportive environment for government bonds, superannuation funds seeking a reliable income from fixed-income investments may be exploring multi-asset credit strategies (MACs).

- MACs typically offer a core allocation to high-yield corporate bonds. In addition, by allocating to lower-duration assets such as asset-backed securities, loans and other floating-rate instruments, MACs may be able to reduce their sensitivity to changes in interest rates.

- It is important to be mindful of the risks when investing beyond traditional credit markets. A disciplined approach, which incorporates ESG analysis, can help to identify the investment opportunities, and avoid the ‘losers’ which run the risk of distress or default.

As the Covid-19 crisis has unfolded, a key theme that has emerged is the ‘tug of war’ between the deflationary forces of the real economy, where private-sector cash flow and incomes remain under pressure, and the inflationary influence of policymakers’ response to the pandemic, with public-sector balance sheets being expanded to new levels in an attempt to limit the fallout. While the deflationary backdrop should prove more supportive for government bonds in the near term, the return potential for many developed bond markets is likely to be limited as yields are close to historic lows. Meanwhile, the potential return of inflation means investors in bond strategies unable to adapt to the changing backdrop may run the risk of seeing returns eroded over time.

In this unsupportive environment for government bonds, superannuation funds seeking a reliable income from fixed-income investments are likely to be exploring alternative solutions and asset classes.

Multi-asset credit strategies (MACs) have enjoyed heightened interest in recent years, and are sometimes suggested by consultants and advisors to their clients as a useful way for bond investors to gain diversification and reduce interest-rate risk.

What are MACs?

MACs can be managed in an opportunistic or benchmark-agnostic manner, and typically offer investors a core allocation to sub-investment-grade corporate bonds (usually with high income). Other areas of the fixed-income universe in which MACs may invest include emerging-market debt, securitised credit, real-estate bonds, direct lending, asset-backed securities and leveraged loans. MACs can also invest in investment-grade and government bonds when they need to be more defensive.

The perceived advantages of such an approach include diversification across a wide range of credit strategies, with access to a variety of risk, return and liquidity profiles. By allocating to lower-duration assets such as asset-backed securities, loans and other floating-rate instruments, MAC strategies may also be able to reduce their sensitivity to changes in interest rates. In addition, giving a skilled manager the discretion to make decisions regarding credit asset allocation can allow pension schemes to take advantage of attractive opportunities while reducing their own governance burden.

However, it is important to be mindful of the risks when investing beyond traditional credit markets. Smaller, high-yield issuers and more complex instruments may be subject to greater liquidity risk and become harder to sell in the event of a market shock or downturn. Higher-yielding credit instruments are also typically issued by companies with higher risks of default.

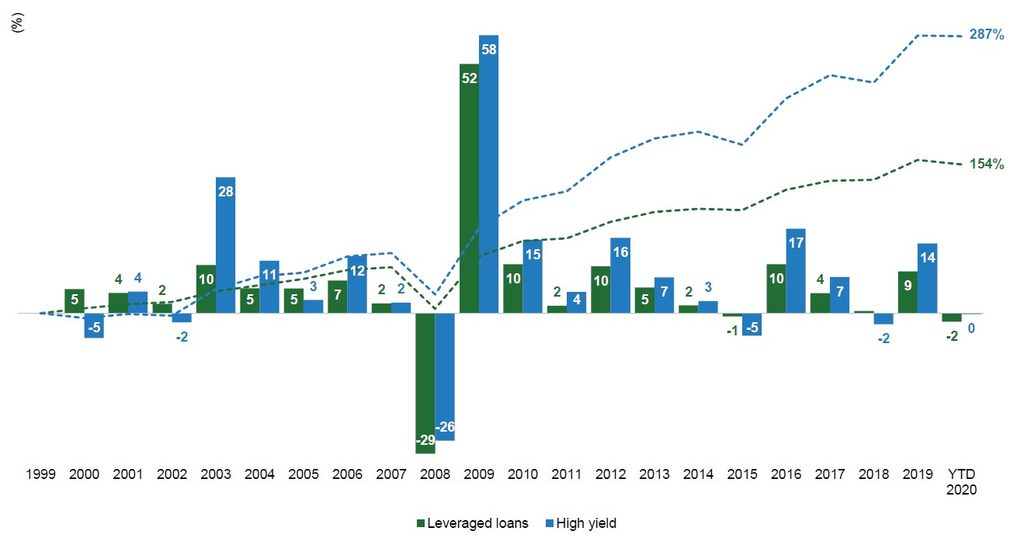

Leveraged loans are favoured by many MAC strategies as they can outperform during the early stages of interest-rate rises owing to the floating-rate nature of their coupons. However, once a tightening phase is entrenched and economies slow, they are likely to be just as vulnerable as other types of credit. Indeed, the performance of high yield has been far superior to that of leveraged loans over the last 20 years (see chart below). Moreover, on a discrete (per-year) basis, since 2003, leveraged loans have only outperformed high-yield bonds on two occasions – 2015 and 2018 – and in both these years the total return was marginally either side of zero. Considering this, we place greater emphasis on high-yield bonds rather than loans when compiling our own multi-asset portfolios.

Performance of high-yield bonds vs. loans

Source: Bank of America Merrill Lynch, 17 August 2020. For illustrative purposes only.

A flexible framework for all stages of the credit cycle

In our view, in managing multi-asset credit portfolios, it is essential to recognise and manage the asymmetric risk/return profile of individual issues and issuers, and to maintain portfolios that are broadly diversified by issue, issuer and country. We believe in-depth research and thorough analysis of the underlying bond documentation and capital structure is critical: a disciplined approach can help to identify the market inefficiencies that can present investment opportunities, and avoid the ‘losers’ which run the risk of distress or default. Opportunities may arise to access smaller, less liquid credit issuers, and in these cases it will be important to retain the ability to exit positions. A process for continuous monitoring of credit holdings enables an issuer to be reviewed or put on a ‘watch list’ as soon as, for instance, a credit problem is identified or the company’s operating fundamentals deteriorate.

It is our contention that the best-performing MAC portfolios also require top-down management of their risk profile based on the market outlook and stage of the credit cycle. For example, at the current stage of the cycle, with default rates rising as economies continue to digest the fallout from the coronavirus crisis, a manager might choose to be underweight the highest-risk (CCC-rated) bonds, have a preference for exposure for secured and shorter-duration credit, and have a higher weighting to developed-market government bonds as a stabilising tool. As the economy begins to recover and default rates fall, more opportunities should arise to gain exposure to unsecured high-yield credit, emerging-market corporate and sovereign bonds, and subordinated debt.

The importance of ESG considerations in credit analysis

Investors have also recently begun to appreciate the importance of incorporating environmental, social and governance (ESG) criteria when undertaking credit analysis. Poor environmental management, for example, can lead to a higher cost of debt, and robust governance can reduce default risk, thereby influencing credit spreads positively. Because such ESG considerations can have a material impact on credit risk (and therefore performance), integrating them into fixed-income analysis should, if done with diligence and consistency, result in superior risk-adjusted returns, as well as helping to influence responsible corporate behaviour and better societal outcomes.

In our view, a multi-asset credit strategy is best managed using a global, holistic approach with the flexibility to navigate all phases of the credit cycle, and with ESG issues fully integrated into the security-selection process. Such a portfolio could be worthy of consideration by superannuation funds and other fixed-income investors seeking to achieve their return objectives in a zero interest-rate world.

Important information

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice.

Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Registered in England No. 01371973. Newton Investment Management is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. Newton Investment Management Limited is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton’s investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. ‘Newton’ and/or ‘Newton Investment Management’ brand refers to Newton Investment Management Limited.

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.